Forex is the largest and most volatile market in the world, meaning speculating on its price movements can be both rewarding and challenging. Here we count down the top ten most trader pairs.

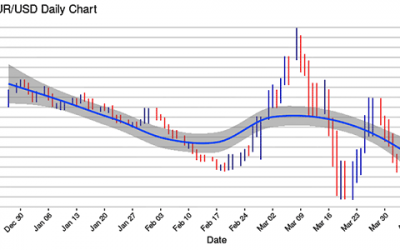

EUR/USD: Eurodollar is dominating with 24% of daily trades. Made up of currencies from the two largest economies of the globe, this versatile pair has a lot of liquidity and tight spreads.

USD/JPY: Featuring the world’s most traded currency, the US dollar, and Asia’s most liquid currency, the Japanese yen. The pair accounts for 13.2% of forex trades. It often forms part of a carry trade, with investors borrowing money in Japan, where interest rates are low, to buy assets in the US.

GBP/USD: The pound dollar, accounting for 9.6% of daily trading volume. With confusion around Brexit, this pair has been extremely volatile in recent years, creating opportunities for profit.

AUD/USD: The Aussie dollar cross has with 5.4% of global trading volume. Its value is closely tied to commodity prices, as coal and iron are among Australia’s chief exports. A slump in either could see the price of this pair fall dramatically.

USD/CAD: The Loonie, or US-Canadian dollar pairing. Named after the bird of the Canadian dollar, the pair accounts for 4.4% of daily trades. Canada’s primary export is oil, so be sure to pay attention to global oil prices if you’re planning on trading this pair.

USD/CNY: The US dollar-Chinese renminbi pair, accounts for 4.1% of trading volume. CNY can only be traded in the onshore Chinese market, so offshore traders should look to the dollar’s pairing with CNH. This tends to be more volatile, meaning it can be a more compelling proposition for speculators.

USD/CHF: The US dollar-Swiss franc cross, otherwise Swissie, with 3.6% of daily forex transactions. The pair is popular when other markets are volatile due to Switzerland’s reputation as a financial safe haven.

USD/HKD: The US-Hong Kong dollar pairing, which has seen daily trading volume reach 3.3% in recent years, at least in part because of the volatility surrounding pro-democracy protests. The value of the Hong Kong dollar is pegged to USD, meaning it can only float within a narrow band so this pair most suitable for scalpers and day traders who look to take advantage of smaller moves.

EUR/GBP: The euro-pound has around the 2% of daily forex transactions. The pair has been heavily influenced by the uncertainty surrounding Brexit in recent years, but its movements can be difficult to predict, as the changing relationship between to UK and Eurozone affects both currencies.

USD/KRW: The US dollar and South Korean won cross, accounting for 1.9% of daily forex transactions. The pair entered the top-ten most traded currency pairs in 2019, as a result of rapid growth in South Korea’s economy, now the fourth largest in Asia.

Most Traded Forex Pairs FAQ

How many forex pairs do you trade?

A good rule of thumb for traders new to the market is to focus on one or two currency pairs. Generally, traders will choose to trade the EUR/USD or USD/JPY because there is so much information and resources available about the underlying economies. Not surprisingly, these two pairs make up much of global daily volume.

What are the 7 major currency pairs?

The 7 major currency pairs are: The euro and US dollar: EUR/USD. The US dollar and Japanese yen: USD/JPY. The British pound sterling and US dollar: GBP/USD. The US dollar and Swiss franc: USD/CHF. The Australian dollar and US dollar: AUD/USD. The US dollar and Canadian dollar: USD/CAD. The New Zealand dollar and US dollar: NZD/USD.

What are the 10 most widely traded currencies in the world?

The 10 most widely traded currencies in the world are as following: United States dollar - USD (US$), Euro - EUR (€), Japanese yen - JPY (¥), Pound sterling - GBP (£), Australian dollar - AUD (A$), Canadian dollar - CAD (C$), Swiss franc - CHF (CHF), Renminbi - CNY (元), Hong Kong dollar - HKD (HK$), New Zealand dollar - NZD (NZ$).

Forex Market

MT4 is a standalone trading platform designed to help you automate your trading. While it is commonly associated with forex trading it can be used to trade other markets as well.

Chinese GDP

MT4 is a standalone trading platform designed to help you automate your trading. While it is commonly associated with forex trading it can be used to trade other markets as well.

Oil Market

MT4 is a standalone trading platform designed to help you automate your trading. While it is commonly associated with forex trading it can be used to trade other markets as well.