Portfolio analysis

Asset allocation

Enterprise products Partners

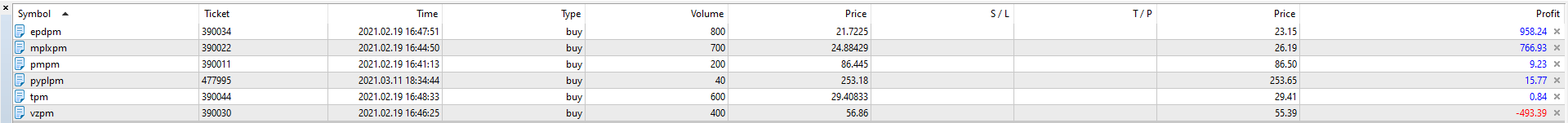

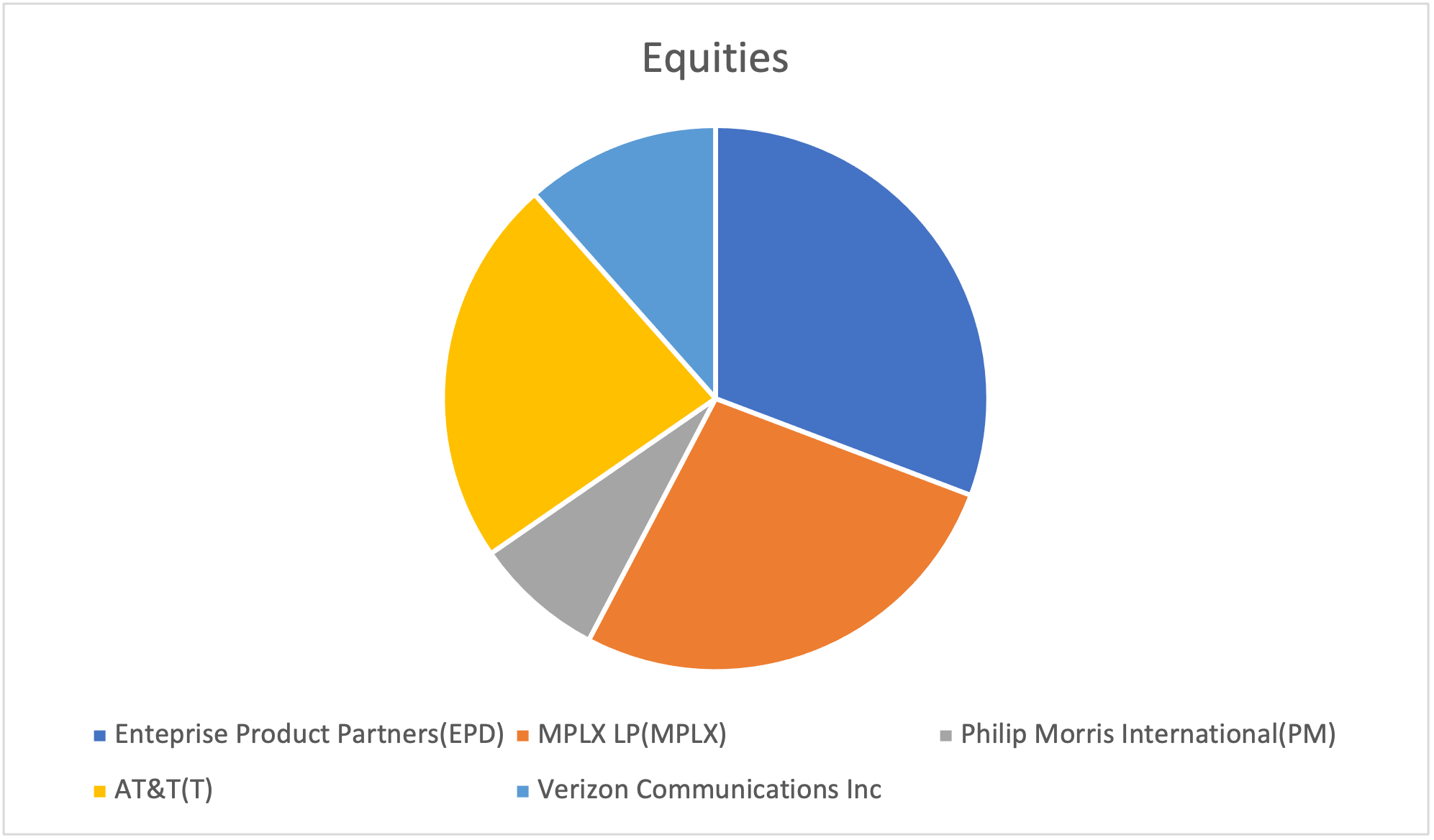

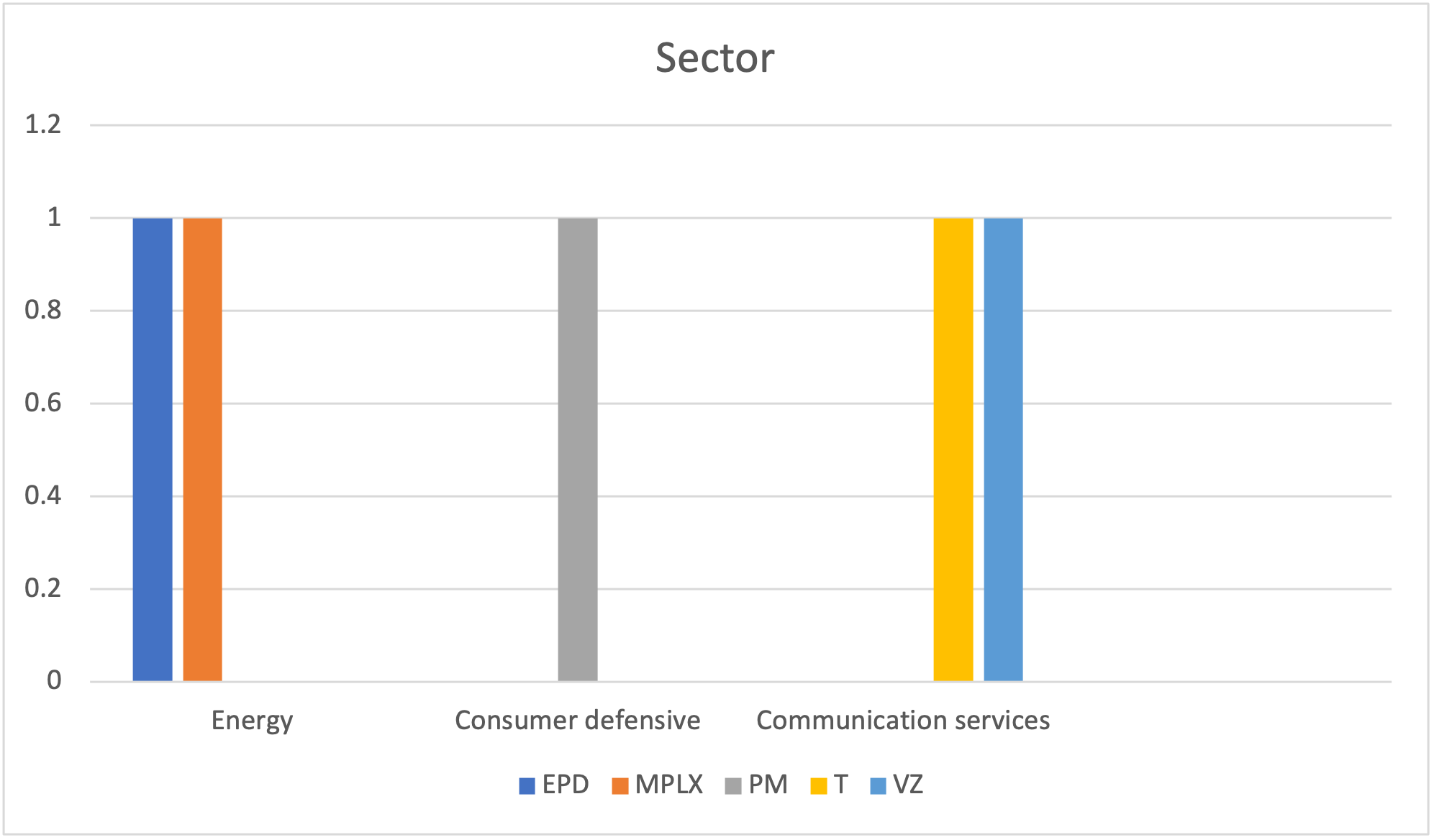

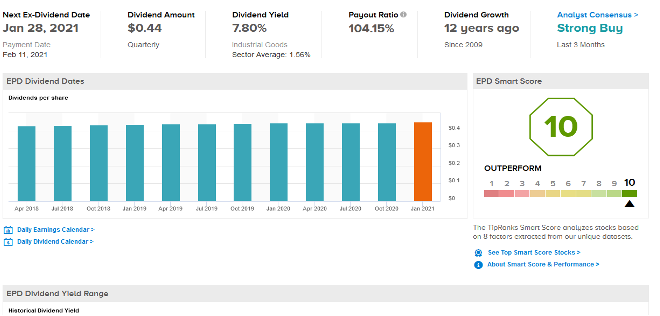

The first Company we chose to buy in our portfolio is Enterprise Products Partners, this Company operates in the Energy sector and the oil & gas industry. EPD has a dividend yield of 7,77% at the moment and it is distributed quarterly to the shareholders. The next dividend date is 29 April 2021. On 19 February 2021 we added 800 shares at the price of €21,72.

Dividend date and history

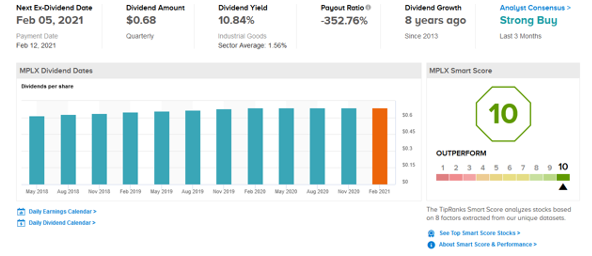

MPLX LP

The second addition in our portfolio is MPLX LP, this Company also operates in the Energy sector and the oil & gas industry. MPLX has a dividend yield of 10,79% at the moment and it is distributed quarterly to the shareholders. The next dividend date is 5 February 2021. On 19 February 2021 we added 700 shares at the price of €24,88.

