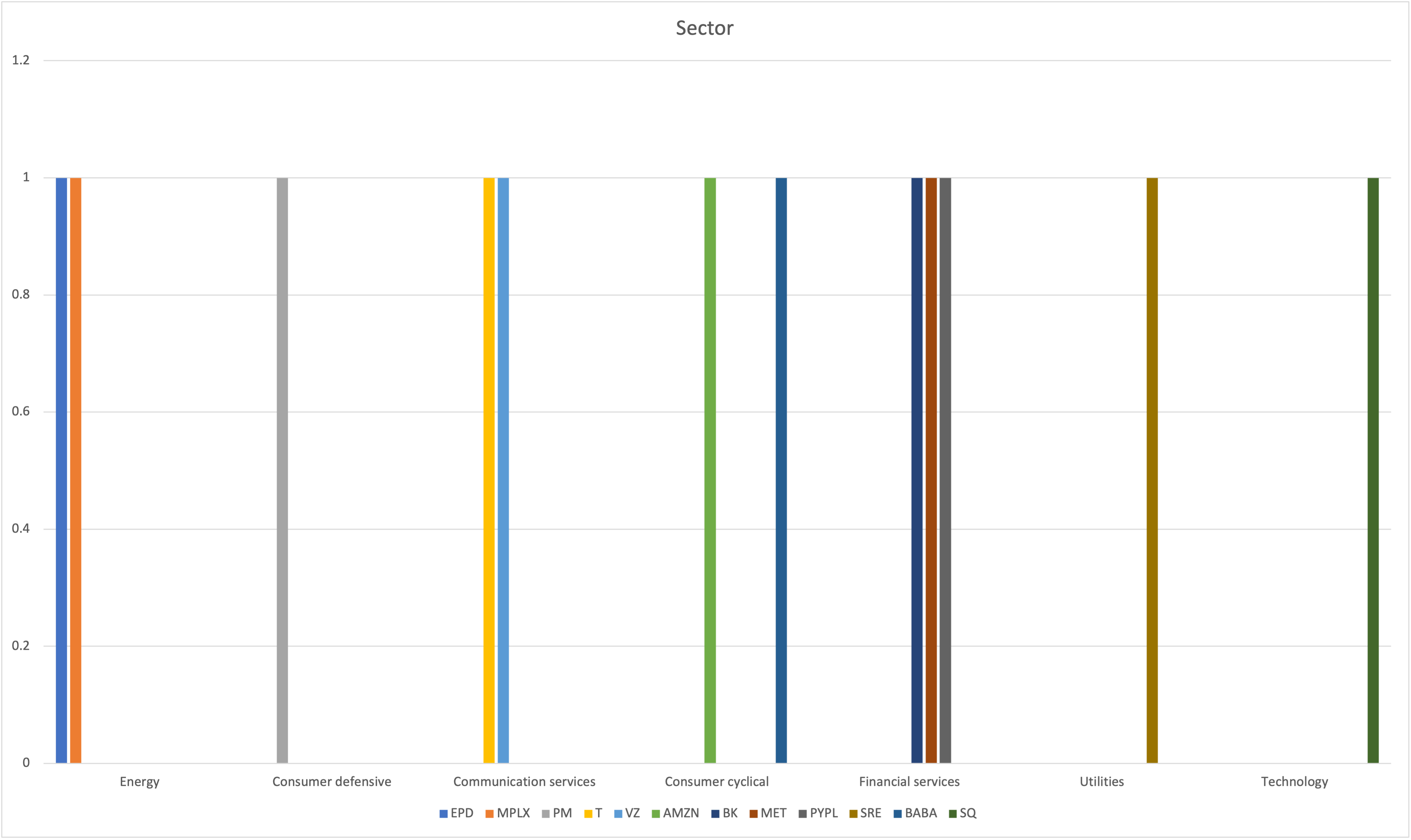

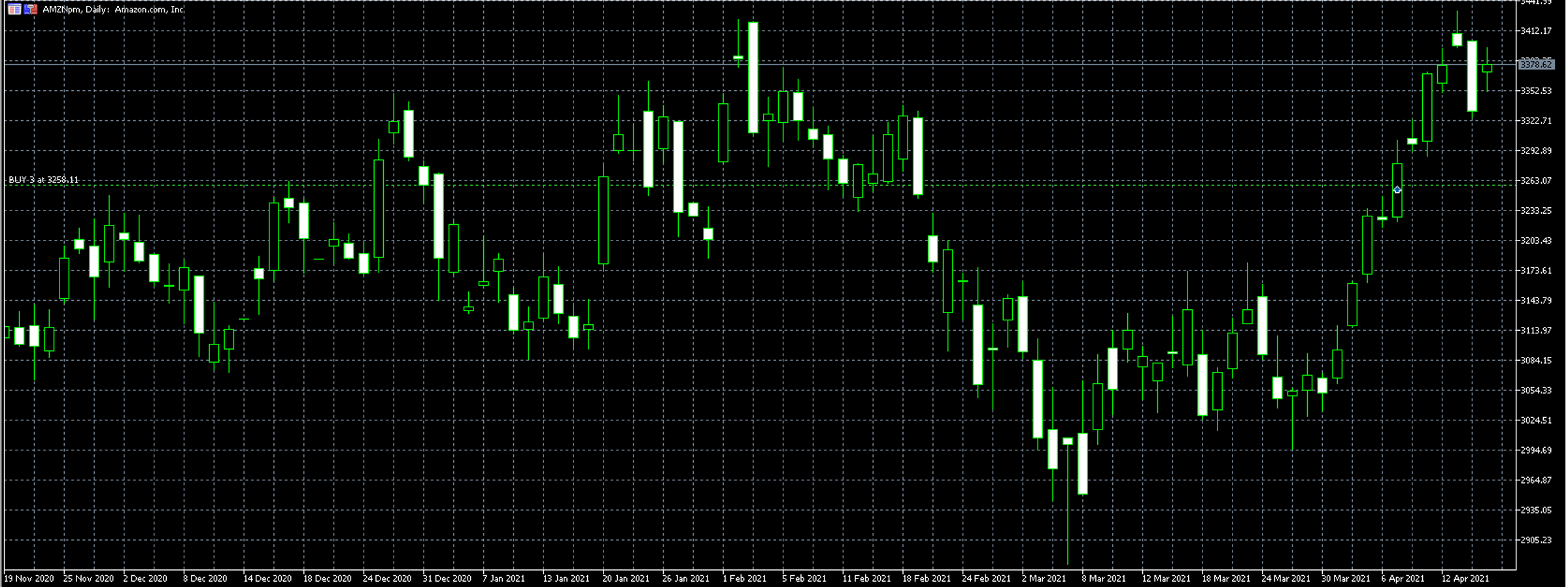

Amazon. Com, Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 3

Acquisition price: €3.258 each share

Profit/(loss) to date: €495

Major Holders breakdown:

14.07% % of Shares Held by All Insider

58.89% % of Shares Held by Institutions

68.54% % of Float Held by Institutions

4,815 Number of Institutions Holding Shares

6 months performance:

