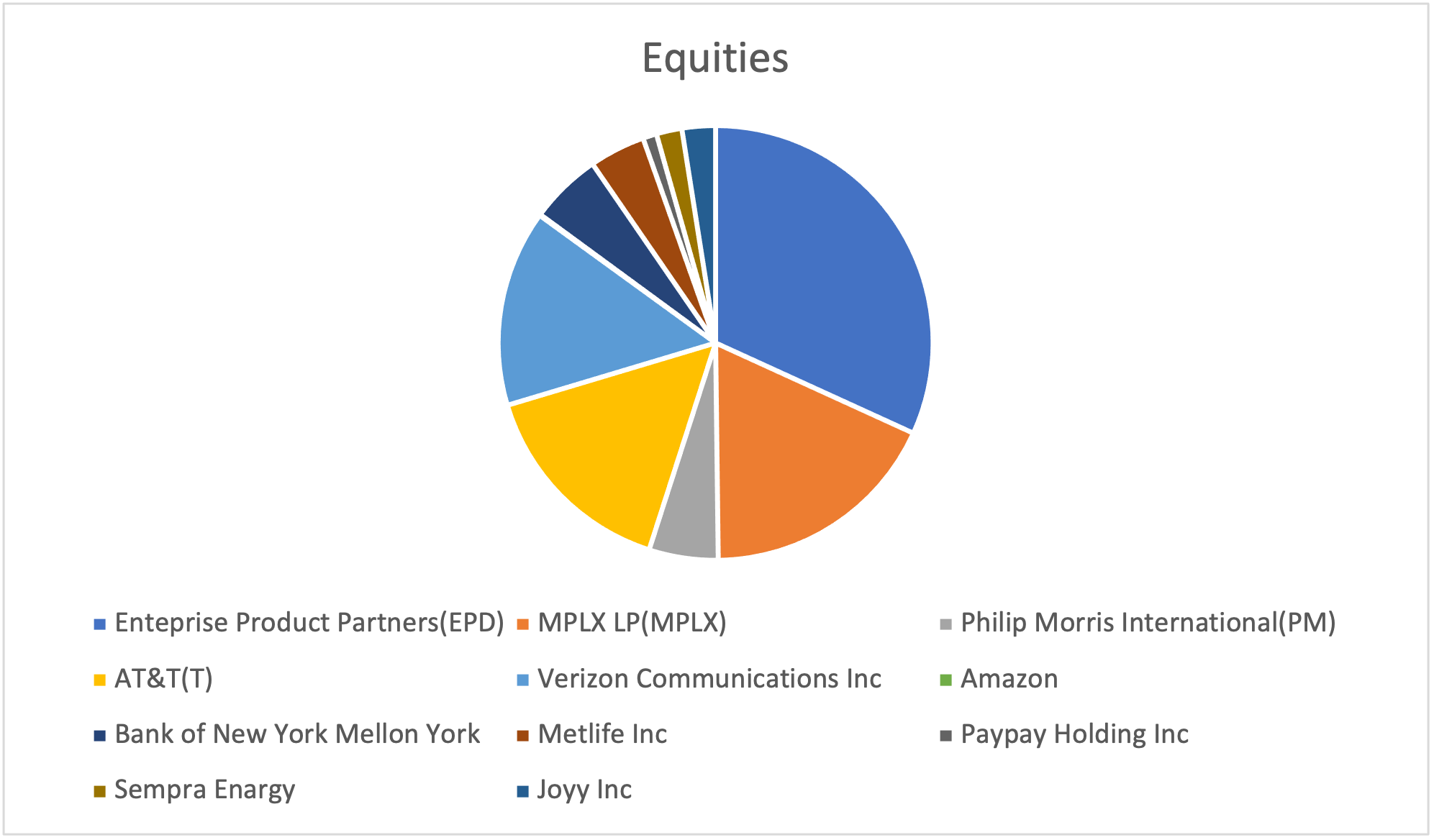

Overall portfolio profit to date: €3.135

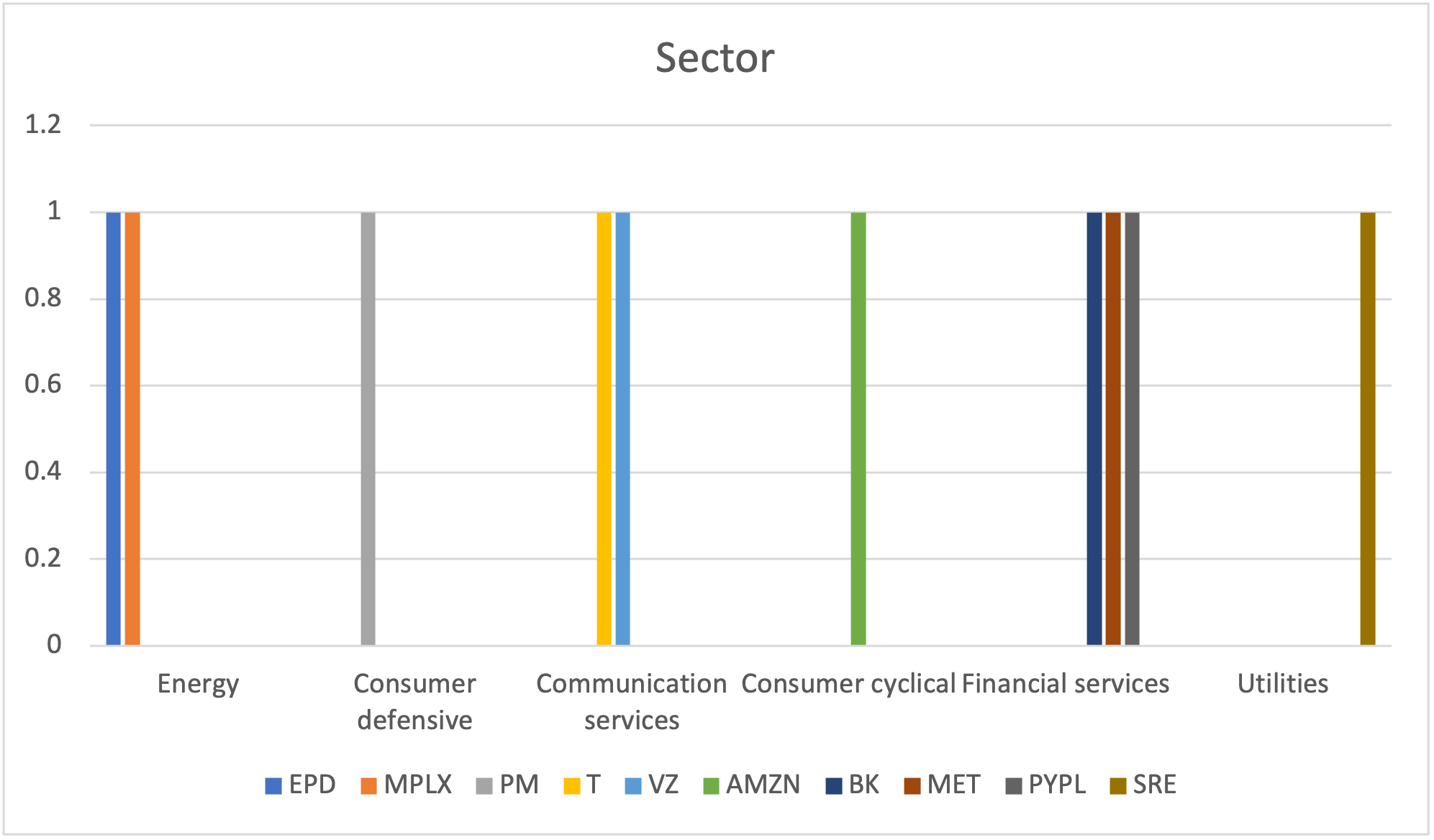

Amazon. Com, Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 3

Acquisition price: €3.258 each share

Profit/(loss) to date: €301,83

Major Holders breakdown:

