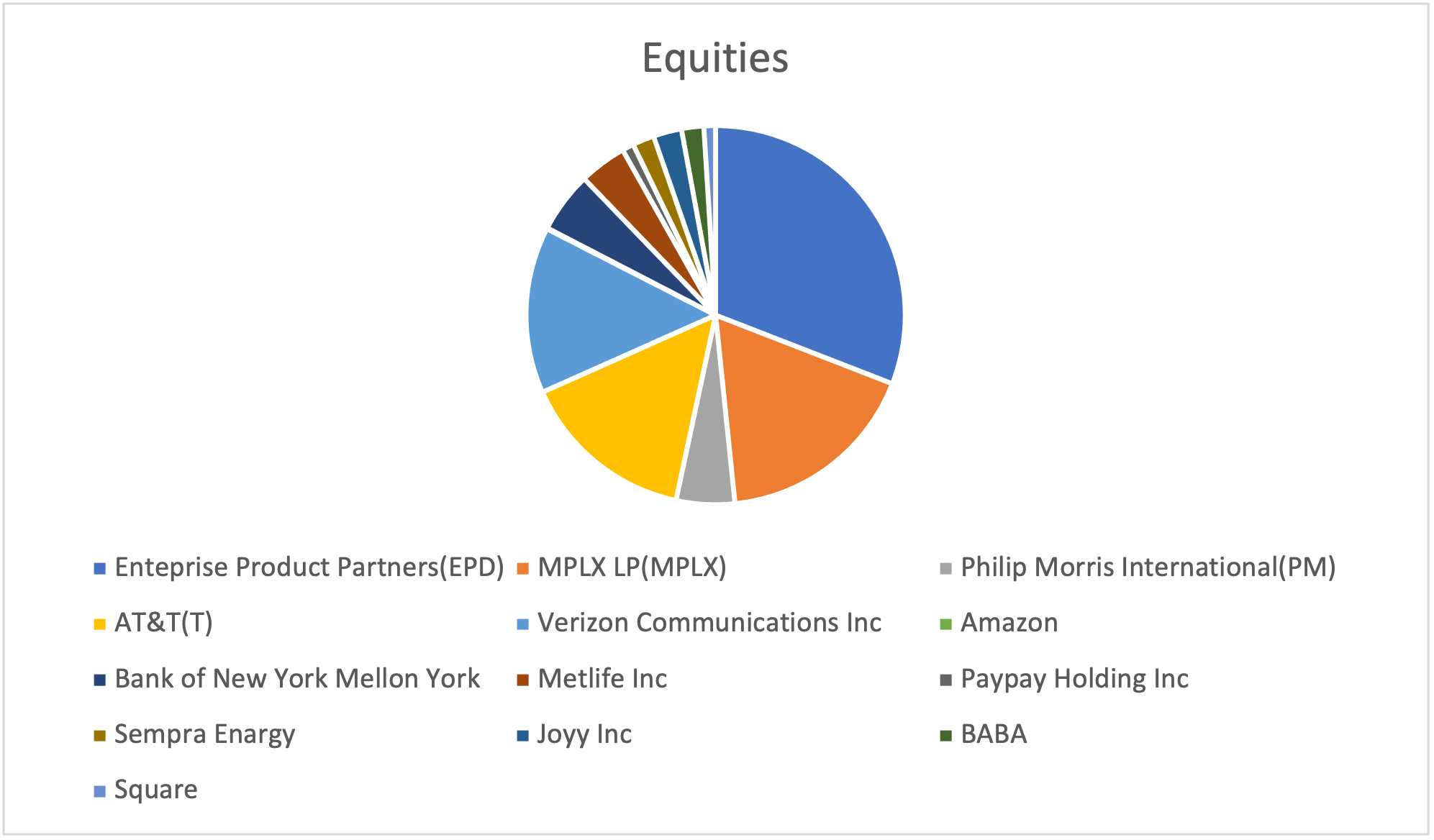

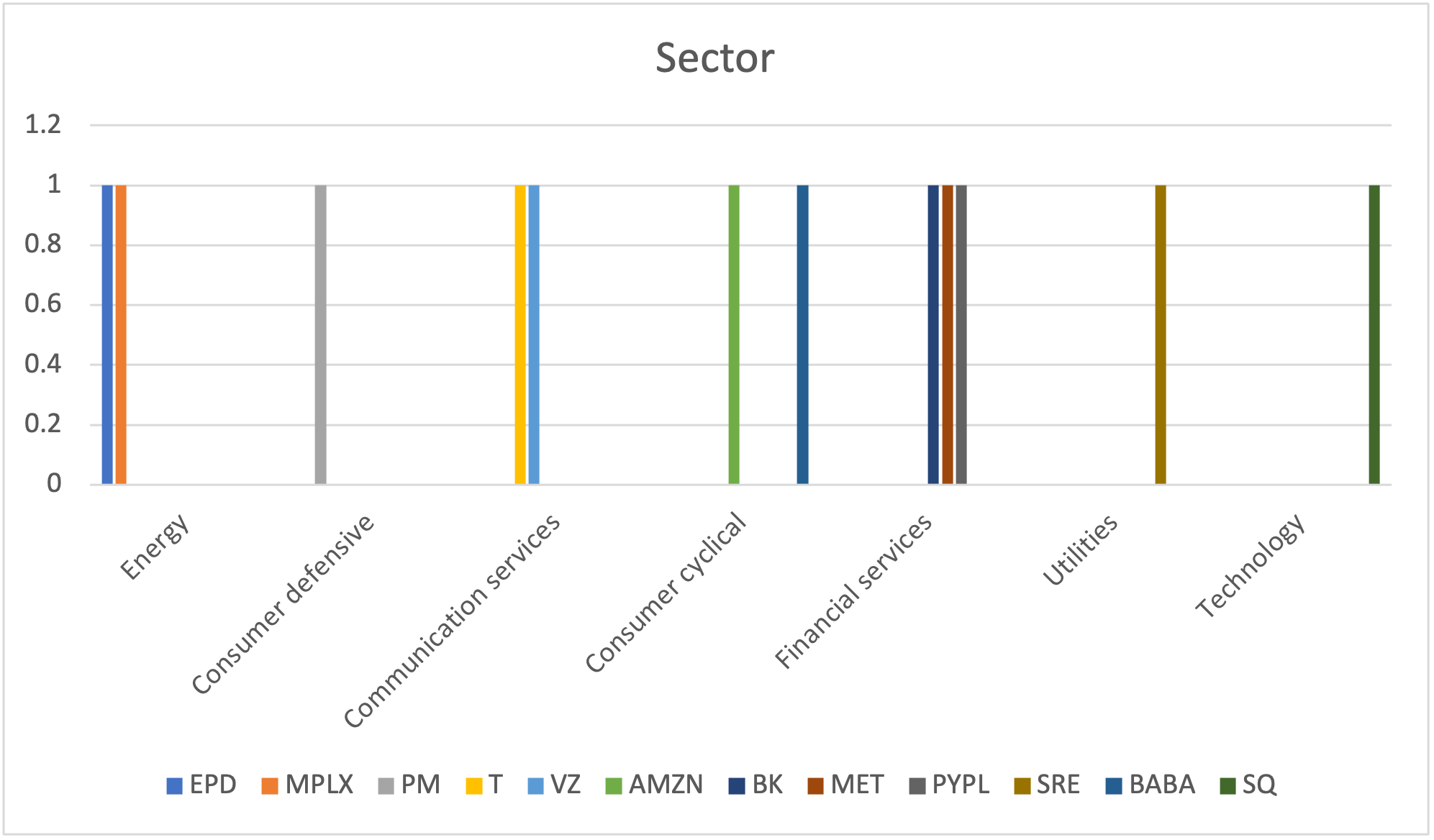

Amazon. Com, Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 3

Acquisition price: €3.258 each share

Profit/(loss) to date: -€166

Major Holders breakdown:

13.67% % of Shares Held by All Insider

59.42% % of Shares Held by Institutions

68.83% % of Float Held by Institutions

4,856 Number of Institutions Holding Shares

6 months performance:

