The better and faster fills are obtained directly from the fact that there are usually a lot of competitive market bids and offers coming via the STP broker’s liquidity provider, which provide for more liquidity within the market and in turn this implies lower and lower obtainable execution prices for the client. In addition client transactions with an STP broker means anonymity for the client since there is no Dealing Desk monitoring the transactions of orders coming in from each client. The orders are instead executed automatically via the market network anonymously.

STP brokers benefit from having several liquidity providers as an increase in the number of providers in the system means the better the fills for the client. A large number of STP brokers will use banks, which trade on the Interbank market (the top-level foreign exchange market where banks exchange different currencies) as their liquidity providers.

Why do brokers choose to be STP Forex Brokers?

Additionally to the fact that most traders prefer to work with an STP broker, for the fact that a Client’s losses are not a brokers profit and as such it is in the Brokers interest for the Client to make successful trades as opposed to losing ones, a broker with an STP process very often suggests that the broker has No Dealing Desk (NDD) and subsequently has far less costs through its overheads and staff salaries. Furthermore NDD means that the broker is more transparent with the clients trades as the client is in fact entering trades into a true market instead of an artificial market that may be created by a market maker.

Every time a client trades through an STP platform, the STP broker will always make a profit. As STP brokers do not trade against clients orders, they add a small markup to the spread they receive from their provider when quoting a bid/ask rate. The STP broker will apply this markup by a certain amount of fractional pips to the bid and ask price it receives from its best bid/ask liquidity provider before passing the rates onto the client via its electronic platform.

As the client places the order through the STP broker’s platform, the orders are sent directly at the lower/higher rate (depending if it is a bid/ask offer) to the liquidity provider and as such the STP broker executes the same orders as the client at a slightly better price subsequent to the markup.

Why do traders choose STP Forex Brokers?

As the STP execution also means there is no re-quote or delay in filling orders, as the technology executes in extreme speed, sorts quotes among the offering and filling orders at the best available price just adding-on small fixed markup usually 1 pip to the quote. Most often, the STP type brings variable spreads due to the changing bid/ask prices, yet at a very competitive spread value usually lower than Market Makers.

One of the advantages among STP execution is that the broker never makes profits on clients’ losses since the company gains its net from a number of executed orders and more interested in the trading sizes.

Working with the best STP Forex broker is a crucial choice for any trader and his its successful trading experience, as you may see loads of unscrupulous brokers or offer among the industry proposals. Pure Market Broker aims to be a transparent with good reputation broker with the Straight Through Processing (STP) business model.

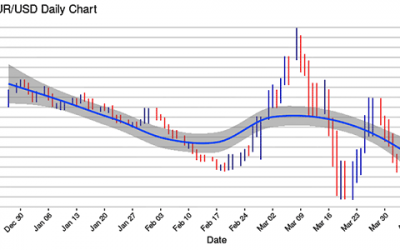

Forex Market

MT4 is a standalone trading platform designed to help you automate your trading. While it is commonly associated with forex trading it can be used to trade other markets as well.

Chinese GDP

MT4 is a standalone trading platform designed to help you automate your trading. While it is commonly associated with forex trading it can be used to trade other markets as well.

Oil Market

MT4 is a standalone trading platform designed to help you automate your trading. While it is commonly associated with forex trading it can be used to trade other markets as well.