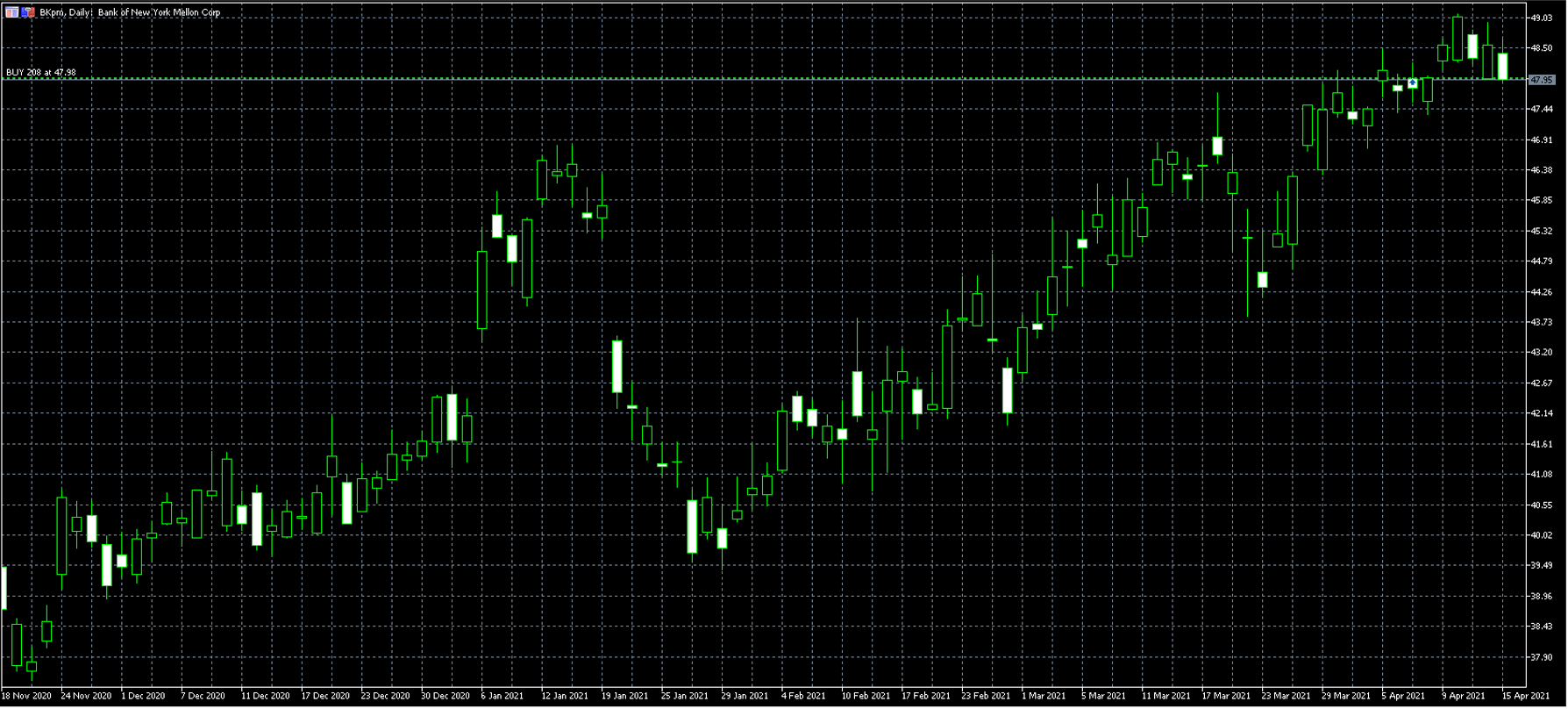

Bank of New York Mellon Corp

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 208

Acquisition price: €47,98 each share

Profit/(loss) to date: €180,22

Major Holders breakdown:

0.23% % of Shares Held by All Insider

86.58% % of Shares Held by Institutions

86.78% % of Float Held by Institutions

1,353 Number of Institutions Holding Shares

6 months performance:

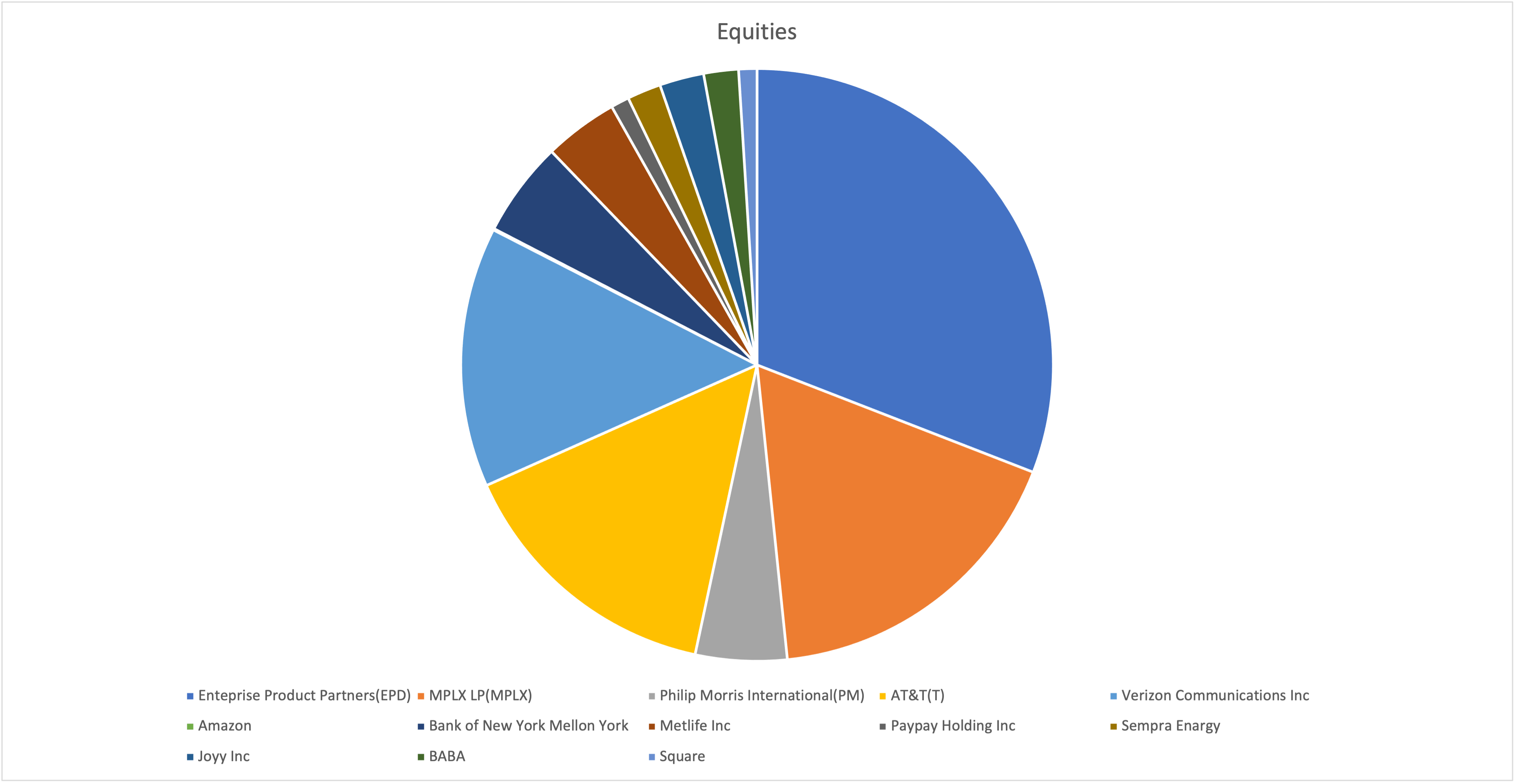

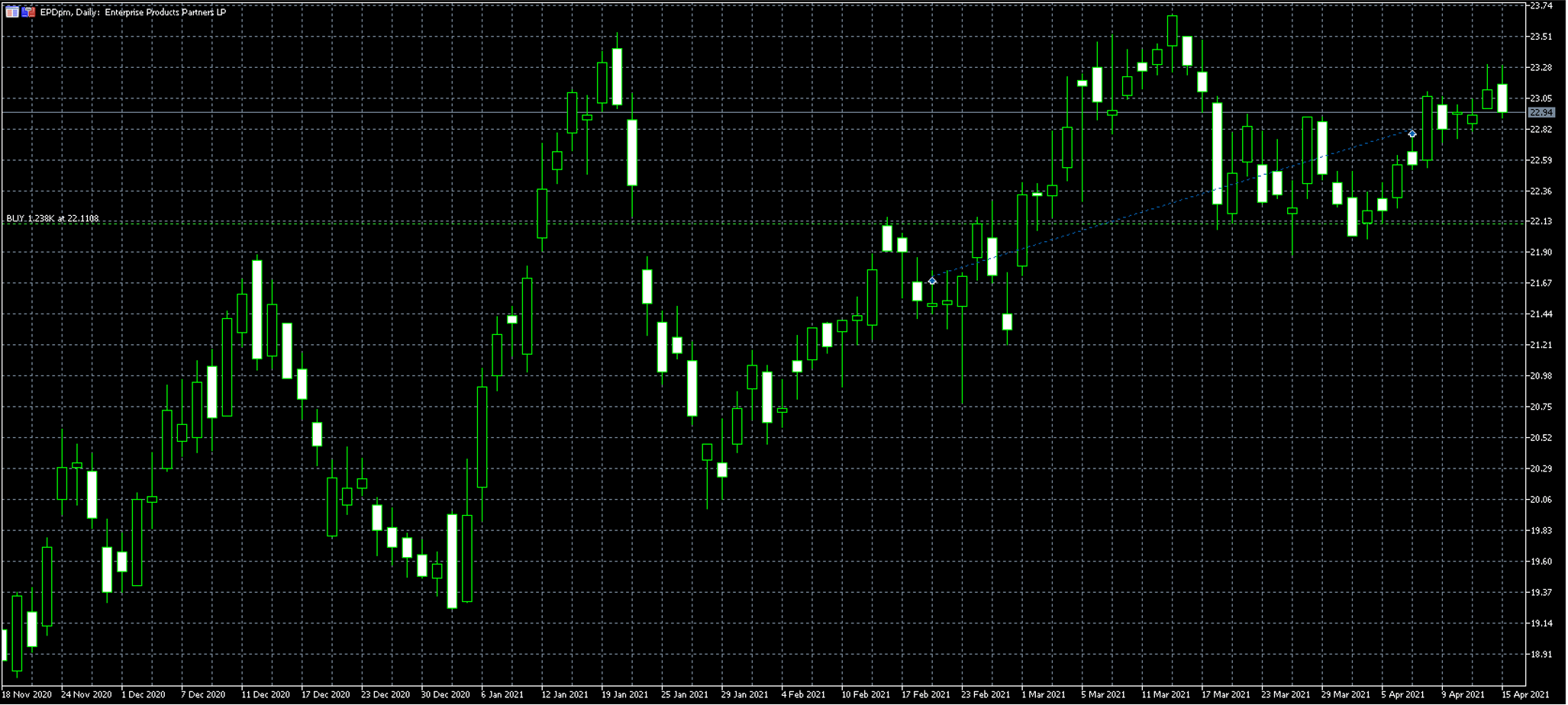

Enterprise Products Partners L.P. (EPD)

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 1.238

Acquisition price: €22,11 each share

Profit/(loss) to date: €1.430

Major Holders breakdown:

32.59% % of Shares Held by All Insider

30.99% % of Shares Held by Institutions

45.96% % of Float Held by Institutions

1,124 Number of Institutions Holding Shares

6 months performance:

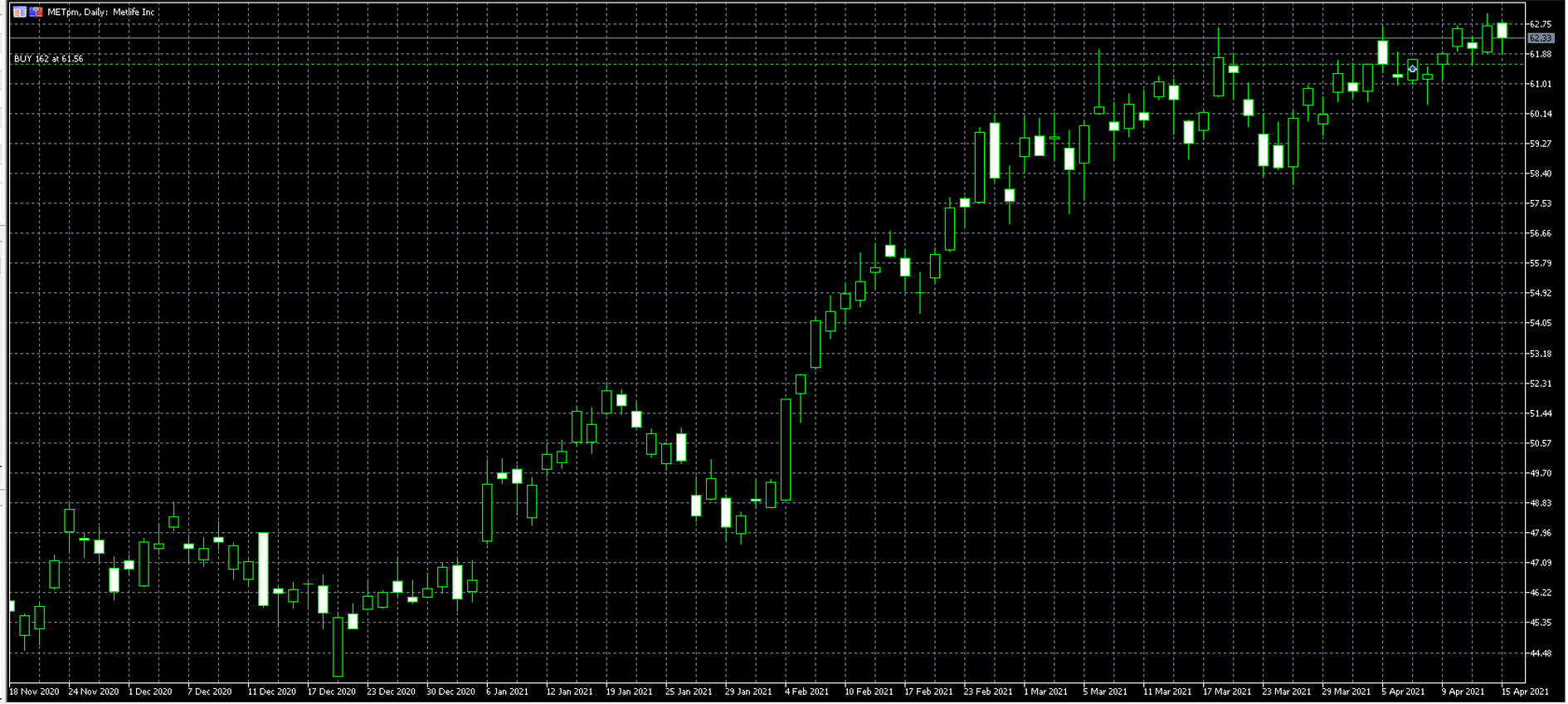

Metlife Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 162

Acquisition price: €61,56 each share

Profit/(loss) to date: €268

Major Holders breakdown:

