The greater the difference between the intrinsic value and the current stock price, the greater the margin of safety for value investors looking for investment opportunities. Because not every value stock will turn its business around successfully, that margin of safety is important for value investors to minimize their losses when they’re wrong about a company.

Value investing is a proven style to earn great returns in the stock market, as demonstrated by the stellar records of value investors like Benjamin Graham, Warren Buffett, John Templeton, Seth Klarman, and Joel Greenblatt.

What Is Value Investing?

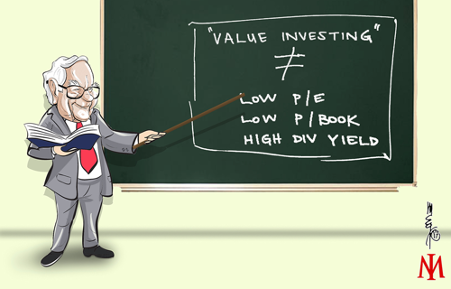

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively ferret out stocks they think the stock market is underestimating. They believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond to a company’s long-term fundamentals. The overreaction offers an opportunity to profit by buying stocks at discounted prices—on sale.

Everyone likes a bargain, and because value investing seeks stocks selling at a discount to their intrinsic value, the investment strategy appeals to those who like to get good deals. All it takes to make money with a value stock is for enough other investors to realize there’s a mismatch between the stock’s current price and what it’s actually worth. Once that happens, the share price should go up to reflect the higher intrinsic value. Then those who bought in at a discount will get their profit.

Furthermore, many investors like the margin of safety provided by a stock that’s purchased for less than what it’s inherently worth. There’s no guarantee the stock price won’t fall further, but it does make additional share-price declines less probable and less dramatic.

For those who see themselves as defensive investors without much tolerance for risk, a good value stock can provide both protection against losing money and the potential to cash in once the stock market recognizes the stock’s true value.

Value investing can require patience because it often takes a long time for a value stock to get repriced at a more appropriate and higher level. For those willing to wait, however, the returns can be quite sizable.

Is value investing right for you?

If your primary investing goal is to keep your risk of permanent losses to an absolute minimum while increasing your odds of generating positive returns, you’re probably a value investor at heart.

By contrast, those who prefer to follow the hottest companies in the market often find value investing downright boring since growth opportunities for value companies tend to be tepid at best.

Value investors have to be resilient as well. The value-finding process eliminates far more stocks than it uncovers, and it can be a highly frustrating way to invest during a bull market.

Many stocks you cross off your buy list during your search will keep rising in value in bull markets despite the fact that you found them too expensive to begin with. But the payback comes when the bull market ends because the margin of safety from value stocks can make it much easier to ride out a downturn.

Intrinsic Value and Value Investing

In the stock market, the equivalent of a stock being cheap or discounted is when its shares are undervalued. Value investors hope to profit from shares they perceive to be deeply discounted.

Investors use various metrics to attempt to find the valuation or intrinsic value of a stock. Intrinsic value is a combination of using financial analysis such as studying a company’s financial performance, revenue, earnings, cash flow, and profit as well as fundamental factors, including the company’s brand, business model, target market, and competitive advantage. Some metrics used to value a company’s stock include:

- Price-to-book (P/B) or book value, which measures the value of a company’s assets and compares them to the stock price. If the price is lower than the value of the assets, the stock is undervalued, assuming the company is not in financial hardship.

- Price-to-earnings (P/E), which shows the company’s track record for earnings to determine if the stock price is not reflecting all of the earnings or is undervalued.

- Free cash flow, which is the cash generated from a company’s revenue or operations after the costs of expenditures have been subtracted. Free cash flow is the cash remaining after expenses have been paid, including operating expenses and large purchases called capital expenditures, which is the purchase of assets like equipment or upgrading a manufacturing plant.

Of course, there are many other metrics used in the analysis, including analyzing debt, equity, sales, and revenue growth. After reviewing these metrics, the value investor can decide to purchase shares if the comparative value—the stock’s current price vis-a-vis its company’s intrinsic worth—is attractive enough.

Bottom line

The most important thing to understand is that value investing requires a long-term mindset. As economist John Maynard Keynes said, “The market can remain irrational longer than you can remain solvent.” The lesson is that, while occasionally one’s timing is lucky and an investment pays off very quickly, even a value-focused strategy doesn’t guarantee quick gains. Mr. Market doesn’t always “realize” very quickly that it was wrong about a stock or that it undervalued an asset.

Value investing strategies take time to follow, but the time and effort you spend are worth it. Understanding and applying the value investing concepts Graham wrote about almost 90 years ago — and that Buffett and others have added to and improved upon since — will make you a better investor with better chances of being successful in choosing great stocks.

Inflation: How can you protect your money from it?

Industries most impacted by the pandemic and when to expect recovery

Stocks portfolio analysis: Latest additions

Industries most impacted by the pandemic and when to expect recovery

REITS: How to earn dividends from real estate investments—without having to buy, manage, or finance any properties yourself

Industries most impacted by the pandemic and when to expect recovery