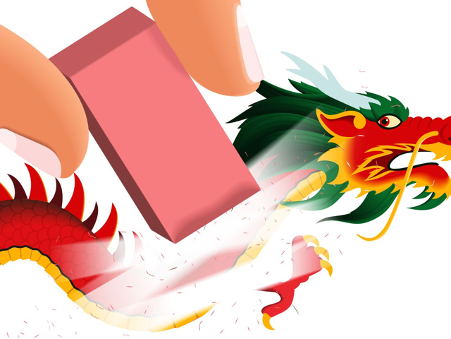

China boasts the world’s second largest economy in the world with millions of consumers eager to spend on fashion, gadgets and properties and stocks that look cheap after a rout. Yet everyone seems to be fleeing Chinese financial markets.

That shows the magnitude of concern about what Beijing’s crackdown on private businesses means for overseas investors. Take superstar fund manager Cathie Wood, for example. Just two weeks ago, she said that Chinese stock valuations are low and are likely to continue staying down. Still, she’s selling shares of companies including tech giant Tencent Holdings Ltd., property site KE Holdings Inc. and Alibaba Group Holding Ltd.

What happened

Shares of Chinese tech stocks were falling for the third session in a row Tuesday in the ongoing fallout from the Chinese government’s crackdown on the for-profit education sector.

Oddly, Chinese tutoring stocks like New Oriental Education Group and TAL Education Group that had seen nearly all of their value wiped out over the last two days were gaining today as some investors saw the sell-off as a buying opportunity. However, big tech stocks like Alibaba Group Holding, JD.com, and Full Truck Alliance were still down today as fear of spreading restrictions on big businesses in China continued to motivate investors to sell.

After falling sharply on Tuesday morning, these stock recovered some of their losses later in the session. Alibaba finished down 3%, JD was off 2%, and Full Truck Alliance had fallen 12.8%. At the same, the iShares MSCI China ETF was down 4%, the third straight session it’s fallen 3% or more.

In addition to the broader concerns on the Chinese regulatory front, both Alibaba and JD.com were downgraded by DZ Bank to sell this morning, likely in response to the regulatory pressure on Chinese stocks.

Prior to the crackdown on the for-profit education sector, which includes a restriction on raising new capital and teaching on weekends and holidays, Chinese authorities had told ridesharing giant Didi Global earlier this month to remove its app from major Chinese app stores, and earlier this year Alibaba was fined $2.8 billion as the result of an anti-monopoly investigation into the e-commerce giant.

Is there a buying opportunity for investors?

Investors who have avoided China because of the risk of its unpredictable government likely feel vindicated after the last few days, but that doesn’t mean that these stocks won’t bounce back. The underlying businesses still remain among the strongest in the world. Alibaba is the world’s biggest e-commerce platform with more than $1 trillion in gross merchandise volume, and JD.com is China’s biggest direct online seller and has built a logistics network that rivals Amazon’s. Recent IPO Full Truck Alliance, a digital freight platform, saw sales double in its most recent quarter.

Even in the current market turmoil, JPMorgan Private Bank’s Alex Wolf sees opportunity in mainland-listed stocks, which are harder for retail investors to access compared to those listed in Hong Kong.

Most Chinese stocks a sector among the hardest hit in the recent market meltdown are listed overseas in the U.S. and Hong Kong and such stocks tend to be largely owned by overseas investors due to how difficult it is for mainland investors to access, said Wolf, who is head of investment strategy for Asia at the firm.

That said, if you have a strong stomach, those who buy in now when many investors are getting out could see upside in the event of a turnaround. Sectors like electric vehicle makers and clean energy producers could even benefit from Xi’s policies.

Investors should be aware of significant risks with investing in Chinese stocks. The authoritarian state and its regulators can impose sweeping restrictions, fines or bans on major companies, often with little notice or transparency.

That risk has been very apparently over the last several months.

Alibaba ran afoul of regulators in late 2020, with regulators opening probes into internet platforms and suspending the Ant Group IPO. In April, China fined Alibaba $2.8 billion for anti-competitive actions and ordered it to change various practices. Alibaba affiliate Ant Group limiting the scope of some of its businesses to comply with regulators’ demands.

Further antitrust probes and fines are likely for other internet giants.

Valuations are down, but even ETF star Cathie Wood is dumping shares, showing the magnitude of concern over Beijing’s tightening regulatory grip.

Best Chinese Stocks To Buy Or Watch during the crackdown

1. LiAuto, Auto manufactures

2. Nio, Auto manufactures

3. BYD, Auto manufacture

4. Sohu, Computer Software-Gaming

5. Weibo, Internet-content

Top 10 Altcoins for January 2022

Top 10 Altcoins for January 2022

Weekly Market News 10-14 January

Weekly Market News 10-14 January

Weekly Market News 3-7 January

Weekly Market News 3-7 January