15.39% % of Shares Held by All Insider

77.47% % of Shares Held by Institutions

91.57% % of Float Held by Institutions

1,415 Number of Institutions Holding Shares

6 months performance:

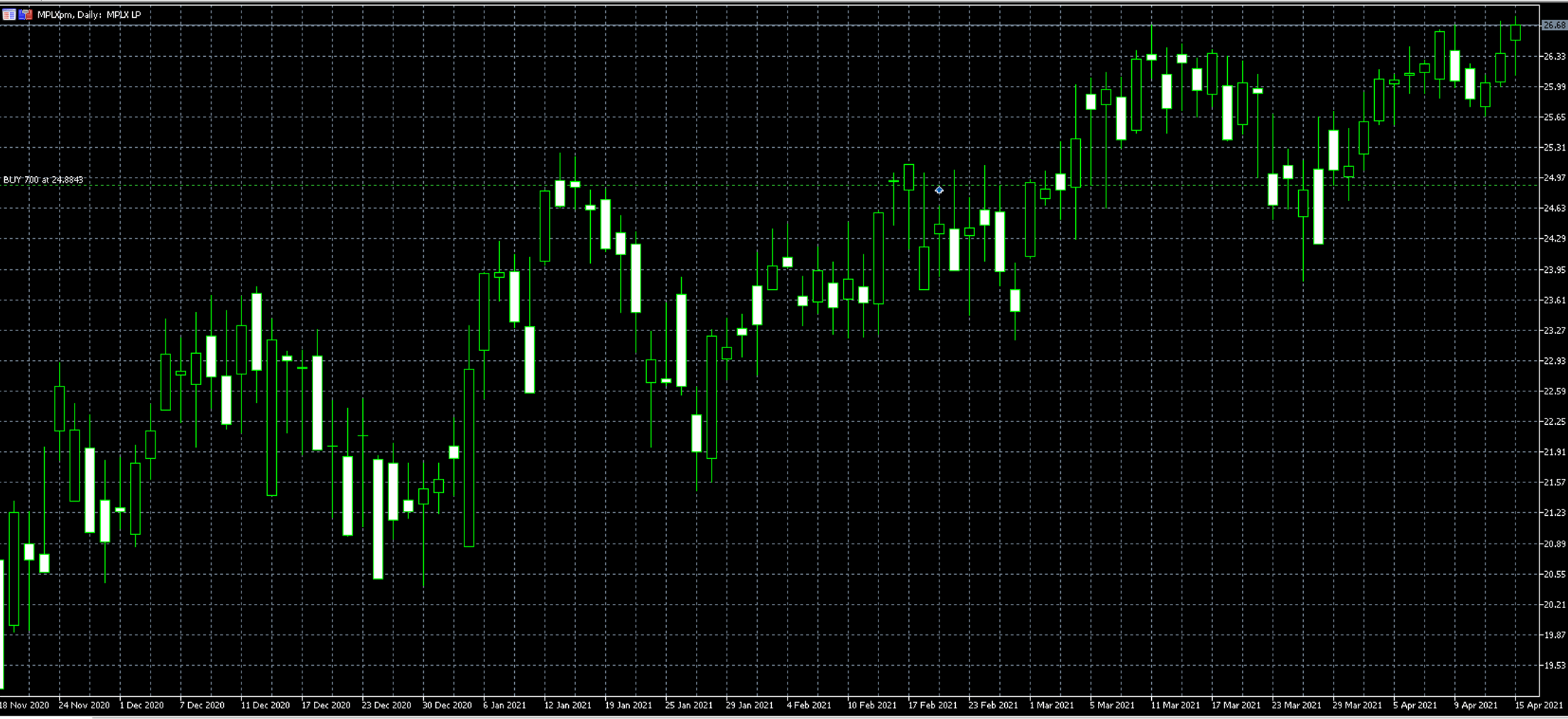

MPLX LP

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 700

Acquisition price: €24,88 each share

Profit/(loss) to date: €1.251

Major Holders breakdown:

62.64% % of Shares Held by All Insider

28.95% % of Shares Held by Institutions

77.49% % of Float Held by Institutions

335 Number of Institutions Holding Shares

6 months performance:

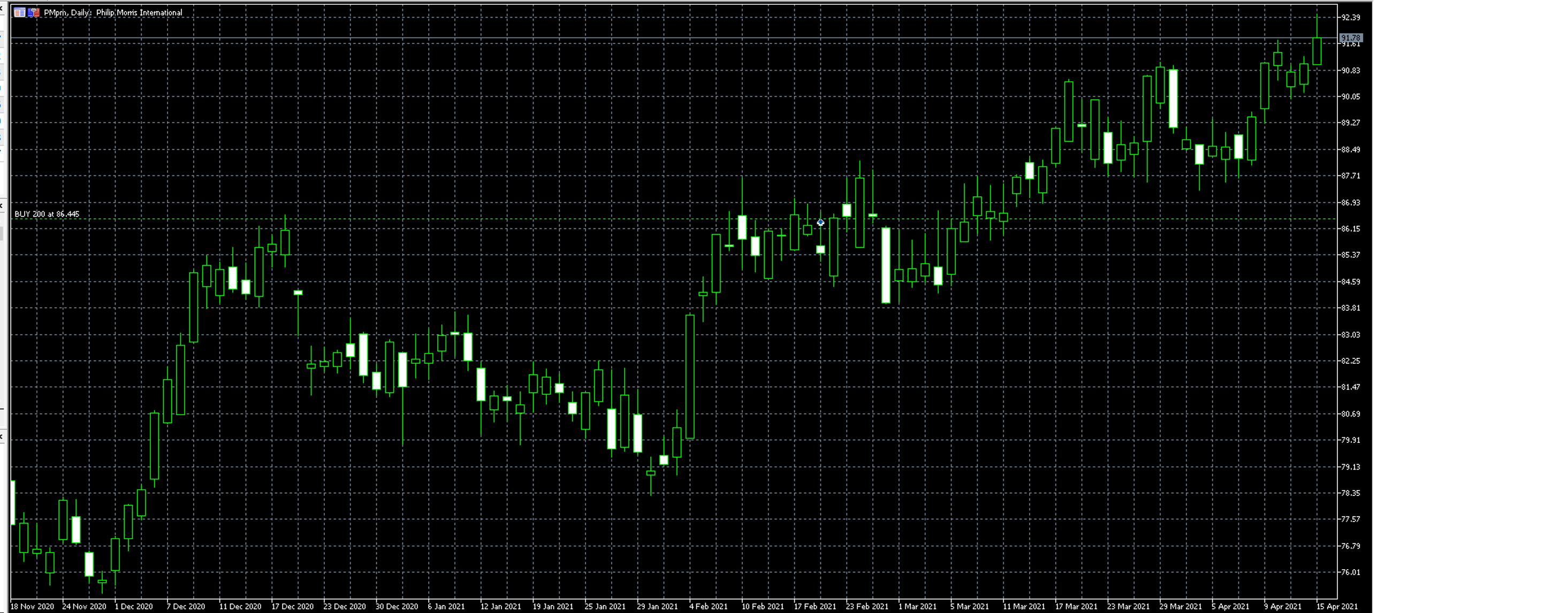

Philip Morris International

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 200

Acquisition price: €86,44 each share

Profit/(loss) to date: €1.252

Major Holders breakdown:

