Additionally, investors are eagerly waiting for 2021 to arrive. Real estate investment trusts, or REITs, are among the industries most looking forward to closing the book in 2020. The pandemic led to store closures and stay-at-home orders across the country, which had a devastating impact on REITs.

What Is a Real Estate Investment Trust (REIT)?

A real estate investment trust is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centres, hotels and commercial forests.

REITs pool the capital of numerous investors and they are modelled after mutual funds, which makes it possible for individual investors to earn dividends and also invest in the real estate market, without having to inject large amount amounts of capital. Moreover, it requires less effort and time since investors do not manage those properties.

Unlike other real estate companies, a REIT does not develop real estate properties to resell them. Instead, a REIT buys and develops properties primarily to operate them as part of its own investment portfolio.

Long-term investment

REITs are more beneficial to investors when they are used as a long-term investment. REITs prices can be affected over short periods of time by too many factors, including interest rate fluctuations. Consequently, you shouldn’t put any money into REITs that you’re going to need within the next five years. Longer time horizons are even better.

Benefits of REIT investing

Paying great dividends is a REIT’s job

While most people find very little “sexy” about dividend stocks, that’s because they don’t appreciate true beauty. True investment beauty is an asset that helps you accumulate wealth (or maintain it, if you’re retired) through a healthy combination of safety and growth.

This type of investments make me wonder, is there anything better than passive income?

One of the major benefits of Real Estate Investment Trusts is the fact that they are able to avoid paying income tax at the corporate level, provided they pay out at least 90% of their income as dividends to their shareholders.

This resolves the double taxation issue that affects most companies since the Company pays taxes on its income at the corporate level, and then investors pay taxes on their dividend income. REIT income is only taxed once.

It is important to mention that historically, REITs, utilities, the big integrated energy companies, and pipeline partnerships have been good dividend payers. They tend to have stable earnings and a lot of assets.

Portfolio diversification

One of the most important principles of investing and risk management is portfolio diversification. There is a well-known phrase ‘Don’t put all your eggs in one basket’ and it is highly relevant in this case.

REITs really do offer historically low correlation with other stocks and bonds. When they go down, those investing counterparts tend to go up. When they go up, the others usually go down. Far from a see-saw effect, this helps balance out your portfolio so you don’t get more motion sickness than you can handle. It leads to higher-risk adjusted returns through tangible assets – which are still very much in need despite the digitalization of seemingly everything around us.

Liquidity

Another major advantage of Real Estate Investment Trusts is that they offer high liquidity since there are more than 200 REITs traded on U.S. stock exchanges for a combined $1 trillion market cap, REITs take a traditionally illiquid asset – real estate – and makes it easily accessible. As such, they allow you to get in on a money-making proposition with long-term demand.

And they do so without locking you into months-long buying and selling ordeals. This also allows for better, faster asset allocation and portfolio rebalancing capabilities.

Transparency

Publicly traded REITs give investors access to income-producing real estate combined with the transparency of investments listed and traded on public markets. REITs must disclose financial information to investors and report on material business developments and risks on a timely basis. Unlike other public companies, REITs’ high dividend payouts and limited retained earnings mean they must more frequently seek funding from the capital markets, requiring them to disclose and justify their plans for using the funds. This requirement provides investors with additional visibility into REITs’ finances and operations. Moreover, disclosure is required by the U.S Securities and Exchange Commission, Generally Accepted Accounting Principles, and the various stock exchanges on which their shares trade.

Our current top 3 choices of REITs are:

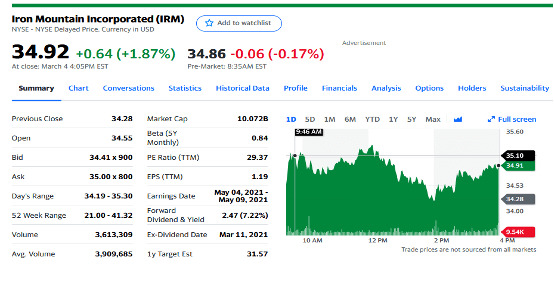

1. Iron mountain Incorporated (IRM)

2. Sabra Health Care REIT, Inc. (SBRA)

3. LTC Properties, Inc. (LTC)

Stocks fell as traders braced for another supersized US rate hike tomorrow: Everything you need to know

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Goldman Sachs Offers Its First Bitcoin-Backed Loan

Goldman Sachs Offers Its First Bitcoin-Backed Loan