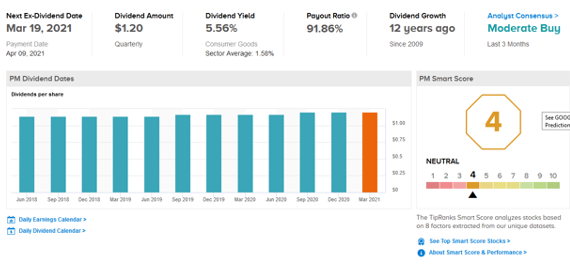

Philip Morris International

Our third addition is Philip Morris International, this Company operates in the consumer defensive sector and the Tobacco industry. PM has a dividend yield of 5,57% at the moment and it is distributed quarterly to its shareholders. The next dividend date is 9 April 2021. On 19 February 2021 we added 200 shares at the price of €86,44.

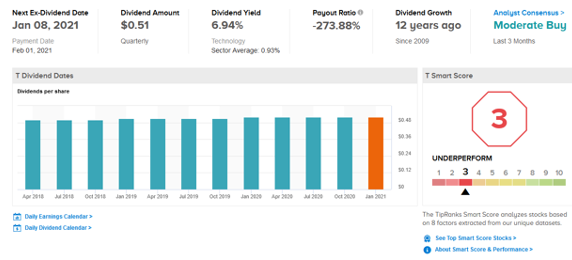

AT&T(T)

We have also added AT&T, this Company operates in the communication services and in the Telecom services industry. AT&T has a dividend yield of 7,19% at the moment and it is distributed quarterly to its shareholders. The next dividend date is 8 April 2021. On 19 February 2021 we added 600 shares at the price of €29,40.

Verizon Communications Inc. (VZ)

Our last addition is Verizon Communications Inc., a Company that operates in communications services sector and Telecom services industry. Verizon has a dividend yield of 4,48% at the moment and it is distributed to its shareholders on a quarterly basis. The next dividend date is at 8 April. On 19 February 2021 we added 300 shares at the price of €56,96.

Stock Portfolio performance 18/6/2021

Stock Portfolio performance 18/6/2021

Bitcoin breaks through $40,000. What’s moving the market?

Bitcoin is the world’s largest cryptocurrency by market capitalization and is now on rise again pushing over the $40,000 mark for the first time since late May. As you can imagine, the CEO of Tesla, Elon Musk has a lot to do with this price increase. Elon Musk, suggested over the weekend that the electric car manufacturer could start using the digital currency as payment once more just a few weeks after ruling it out because of its allegedly unsuitable energy usage involved in mining.

Stock Portfolio performance 11/6/2021

Stock Portfolio performance 11/6/2021