0.21% % of Shares Held by All Insider

75.38% % of Shares Held by Institutions

75.53% % of Float Held by Institutions

2,273 Number of Institutions Holding Shares

6 months performance:

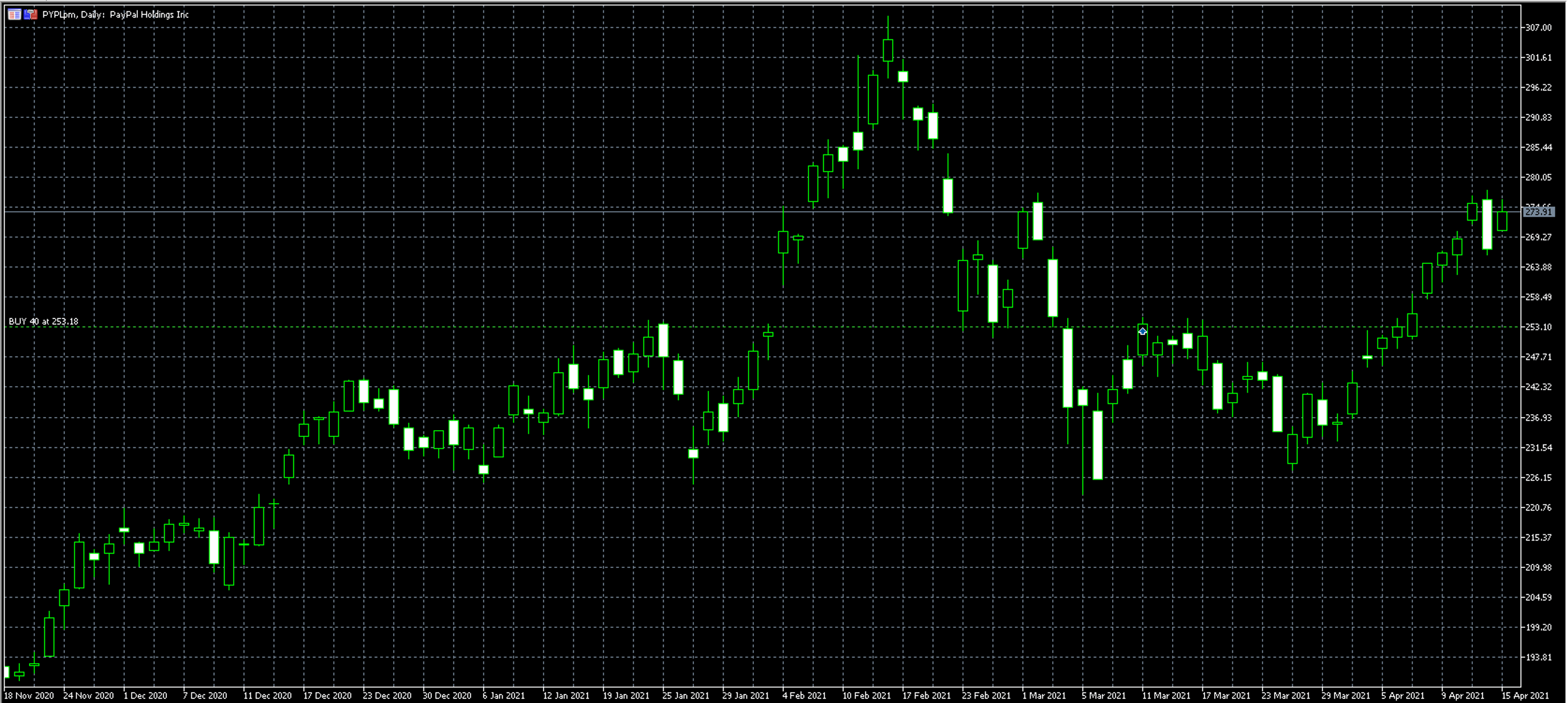

PayPal Holdings Inc

Date of acquisition of shares: 11/2/2021

Number of shares acquired: 40

Acquisition price: €253,18 each share

Profit/(loss) to date: €699

Major Holders breakdown:

0.13% % of Shares Held by All Insider

84.79% % of Shares Held by Institutions

84.89% % of Float Held by Institutions

3,249 Number of Institutions Holding Shares

6 months performance:

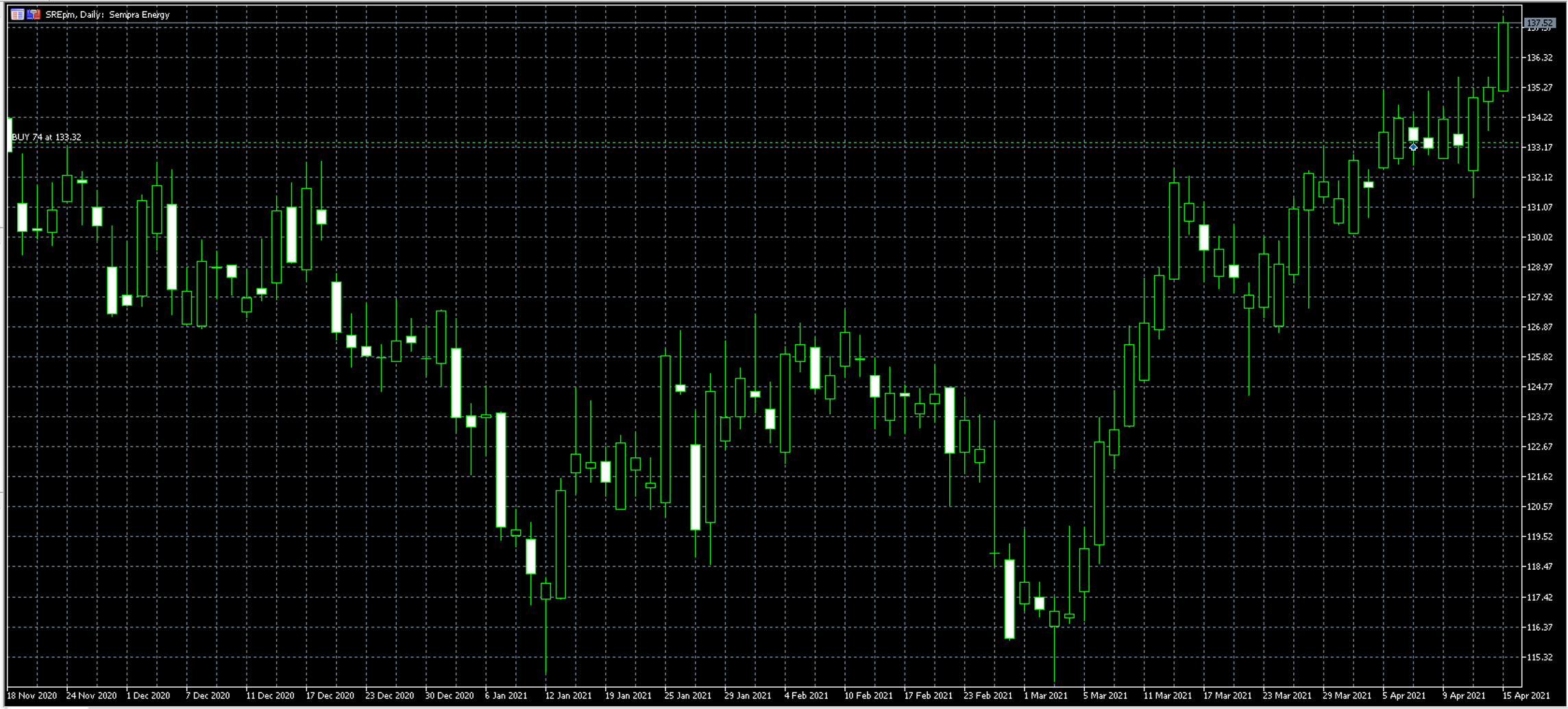

Sempra Energy

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 74

Acquisition price: €133,32 each share

Profit/(loss) to date: €77

Major Holders breakdown:

0.06% % of Shares Held by All Insider

83.56% % of Shares Held by Institutions

83.60% % of Float Held by Institutions

1,169 Number of Institutions Holding Shares

6 months performance:

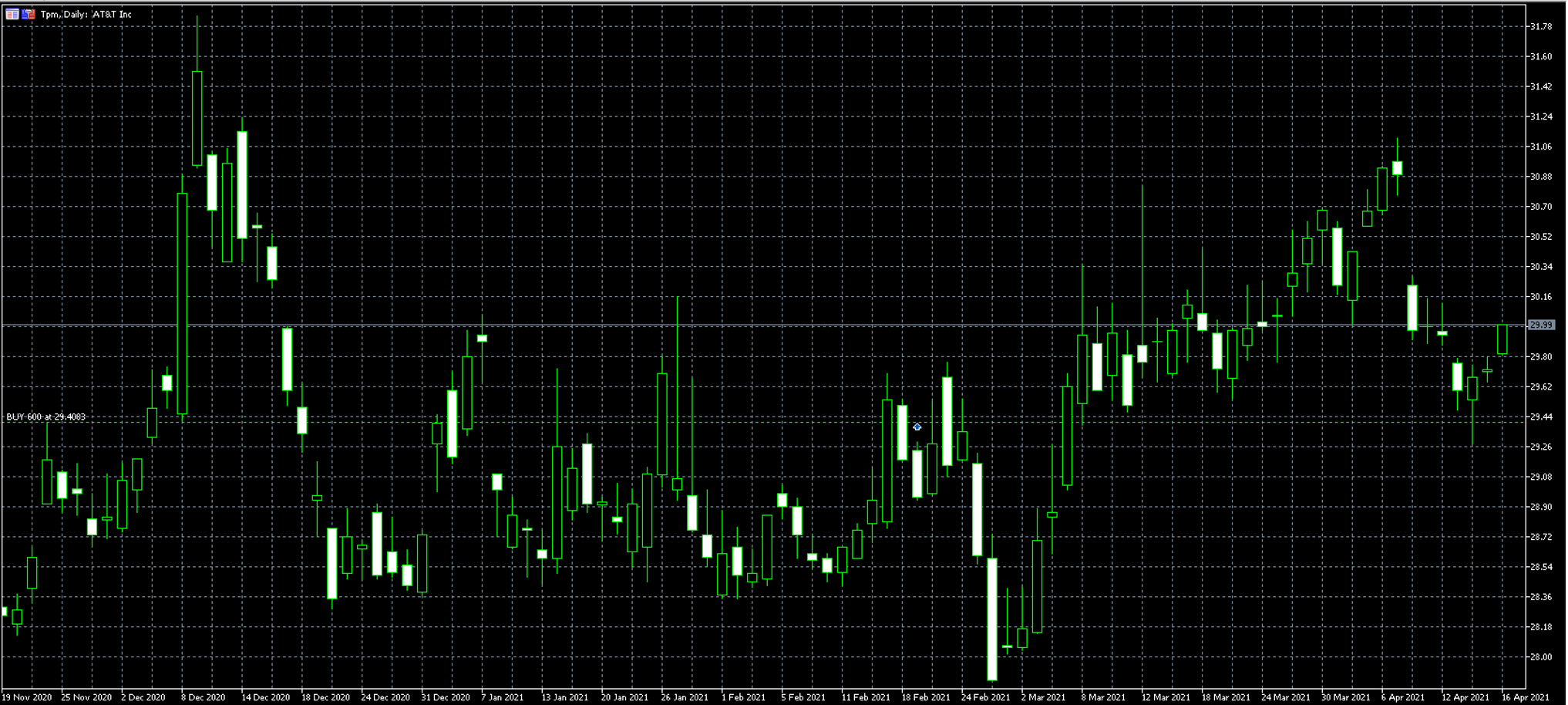

AT &T Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 600

Acquisition price: €29,40 each share

Profit/(loss) to date: €699

Major Holders breakdown:

0.10% % of Shares Held by All Insider

52.96% % of Shares Held by Institutions

53.02% % of Float Held by Institutions

3,164 Number of Institutions Holding Shares

6 months performance:

