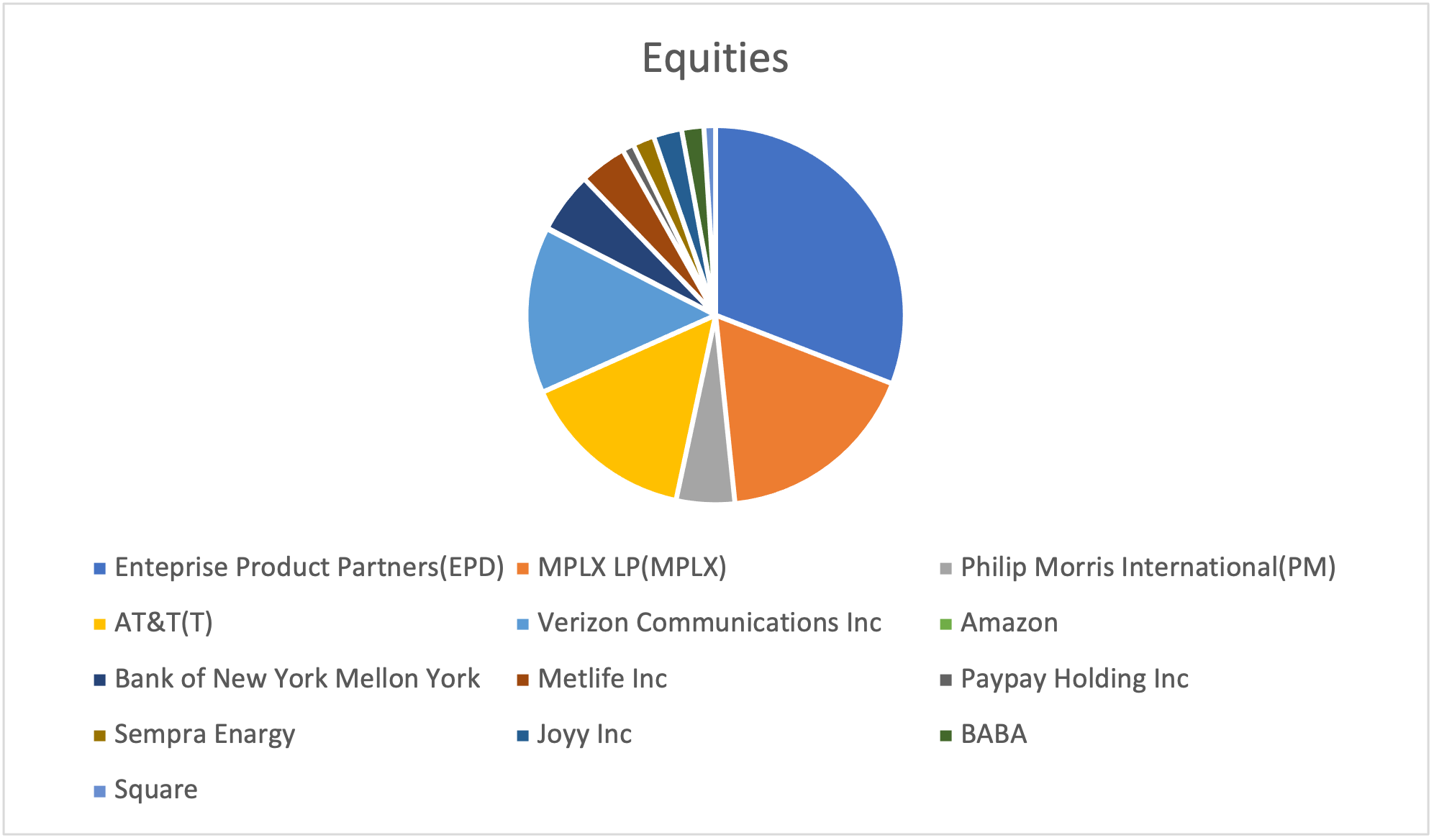

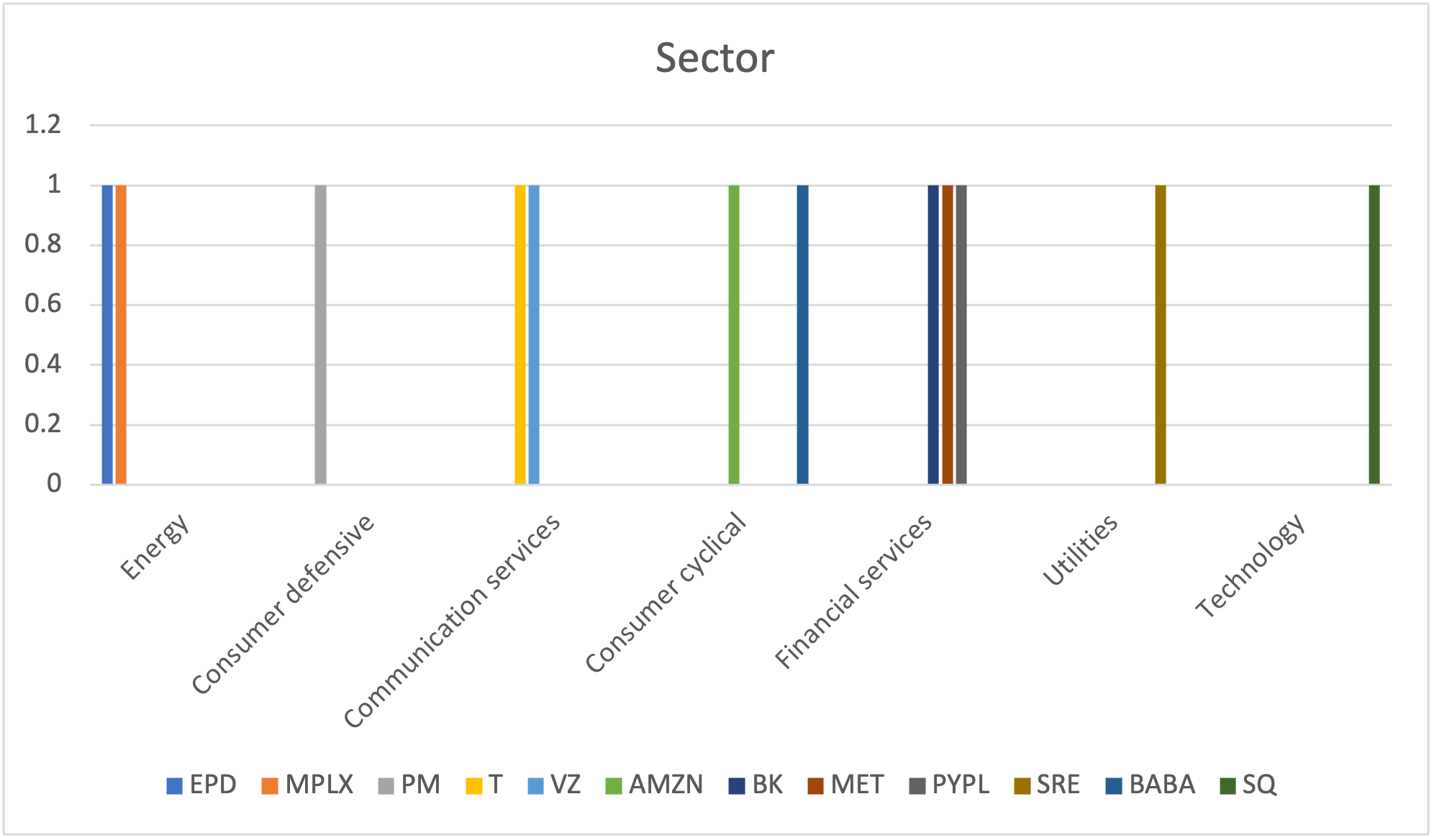

Amazon. Com, Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 3

Acquisition price: €3.258 each share

Profit/(loss) to date: €120,62

Major Holders breakdown:

14.07% % of Shares Held by All Insider

58.91% % of Shares Held by Institutions

68.56% % of Float Held by Institutions

4,811 Number of Institutions Holding Shares

6 months performance:

Bank of New York Mellon Corp

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 208

Acquisition price: €47,98 each share

Profit/(loss) to date: (€275)

