As a relatively new industry, there is no benchmark for electric car companies. However, electric car stocks can be compared to the broader equity market as represented by the Russell 1000. The Russell 1000 has provided a total return of 35.7% over the past 12 months.

Given that the stock market today seems to be taking a fresh look at some of these EV startups, it doesn’t hurt to put up a list of top EV stocks to buy to ride along with the current momentum. With competition heating up in the space, chasing the high price tag of Tesla (NASDAQ: TSLA) need not be the only game. After all, it is reasonable to wonder if Tesla’s prospective returns can match up to its past performance.

Instead, many have been turning to up-and-coming EV stocks in the hope that these stocks may deliver returns similar to Tesla in its early days. If you’re looking for the next best EV stocks to buy, do you have the following names on your watchlist?

1. General motors

While high-profile electric vehicle stocks may get more of the attention these days, General Motors is not sitting on the sidelines either. In fact, GM is not only pushing into the EV market but also invests heavily in autonomous vehicle technology. Of course, GM is no Tesla. But that doesn’t mean GM can’t be one of the best EV stocks for investors. In fact, the Detroit automaker expects the first-half profit to be “significantly better” than previously forecast.

On June 16th, it was reported that General Motors Company (NYSE: GM) will be increasing its EV and autonomous vehicle investments to $35 billion by 2025. The move came in light of the company’s profitability for this year so far having exceeded expectations, and because General Motors Company (NYSE: GM) wants to be a leader in the transformation of the industry. For the first quarter of 2021, General Motors Company had an EPS of $2.25 versus estimates of $1.05. The company’s revenue for the quarter was valued at $32.47 billion and it has a forward PE ratio of 9.77. It has also gained 42.59% in the past 6 months and 45.05% year to date.

By the end of the first quarter of 2021, 86 hedge funds out of the 866 tracked by Insider Monkey held stakes in this company. The total value of their stakes was about $8.05 billion. Comparatively, in the previous quarter 70 hedge funds held stakes in the company worth roughly $6.33 billion.

2. Ford Motor Company

Ford Motor Company is a manufacturer of automobiles including trucks, cars, sport utility vehicles, and now EVs. The company ranks 4th on our list of the best EV stocks to invest in and operates through three segments, namely the Automotive, Mobility, and Ford Credit segments.

On June 17th, Ford Motor Company announced that it would be acquiring Electriphi, a California-based charging management, and fleet monitoring software provider. The company said the decision came about in light of their desire to merge Electriphi’s team with Ford Pro to develop advanced charging and energy management experiences for EV users. Ford Motor Company also provided second-quarter guidance on the same day, saying that it expected adjusted earnings before interest and taxes to exceed prior expectations and be higher than the values they saw a year ago.

In the first quarter of 2021, Ford Motor Company had an adjusted EPS of $0.89 versus estimates of $0.21, and revenue valued at $36.23 billion. The company also has a gross profit margin of 8.07% and a forward PE ratio of 12.8. Ford Motor Company gained 62.6% in the past 6 months and 70.42% year to date.

By the end of the first quarter of 2021, 49 hedge funds out of the 866 tracked by Insider Monkey held stakes in this company. The total value of their stakes was about $2.19 billion. Comparatively, in the previous quarter 41 hedge funds held stakes in the company worth roughly $1.65 billion.

3. Tesla

Tesla, Inc. is a developer of EVs and energy generation and storage systems in the US and internationally. It has two segments, Automotive and Energy Generation and Storage, and it ranks 2nd on our list of the best EV stocks to invest in.

On June 15th, Mizuho reiterated a Buy rating for Tesla, Inc. in light of strong battery electric vehicle sales for the company and the fact that it is the market share leader for BEVs as of the first quarter of 2021, with a 24% market share. For the first quarter, it also had an EPS of $0.93, versus the estimates of $0.78. Revenue was reported to be $10.39 billion, representing 38.11% growth year over year. The company has a gross profit margin of 12.18%.

By the end of the first quarter of 2021, 62 hedge funds out of the 866 tracked by Insider Monkey held stakes in this company. The total value of their stakes was about $10 billion. Comparatively, in the previous quarter 68 hedge funds held stakes in the company worth roughly $12.3 billion.

4. ChargePoint Holdings

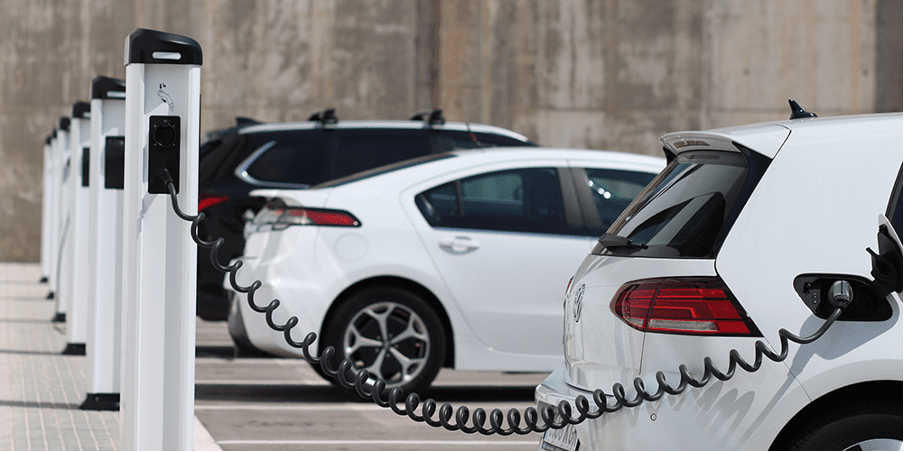

Charging network operator ChargePoint Holdings is your pick-and-shovel play in this red-hot industry. The company operates one of the largest networks of independently-owned EV charging stations globally. In terms of scale, ChargePoint’s stations are present across 14 countries today. Arguably, CHPT stock offers investors a means to bet on both EV trends and infrastructure stocks at the same time. These tailwinds are powering up CHPT stock to a level it hasn’t seen since February.

Earlier this month, the company also announced a new partnership with Mercedes called “Mercedes me Charge” for the EQ line of EVs. This partnership is another step for the company’s strategy in increasing adoption and charger utilization. There’s been a lot of excitement for EV charging stocks over the past year, driven by the rapid expansion of EV production by automakers.

And with so much uncertainty in the space, going with a market leader like ChargePoint seems like a safer bet. Whether CHPT would play out as a profitable charging leader remains to be seen. But its dominant position in the charging network space could help it stay ahead of competitors.

5. Magna International Inc.

Lastly, we have Magna International Inc, one of the most diversified automotive parts suppliers in the world. Magna stands to benefit from key emerging trends including electrification and autonomous driving. The firm’s sharp focus on innovation and technology development along with regular program launches is likely to boost its prospects. Strategic alliances with Fisker, LG Electronics, Waymo and REE are set to drive Magna. Healthy balance sheet and investor-friendly moves instill optimism. Currently carrying a Zacks Rank #2 and a VGM Score of A, Magna has a long-term expected EPS growth rate of 19.5%.

Elon Musk strikes deal to buy Twitter for $44bn

Netflix’s stocks plunges by 35% wiping more than $50 billion off market cap

Netflix’s stocks plunges by 35% wiping more than $50 billion off market cap

Microsoft Buys Activision for $69 Billion with Eyes on Metaverse Development

Microsoft Buys Activision for $69 Billion with Eyes on Metaverse Development