Bank of New York Mellon Corp

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 208

Acquisition price: €47,98 each share

Profit/(loss) to date: €700

Major Holders breakdown:

0.25% % of Shares Held by All Insider

84.78% % of Shares Held by Institutions

85.00% % of Float Held by Institutions

1,392 Number of Institutions Holding Shares

6 months performance:

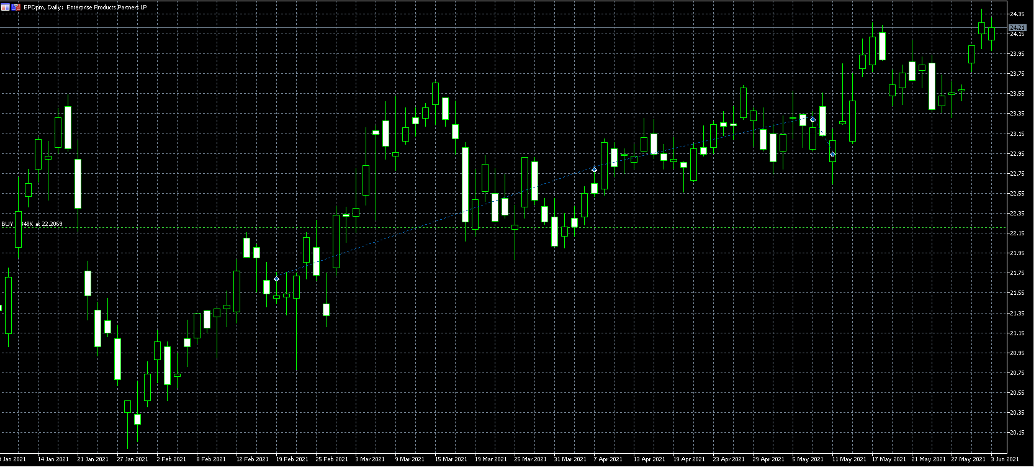

Enterprise Products Partners L.P. (EPD)