14.13% % of Shares Held by All Insider

58.95% % of Shares Held by Institutions

68.65% % of Float Held by Institutions

4,800 Number of Institutions Holding Shares

6 months performance:

Bank of New York Mellon Corp

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 208

Acquisition price: €47,98 each share

Profit/(loss) to date: (€22,58)

Major Holders breakdown:

0.23% % of Shares Held by All Insider

86.50% % of Shares Held by Institutions

86.69% % of Float Held by Institutions

1,355 Number of Institutions Holding Shares

6 months performance:

Enterprise Products Partners L.P. (EPD)

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 1.238

Acquisition price: €22,11 each share

Profit/(loss) to date: €753,70

Major Holders breakdown:

32.59% % of Shares Held by All Insider

30.94% % of Shares Held by Institutions

45.90% % of Float Held by Institutions

1,116 Number of Institutions Holding Shares

6 months performance:

Metlife Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 162

Acquisition price: €61,56 each share

Profit/(loss) to date: €90,62

Major Holders breakdown:

15.39% % of Shares Held by All Insider

77.56% % of Shares Held by Institutions

91.66% % of Float Held by Institutions

1,405 Number of Institutions Holding Shares

6 months performance:

MPLX LP

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 700

Acquisition price: €24,88 each share

Profit/(loss) to date: €991

Major Holders breakdown:

62.64% % of Shares Held by All Insider

28.84% % of Shares Held by Institutions

77.21% % of Float Held by Institutions

334 Number of Institutions Holding Shares

6 months performance:

Philip Morris International

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 200

Acquisition price: €86,44 each share

Profit/(loss) to date: €874

Major Holders breakdown:

0.21% % of Shares Held by All Insider

75.38% % of Shares Held by Institutions

75.54% % of Float Held by Institutions

2,256 Number of Institutions Holding Shares

6 months performance:

PayPal Holdings Inc

Date of acquisition of shares: 11/2/2021

Number of shares acquired: 40

Acquisition price: €253,18 each share

Profit/(loss) to date: €689

Major Holders breakdown:

0.14% % of Shares Held by All Insider

84.81% % of Shares Held by Institutions

84.93% % of Float Held by Institutions

3,225 Number of Institutions Holding Shares

6 months performance:

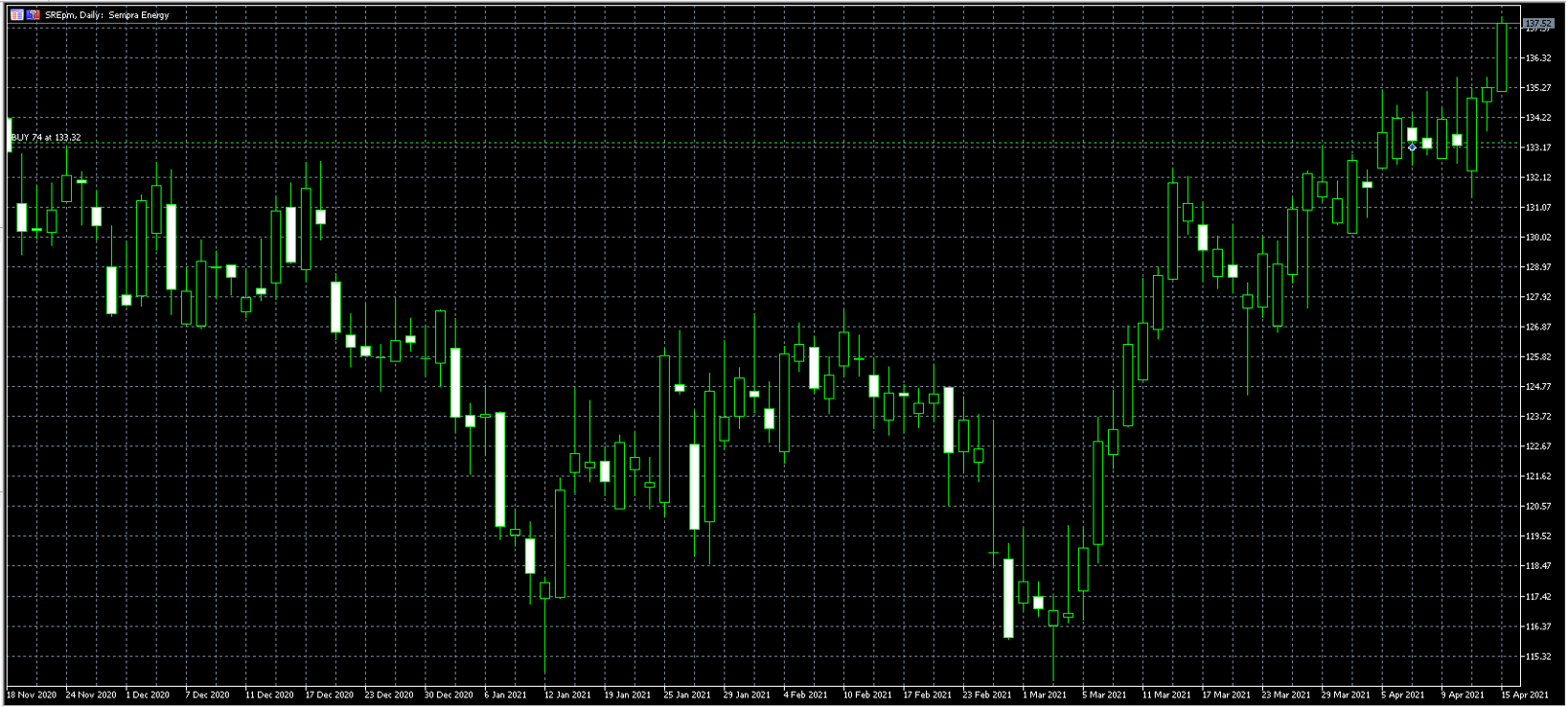

Sempra Energy

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 74

Acquisition price: €133,32 each share

Profit/(loss) to date: €253

Major Holders breakdown:

0.06% % of Shares Held by All Insider

83.50% % of Shares Held by Institutions

83.55% % of Float Held by Institutions

1,160 Number of Institutions Holding Shares

6 months performance:

AT &T Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 600

Acquisition price: €29,40 each share

Profit/(loss) to date: €236

Major Holders breakdown:

0.10% % of Shares Held by All Insider

53.01% % of Shares Held by Institutions

53.06% % of Float Held by Institutions

3,168 Number of Institutions Holding Shares

6 months performance:

Verizon Communications Inc.

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 569

Acquisition price: €57,54 each share

Profit/(loss) to date: €166

Major Holders breakdown:

0.02% % of Shares Held by All Insider

68.15% % of Shares Held by Institutions

68.17% % of Float Held by Institutions

3,452 Number of Institutions Holding Shares

6 months performance:

Verizon Communications Inc.

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 97

Acquisition price: €103,31 each share

Profit/(loss) to date: (€656)

Major Holders breakdown:

1.41% % of Shares Held by All Insider

76.17% % of Shares Held by Institutions

77.26% % of Float Held by Institutions

371 Number of Institutions Holding Shares

6 months performance:

Elon Musk strikes deal to buy Twitter for $44bn

Netflix’s stocks plunges by 35% wiping more than $50 billion off market cap

Netflix’s stocks plunges by 35% wiping more than $50 billion off market cap

Microsoft Buys Activision for $69 Billion with Eyes on Metaverse Development

Microsoft Buys Activision for $69 Billion with Eyes on Metaverse Development