Major Holders breakdown:

0.23% % of Shares Held by All Insider

86.59% % of Shares Held by Institutions

86.79% % of Float Held by Institutions

1,356 Number of Institutions Holding Shares

6 months performance:

Enterprise Products Partners L.P. (EPD)

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 1.238

Acquisition price: €22,11 each share

Profit/(loss) to date: €748,52

Major Holders breakdown:

32.59% % of Shares Held by All Insider

30.96% % of Shares Held by Institutions

45.93% % of Float Held by Institutions

1,117 Number of Institutions Holding Shares

6 months performance:

Metlife Inc

Metlife Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 162

Acquisition price: €61,56 each share

Profit/(loss) to date: €24,18

Major Holders breakdown:

15.39% % of Shares Held by All Insider

77.54% % of Shares Held by Institutions

91.64% % of Float Held by Institutions

1,410 Number of Institutions Holding Shares

6 months performance:

MPLX LP

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 700

Acquisition price: €24,88 each share

Profit/(loss) to date: €676,58

Major Holders breakdown:

62.64% % of Shares Held by All Insider

28.95% % of Shares Held by Institutions

77.48% % of Float Held by Institutions

332 Number of Institutions Holding Shares

6 months performance:

Philip Morris International

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 200

Acquisition price: €86,44 each share

Profit/(loss) to date: €1.228

Major Holders breakdown:

0.21% % of Shares Held by All Insider

75.31% % of Shares Held by Institutions

75.47% % of Float Held by Institutions

2,266 Number of Institutions Holding Shares

6 months performance:

PayPal Holdings Inc

Date of acquisition of shares: 11/2/2021

Number of shares acquired: 40

Acquisition price: €253,18 each share

Profit/(loss) to date: €112

Major Holders breakdown:

0.13% % of Shares Held by All Insider

84.83% % of Shares Held by Institutions

84.93% % of Float Held by Institutions

3,239 Number of Institutions Holding Shares

6 months performance:

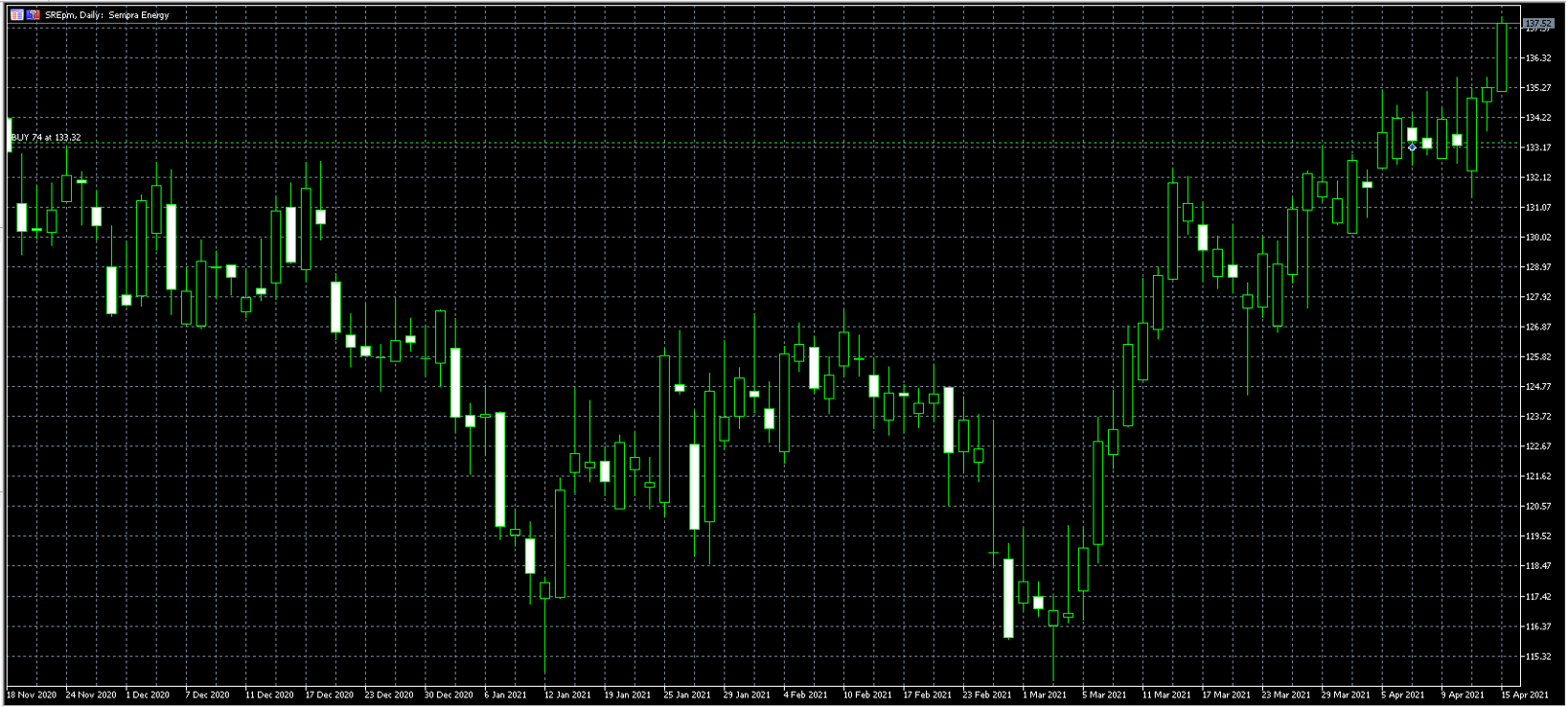

Sempra Energy

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 74

Acquisition price: €133,32 each share

Profit/(loss) to date: €241

Major Holders breakdown:

0.06% % of Shares Held by All Insider

83.50% % of Shares Held by Institutions

83.54% % of Float Held by Institutions

1,163 Number of Institutions Holding Shares

6 months performance:

AT &T Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 600

Acquisition price: €29,40 each share

Profit/(loss) to date: €892

Major Holders breakdown:

0.10% % of Shares Held by All Insider

53.01% % of Shares Held by Institutions

53.07% % of Float Held by Institutions

3,165 Number of Institutions Holding Share

6 months performance:

Verizon Communications Inc.

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 569

Acquisition price: €57,54 each share

Profit/(loss) to date: (€188)

Major Holders breakdown:

0.02% % of Shares Held by All Insider

68.14% % of Shares Held by Institutions

68.15% % of Float Held by Institutions

3,461 Number of Institutions Holding Shares

6 months performance:

Joyy Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 97

Acquisition price: €103,31 each share

Profit/(loss) to date: (€749)

Major Holders breakdown:

1.41% % of Shares Held by All Insider

77.46% % of Shares Held by Institutions

78.56% % of Float Held by Institutions

370 Number of Institutions Holding Shares

6 months performance:

Square Inc.

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 40

Acquisition price: €250 each share

Profit/(loss) to date: (€176)

Major Holders breakdown:

0.93% % of Shares Held by All Insider

75.76% % of Shares Held by Institutions

76.48% % of Float Held by Institutions

1,630 Number of Institutions Holding Shares

6 months performance:

Alibaba Group Holding Limited (BABA)

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 74

Acquisition price: €236,52 each share

Profit/(loss) to date: (€445)

Major Holders breakdown:

10.21% % of Shares Held by All Insider

39.87% % of Shares Held by Institutions

44.41% % of Float Held by Institutions

2,821 Number of Institutions Holding Shares

6 months performance:

Stock Portfolio performance 18/6/2021

Stock Portfolio performance 18/6/2021

Bitcoin breaks through $40,000. What’s moving the market?

Bitcoin is the world’s largest cryptocurrency by market capitalization and is now on rise again pushing over the $40,000 mark for the first time since late May. As you can imagine, the CEO of Tesla, Elon Musk has a lot to do with this price increase. Elon Musk, suggested over the weekend that the electric car manufacturer could start using the digital currency as payment once more just a few weeks after ruling it out because of its allegedly unsuitable energy usage involved in mining.

Stock Portfolio performance 11/6/2021

Stock Portfolio performance 11/6/2021