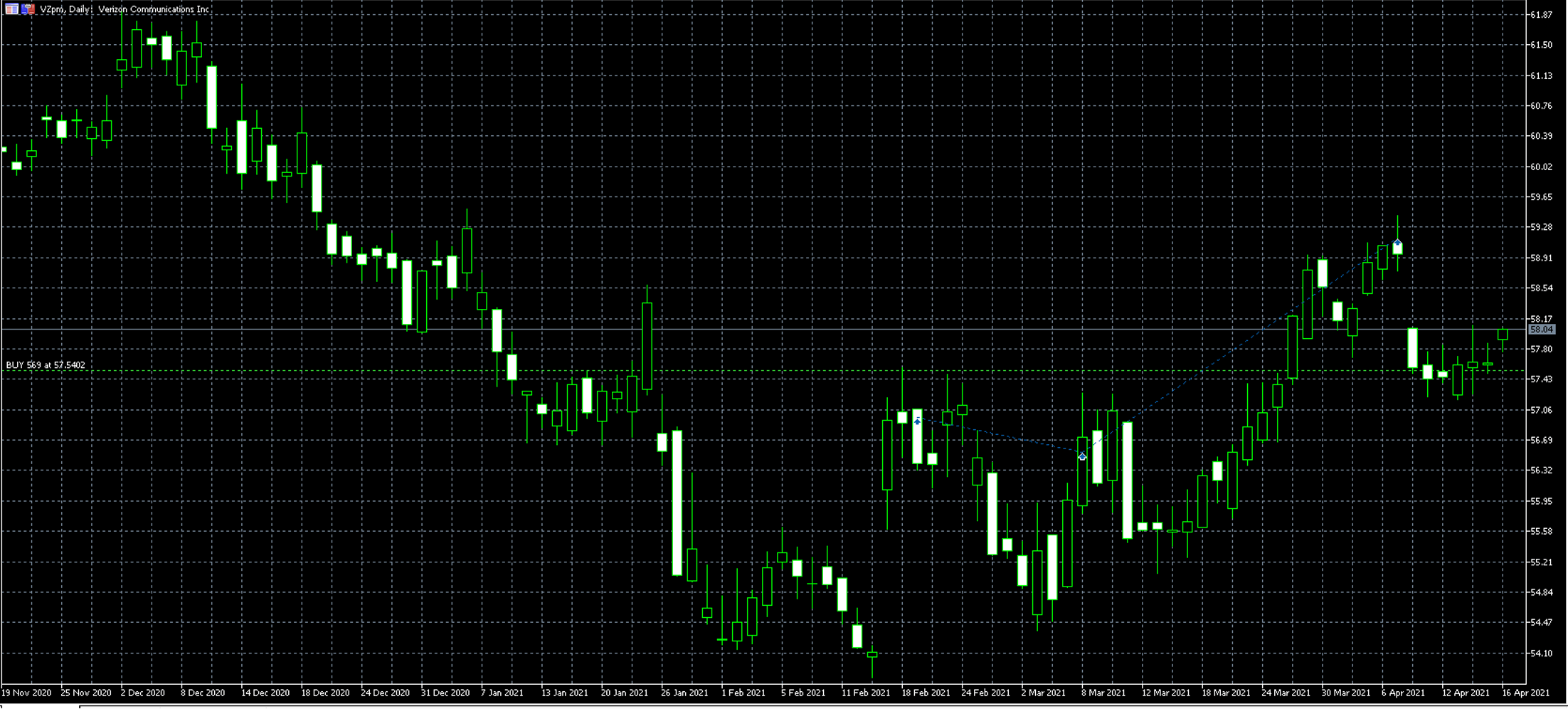

Verizon Communications Inc.

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 569

Acquisition price: €57,54 each share

Profit/(loss) to date: (€582)

Major Holders breakdown:

0.02% % of Shares Held by All Insider

68.08% % of Shares Held by Institutions

68.09% % of Float Held by Institutions

3,468 Number of Institutions Holding Shares

6 months performance:

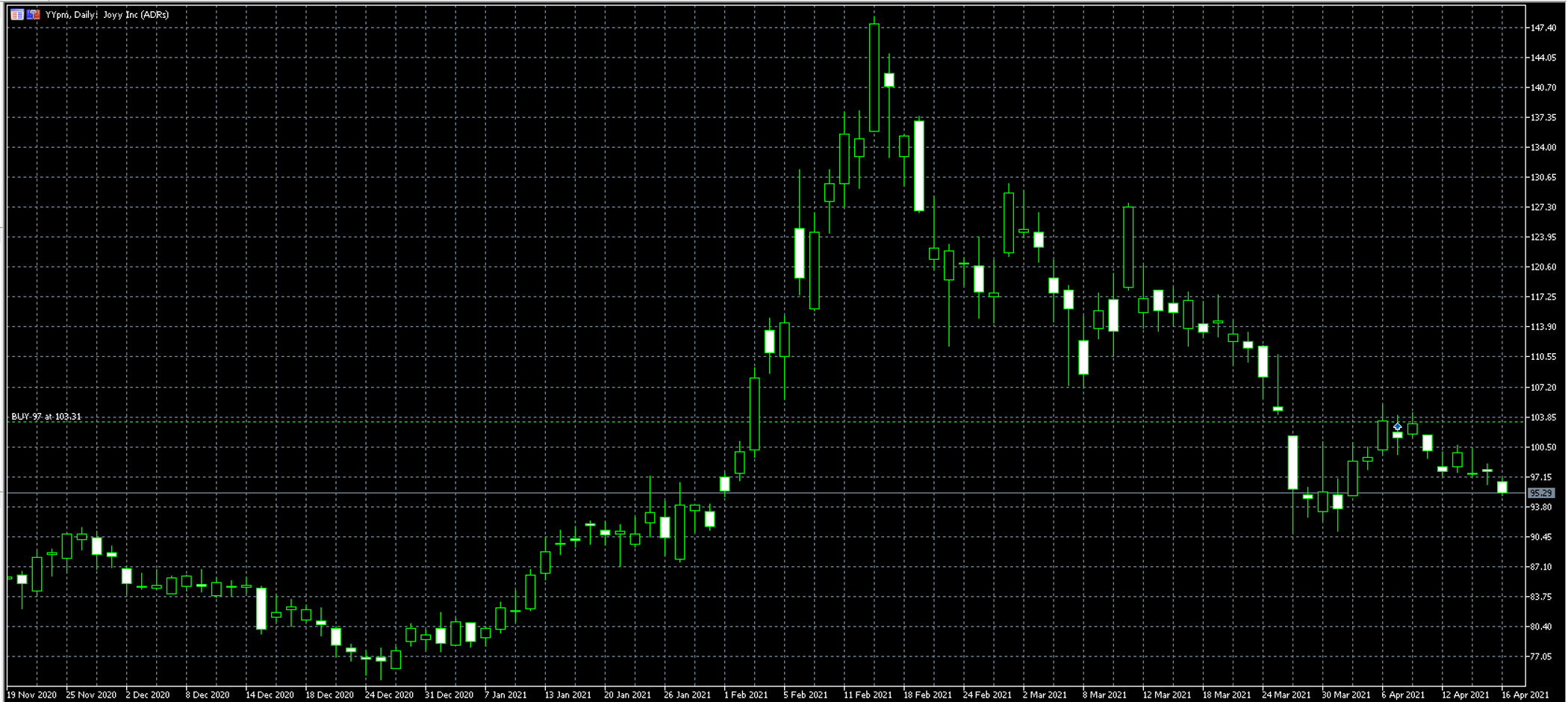

Joyy Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 97

Acquisition price: €103,31 each share

Profit/(loss) to date: (€514)

Major Holders breakdown:

1.41% % of Shares Held by All Insider

77.51% % of Shares Held by Institutions

78.62% % of Float Held by Institutions

374 Number of Institutions Holding Shares

6 months performance:

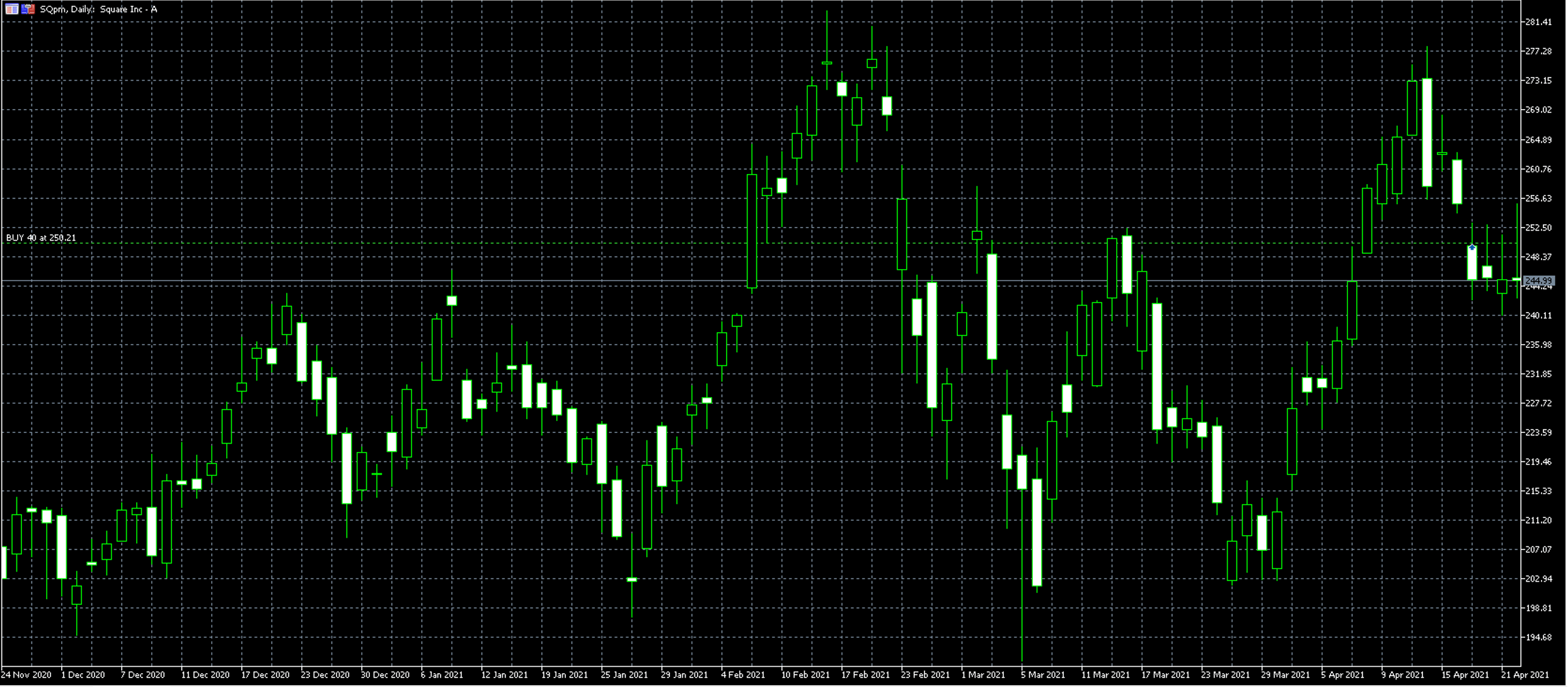

Square Inc.

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 40

Acquisition price: €250 each share

Profit/(loss) to date: €102

Major Holders breakdown:

0.93% % of Shares Held by All Insider

75.81% % of Shares Held by Institutions

76.52% % of Float Held by Institutions

1,639 Number of Institutions Holding Shares

6 months performance:

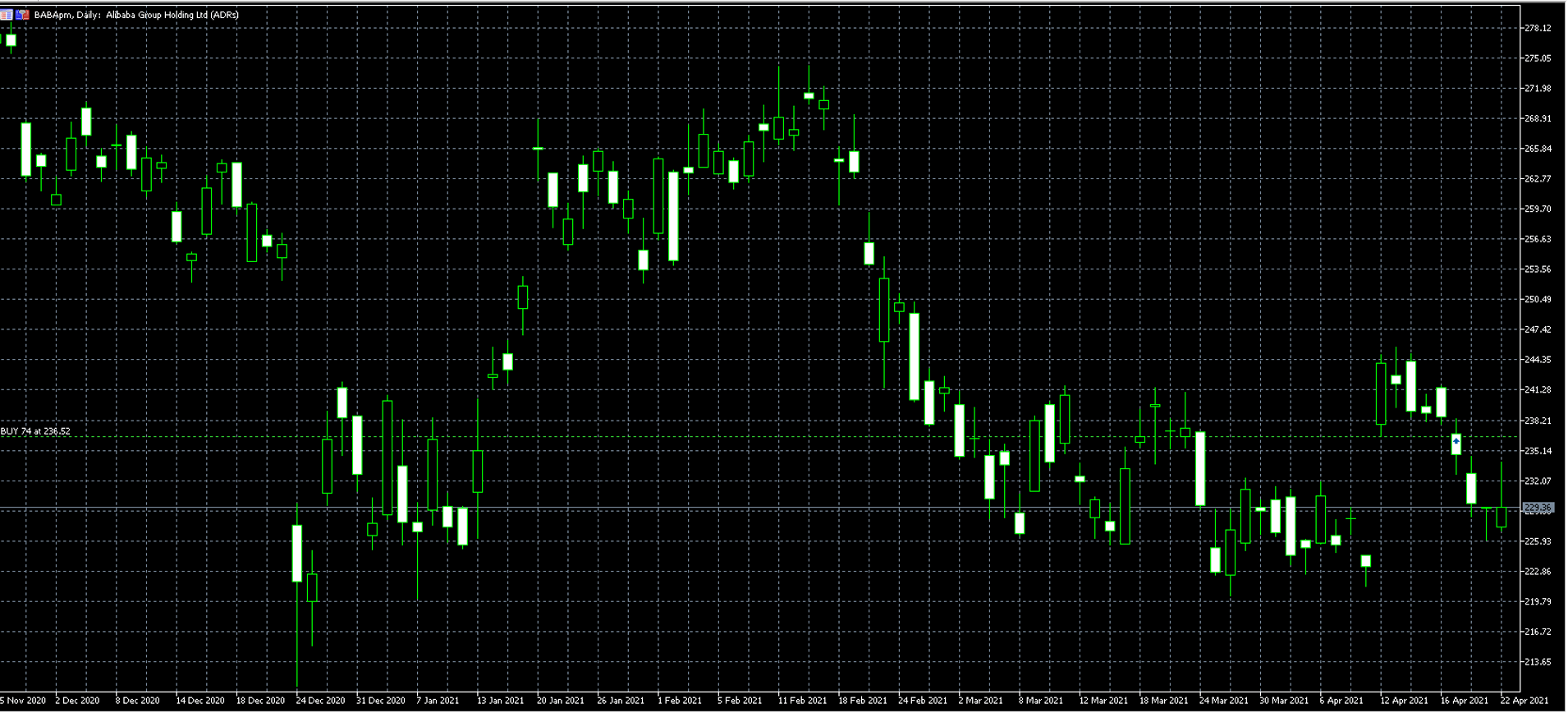

Alibaba Group Holding Limited (BABA)

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 74

Acquisition price: €236,52 each share

Profit/(loss) to date: €2

Major Holders breakdown:

10.21% % of Shares Held by All Insider

39.89% % of Shares Held by Institutions

44.43% % of Float Held by Institutions

2,818 Number of Institutions Holding Shares

6 months performance:

Technical analysis: What Is the Risk/Reward Ratio and How to Use It

What is Forex and how does it work?

Forex market has became increasingly popular in the recent years as we see more and more individuals to get involved and trade in the foreign exchange market.

What is stock split and stock split reverse?

Apple, Amazon and Tesla have all split their stocks in the past in order to make their shares more accessible to retail investors. In the following article you will learn what a stock split is, why do companies go through the hassle and expense of a stock split, what are reverse stock splits and why would a company do a reverse split.