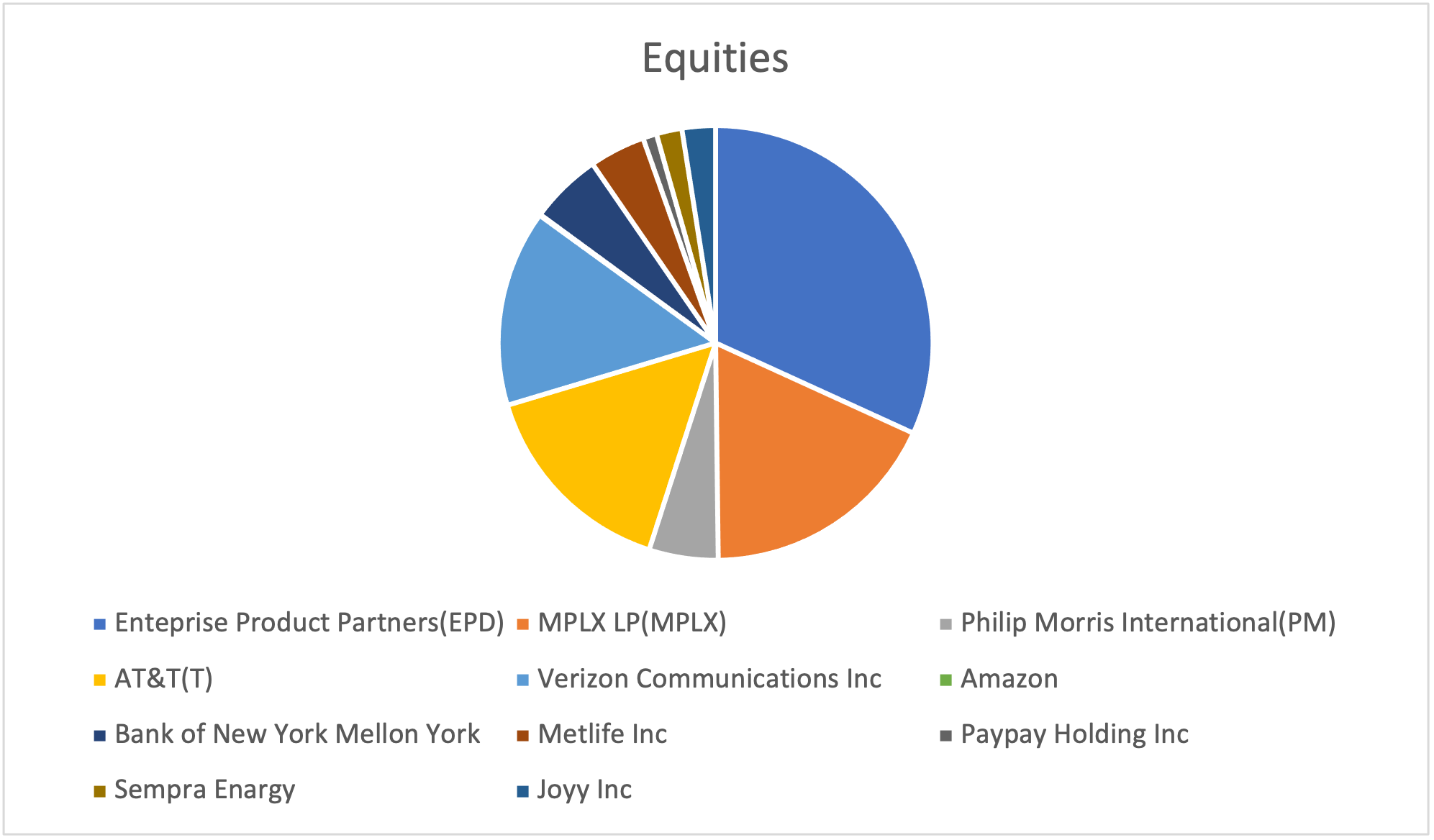

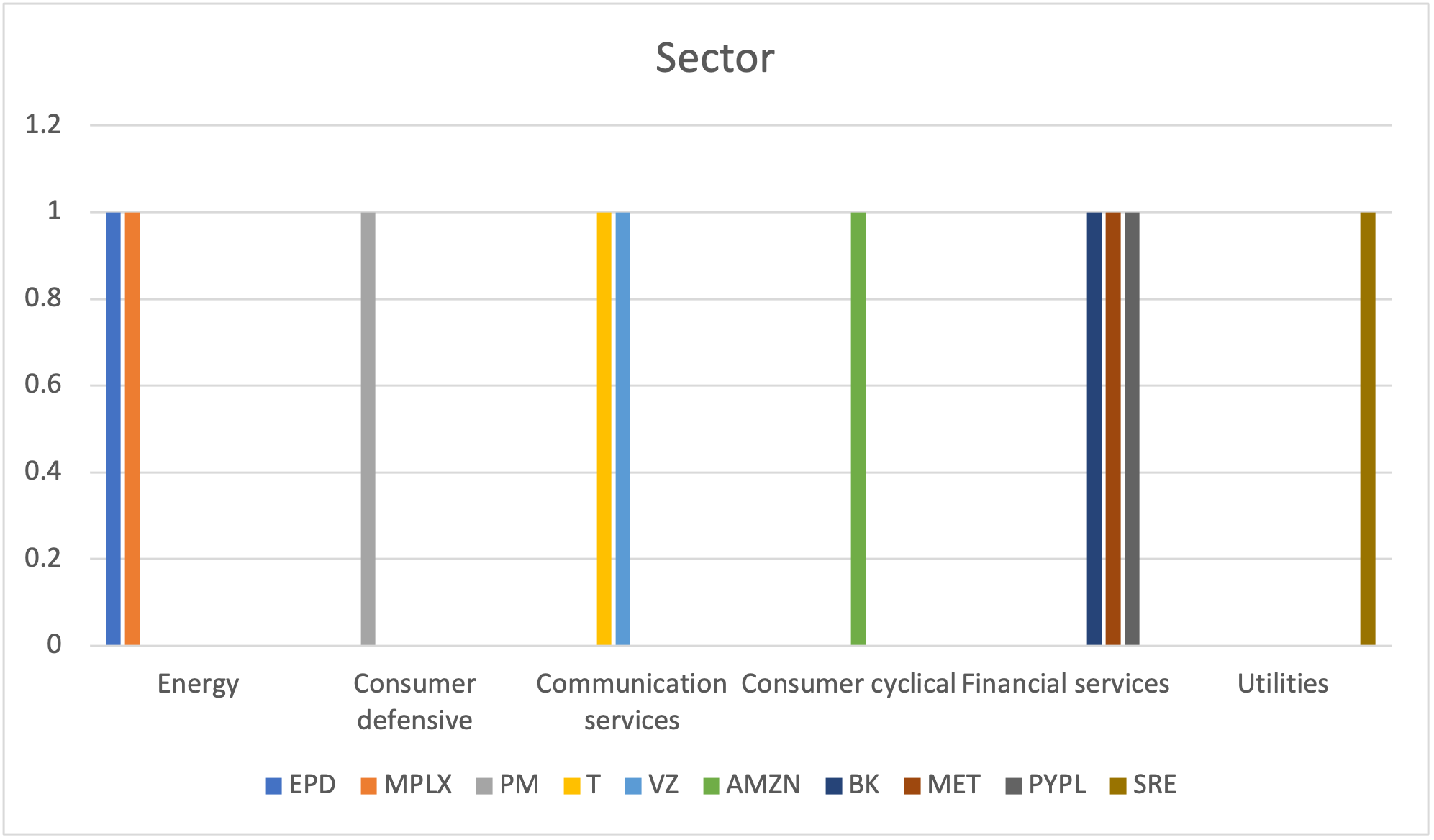

Portfolio analysis

Asset allocation

Amazon. Com, Inc

One of our new additions to our portfolio is Amazon. The Company operates in the consumer cyclical sector and Internet retail industry.

Valuation is also important, so investors should note that AMZN has a Forward P/E ratio of 68.13 right now. This represents a premium compared to its industry’s average Forward P/E of 63.64. Despite the relatively high P/E ratio, analysts argue that Amazon stock may be 70% undervalued and the Company worth more than its current valuation.

Investors should also note that AMZN has a PEG ratio of 2.53 right now. This popular metric is similar to the widely-known P/E ratio, with the difference being that the PEG ratio also takes into account the company’s expected earnings growth rate. The Internet – Commerce was holding an average PEG ratio of 2.39 at yesterday’s closing price.

Wall Street will be looking for positivity from AMZN as it approaches its next earnings report date. On that day, AMZN is projected to report earnings of $9.89 per share, which would represent year-over-year growth of 97.41%. Our most recent consensus estimate is calling for quarterly revenue of $105.05 billion, up 39.23% from the year-ago period. On 7 April 2021 we added 3 shares at the price of €3.258.

The Bank of New York Mellon Corporation

We have also added 208 shares of Bank of New York Mellon Corporation to our portfolio on 7 April 2021 at the price of €47,98. This Company operates in Financial services sector and the Asset Management industry.