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 1.238

Acquisition price: €22,11 each share

Profit/(loss) to date: €2.120

Major Holders breakdown:

32.54% % of Shares Held by All Insider

29.91% % of Shares Held by Institutions

44.33% % of Float Held by Institutions

1,145 Number of Institutions Holding Shares

6 months performance:

Metlife Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 162

Acquisition price: €61,56 each share

Profit/(loss) to date: €625

Major Holders breakdown:

15.37% % of Shares Held by All Insider

78.69% % of Shares Held by Institutions

92.98% % of Float Held by Institutions

1,458 Number of Institutions Holding Shares

6 months performance:

MPLX LP

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 700

Acquisition price: €24,88 each share

Profit/(loss) to date: €2.360

Major Holders breakdown:

63.10% % of Shares Held by All Insider

28.06% % of Shares Held by Institutions

76.05% % of Float Held by Institutions

345 Number of Institutions Holding Shares

6 months performance:

Philip Morris International

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 200

Acquisition price: €86,44 each share

Profit/(loss) to date: €1.781

Major Holders breakdown:

0.21% % of Shares Held by All Insider

75.92% % of Shares Held by Institutions

76.07% % of Float Held by Institutions

2,290 Number of Institutions Holding Shares

6 months performance:

PayPal Holdings Inc

Date of acquisition of shares: 11/2/2021

Number of shares acquired: 40

Acquisition price: €253,18 each share

Profit/(loss) to date: -€179

Major Holders breakdown:

0.12% % of Shares Held by All Insider

82.67% % of Shares Held by Institutions

82.77% % of Float Held by Institutions

3,336 Number of Institutions Holding Shares

6 months performance:

Sempra Energy

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 74

Acquisition price: €133,32 each share

Profit/(loss) to date: €216

Major Holders breakdown:

0.05% % of Shares Held by All Insider

88.64% % of Shares Held by Institutions

88.68% % of Float Held by Institutions

1,140 Number of Institutions Holding Shares

6 months performance:

AT &T Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 600

Acquisition price: €29,40 each share

Profit/(loss) to date: -€400

Major Holders breakdown:

0.10% % of Shares Held by All Insider

52.68% % of Shares Held by Institutions

52.73% % of Float Held by Institutions

3,200 Number of Institutions Holding Shares

6 months performance:

Verizon Communications Inc.

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 569

Acquisition price: €57,54 each share

Profit/(loss) to date: -€300

Major Holders breakdown:

0.02% % of Shares Held by All Insider

66.81% % of Shares Held by Institutions

66.82% % of Float Held by Institutions

3,501 Number of Institutions Holding Shares

6 months performance:

Joyy Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 97

Acquisition price: €103,31 each share

Profit/(loss) to date: -€2.500

Major Holders breakdown:

1.44% % of Shares Held by All Insider

89.31% % of Shares Held by Institutions

90.61% % of Float Held by Institutions

386 Number of Institutions Holding Shares

6 months performance:

Square Inc.

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 40

Acquisition price: €250 each share

Profit/(loss) to date: -€1.286

Major Holders breakdown:

1.23% % of Shares Held by All Insider

74.08% % of Shares Held by Institutions

75.00% % of Float Held by Institutions

1,700 Number of Institutions Holding Shares

6 months performance:

Alibaba Group Holding Limited (BABA)

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 74

Acquisition price: €236,52 each share

Profit/(loss) to date: -€1.093

Major Holders breakdown:

10.18% % of Shares Held by All Insider

35.87% % of Shares Held by Institutions

39.94% % of Float Held by Institutions

2,784 Number of Institutions Holding Shares

6 months performance:

Stock Portfolio performance 18/6/2021

Stock Portfolio performance 18/6/2021

Bitcoin breaks through $40,000. What’s moving the market?

Bitcoin is the world’s largest cryptocurrency by market capitalization and is now on rise again pushing over the $40,000 mark for the first time since late May. As you can imagine, the CEO of Tesla, Elon Musk has a lot to do with this price increase. Elon Musk, suggested over the weekend that the electric car manufacturer could start using the digital currency as payment once more just a few weeks after ruling it out because of its allegedly unsuitable energy usage involved in mining.

Stock Portfolio performance 11/6/2021

Stock Portfolio performance 11/6/2021