Market reaction

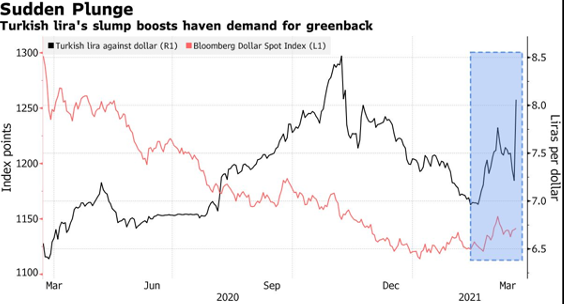

Turkey’s lira fell 15% near it’s all-time low after markets opened following President Tayyip Erdogan’s shock weekend decision to oust the hawkish central bank governor Naci Agbal, and install a like-minded critic of high interest rates.

The removal has shocked both local and foreign investors who had praised Turkey’s central bank’s recent monetary policy.

Turkey’s stocks and bonds tumbled as the shock dismissal of the central bank chief triggered concern the country is headed for a fresh bout of currency turbulence.

The Turkish president has appointed Sahap Kavcioglu, a former banker and ruling party lawmaker, in the early hours on Saturday marked the third time since mid-2019 that Erdogan has abruptly fired a central bank chief. There were concerns in the market, regarding a sharp selloff in Turkish assets and a pivot from rate hikes to cuts but the new central bank governor had sought to ease these concerns over a 90-minute call on Sunday, in which he told bank CEOs he planned no immediate policy change.

“The replacement of the CBRT governor is a major blow to investor confidence in Turkey,” wrote Adam Cole, chief currency strategist at RBC Capital Markets. “Not surprisingly, geographical proximity leaves Europe most exposed.”

During his short tenure, Agbal had succeeded where various predecessors had not in cultivating trust in the central bank’s inflation-targeting framework, in restoring monetary policy independence, in encouraging international investors to re-engage with the crisis-prone Turkish narrative, in driving an 18.0% rally in the lira against the dollar, and most crucially in arresting and even reversing the damaging trend of dollarization in the economy.

The lira’s decline puts it within a few percentage points of a record low reached on Nov. 6, the day before Agbal was appointed. It was trading at 7.858 to the dollar at 1:13 p.m. in Istanbul after weakening to 8.4707 in early Asian hours, when liquidity for emerging-market currencies tends to be thinner.

Inflation concerns

Inflation in the country has largely been caused by credit-driven growth, foreign exchange depreciation and rising global energy prices.

A former member of parliament for Erdogan’s AK Party (AKP), Kavcioglu has espoused the unorthodox views shared by the president. He wrote high rates “indirectly cause inflation to rise,” in a newspaper column last month.

Turkish president’ desire to keep rates low stems from his view that interest rates cause inflation; the vast majority of economists argue that it’s the other way around, and that Turkey desperately needs monetary policy tightening to quell its currently 15% inflation level and shore up the currency.

Erik Meyersson, senior economist at Handelsbanken Macro Research in Stockholm, claimed that inflation is likely to accelerate as the lira takes another tumble, inflation expectations increase, and various global factors further weigh on the situation and it will require a lot from Turkish authorities to avoid another financial crisis in the coming period.

Economists have long been wary of what many describe as Erdogan’s strong-arming of the central bank to keep interest rates lower, spooking investors over the bank’s lack of autonomy on monetary policy.

The aforementioned policies along with other factors including falling foreign exchange reserves and high debt levels, have sent the currency falling for years. In late 2017, a dollar bought 3.5 lira.

Higher interest rates lead to higher costs of borrowing which deters consumers from over-spending, while encouraging people to save. However, the downside is often slower economic growth.

Stock Portfolio performance 18/6/2021

Stock Portfolio performance 18/6/2021

Bitcoin breaks through $40,000. What’s moving the market?

Bitcoin is the world’s largest cryptocurrency by market capitalization and is now on rise again pushing over the $40,000 mark for the first time since late May. As you can imagine, the CEO of Tesla, Elon Musk has a lot to do with this price increase. Elon Musk, suggested over the weekend that the electric car manufacturer could start using the digital currency as payment once more just a few weeks after ruling it out because of its allegedly unsuitable energy usage involved in mining.

Stock Portfolio performance 11/6/2021

Stock Portfolio performance 11/6/2021