Shares of Bank of New York Mellon performed really well since the beginning of this year amid hopes over economic recovery and coronavirus vaccine rollout. The company offers a decent dividend yield of 2.61% despite a massive share price rally. Also, Berkshire Hathaway held a $72 million stake in The Bank of New York Mellon Corporation at the beginning of this year, accounting for 1.14% of the overall portfolio.

This company is expected to post quarterly earnings of $0.86 per share in its upcoming report, which represents a year-over-year change of -18.1%. Revenues are expected to be $3.84 billion, down 7.3% from the year-ago quarter.

MetLife, Inc

MetLife is considered to be one of the 10 best home Insurance companies. On 7 April 2021 we have added 162 shares of the aforementioned Company for the price of €61,56. MetLife operates in the Financial services sector and the Life insurance industry.

The company offers life and homeowners insurance and financial services to clients in the US, Europe, Latin America, Africa, the Middle East, and Asia. If you want to handle your insurance needs online or via an app, MetLife might be a good place to start your search for home insurance. Account-holders can view their policies and pay bills by credit card using the MetLife app.

The company’s revenue in 2020 came in at $42 billion. Morgan Stanley analysts have given MetLife an Overweight ranking. The target price was set at $70. Shares of MET surged 73% over the past twelve months. MetLife’s book value was $83.50 per share as of the full fiscal year that ended in December 2020. The stock price has risen 122.22% over the past year, determining a 52-week range of $26.82 to $62.66. Moreover, the current P/E ratio of the Company is 10 and EPS 5,68.

PayPal Holdings, Inc

On 11 March 2021 we have added 40 shares of PayPal Holdings, Inc at €253,18. The Company operates in the Financial Services sector and the Credit Services industry.

Net revenue increased by 22% year-over-year, while operating income rose by 21% year-over-year, capping an extraordinary year for Paypal as it released numerous new products and scaled up its global acceptance. Business momentum is expected to continue in 2021, with an estimated 50 million net new accounts added and TPV growing in the high-20% range year-over-year. Paypal generated $5 billion of free cash flow in 2020 and believes that it can generate $1 billion more this year. In 2019, the company reported EPS of $2.96 per share. For 2020, the firm’s earnings grew 31% to $3.88 a share. Analysts expect the company’s EPS to grow 18% in 2021 and another 26% in 2022.

The company is also going big on cryptocurrencies. It acquired Curv, an Israeli-based provider of cloud-based infrastructure for digital asset security, back in early March. Paypal also launched an initiative known as “Checkout with Crypto”, enabling customers in the U.S. to utilize cryptocurrencies in tandem with other payment methods when paying with their Paypal digital wallets.

Sempra Energy

Another addition to our portfolio is Sempra Energy. On 7 April 2021 we have added 74 shares at the price of €133,32. The Company operates in Utilities sector and Utilities-Diversified industry.

Sempra Energy is the only North American utility sector company included on the Dow Jones Sustainability World Index and was also named one of the “World’s Most Admired Companies” for 2021 by Fortune Magazine. Sempra Energy is consistently recognized as a leader in sustainable business practices and for its long-standing commitment to building a high-performing culture including safety and diversity and inclusion. The stock has seen a price change of 3.71% since the start of the year. The natural gas and electricity provider is paying out a dividend of $1.1 per share at the moment, with a dividend yield of 3.33% compared to the Utility – Gas Distribution industry’s yield of 2.94% and the S&P 500’s yield of 1.37%.

Looking at dividend growth, the company’s current annualized dividend of $4.40 is up 5.3% from last year. Sempra has increased its dividend 5 times on a year-over-year basis over the last 5 years for an average annual increase of 8.13%.

Joyy Inc.

Last but not least, we have added 97 shares of Joyy Inc on 7 April 2021 at the price of €103,31. The Company operates in the Communication Services and Internet Content & Information industry.

JOYY Inc., might not be a large cap stock, but it saw a significant share price rise of over 20% in the past couple of months on the NASDAQGS. As a mid-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock.

Joyy’s P/E ratio is relatively low at the moment at 5,46 and EPS 18,32. Moreover, net revenues increased by 77.5% to RMB3,783.5 million (US$579.9 million) in the fourth quarter of 2020 from RMB2,131.9 million in the corresponding period of 2019, primarily driven by the growth of live streaming revenues from BIGO.

Stocks fell as traders braced for another supersized US rate hike tomorrow: Everything you need to know

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Goldman Sachs Offers Its First Bitcoin-Backed Loan

Goldman Sachs Offers Its First Bitcoin-Backed Loan