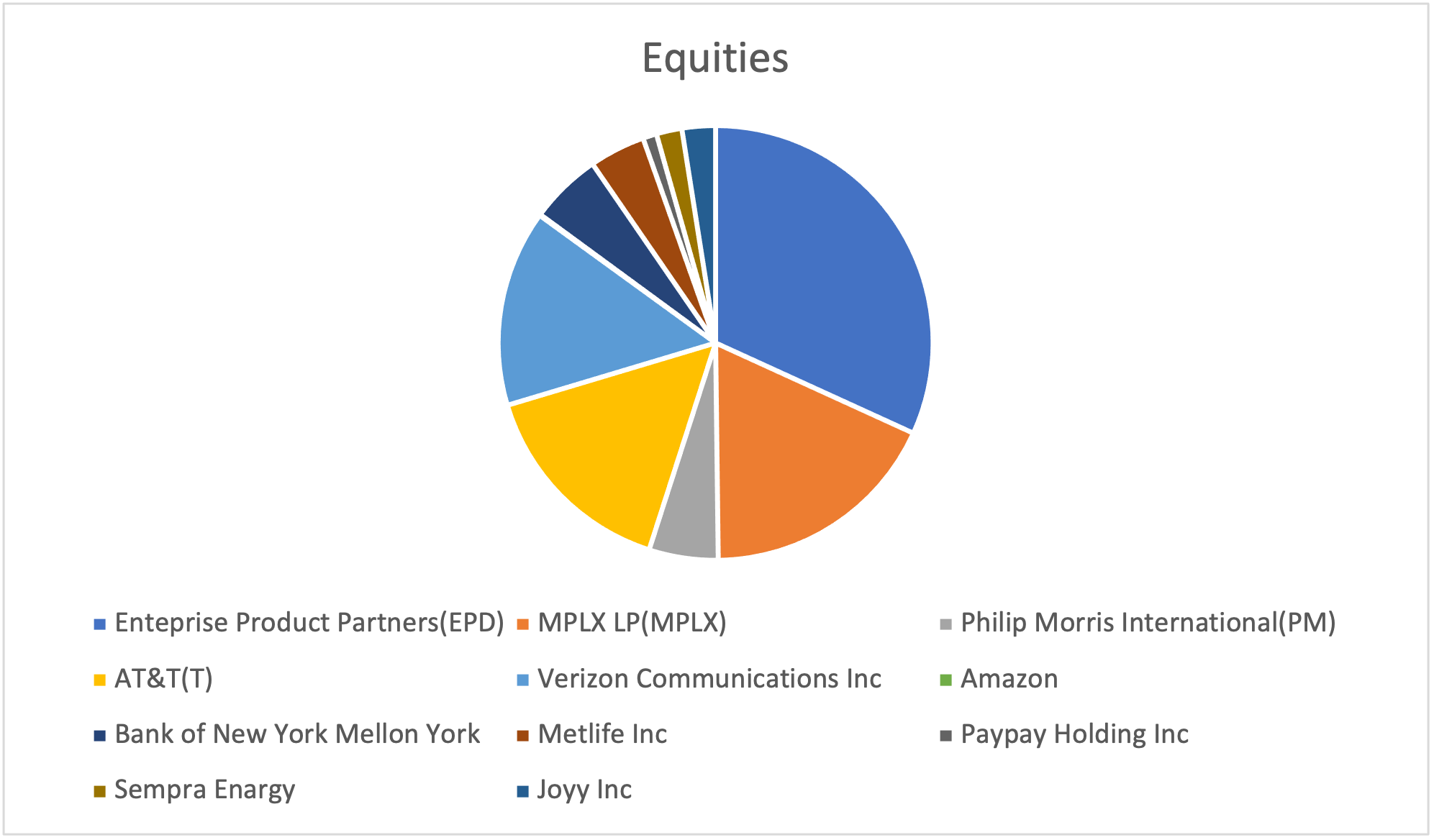

Overall portfolio profit to date: €3.135

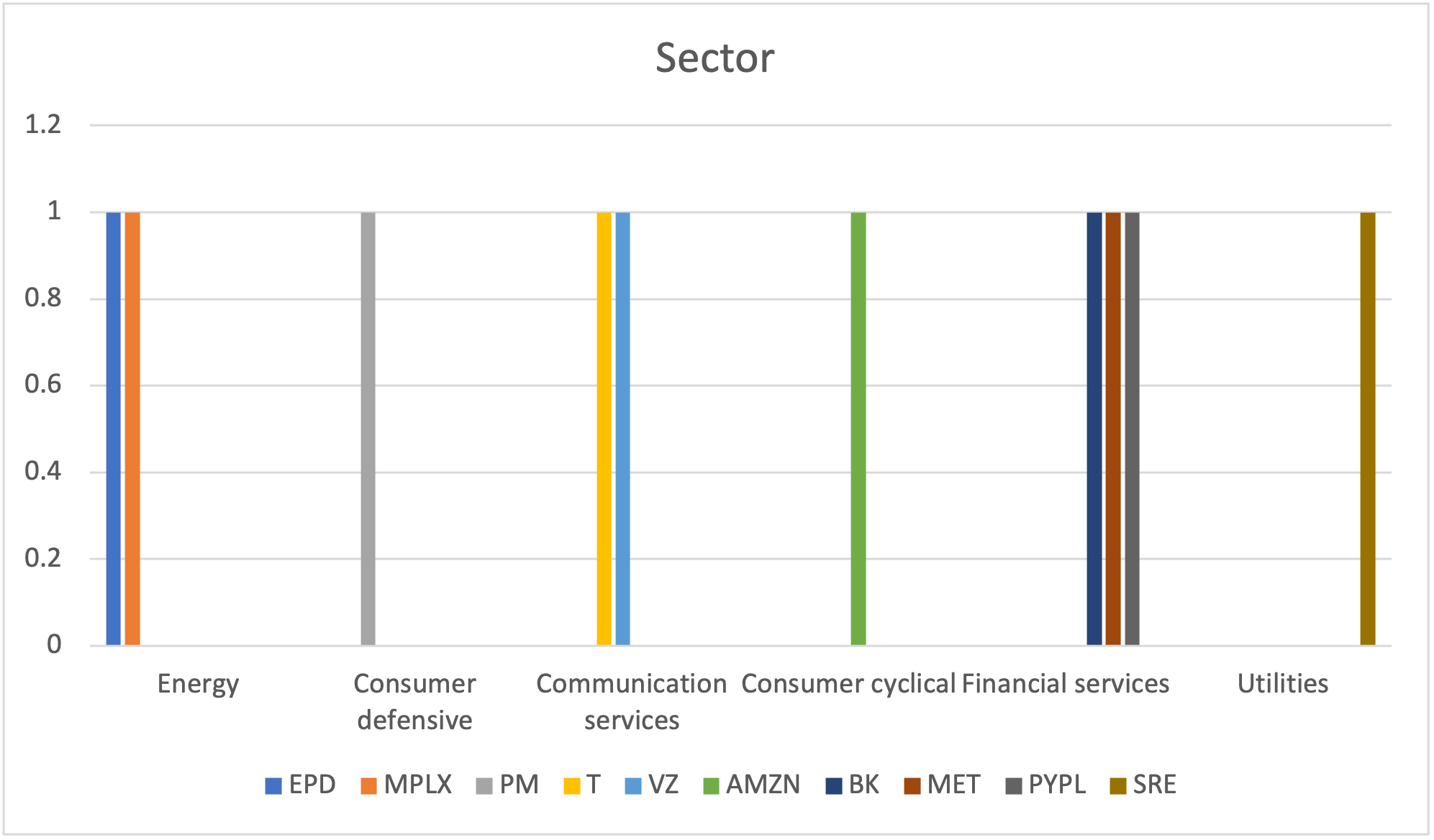

Amazon. Com, Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 3

Acquisition price: €3.258 each share

Profit/(loss) to date: €301,83

Major Holders breakdown:

14.13% % of Shares Held by All Insider

58.95% % of Shares Held by Institutions

68.65% % of Float Held by Institutions

4,800 Number of Institutions Holding Shares

6 months performance:

Bank of New York Mellon Corp

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 208

Acquisition price: €47,98 each share

Profit/(loss) to date: (€22,58)

Major Holders breakdown:

0.23% % of Shares Held by All Insider

86.50% % of Shares Held by Institutions

86.69% % of Float Held by Institutions

1,355 Number of Institutions Holding Shares

6 months performance:

Enterprise Products Partners L.P. (EPD)

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 1.238

Acquisition price: €22,11 each share

Profit/(loss) to date: €753,70

Major Holders breakdown:

32.59% % of Shares Held by All Insider

30.94% % of Shares Held by Institutions

45.90% % of Float Held by Institutions

1,116 Number of Institutions Holding Shares

6 months performance:

Metlife Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 162

Acquisition price: €61,56 each share

Profit/(loss) to date: €90,62

Major Holders breakdown:

15.39% % of Shares Held by All Insider

77.56% % of Shares Held by Institutions

91.66% % of Float Held by Institutions

1,405 Number of Institutions Holding Shares

6 months performance:

MPLX LP

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 700

Acquisition price: €24,88 each share

Profit/(loss) to date: €991

Major Holders breakdown:

62.64% % of Shares Held by All Insider

28.84% % of Shares Held by Institutions

77.21% % of Float Held by Institutions

334 Number of Institutions Holding Shares

6 months performance:

Philip Morris International

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 200

Acquisition price: €86,44 each share

Profit/(loss) to date: €874

Major Holders breakdown:

0.21% % of Shares Held by All Insider

75.38% % of Shares Held by Institutions

75.54% % of Float Held by Institutions

2,256 Number of Institutions Holding Shares

6 months performance:

PayPal Holdings Inc

Date of acquisition of shares: 11/2/2021

Number of shares acquired: 40

Acquisition price: €253,18 each share

Profit/(loss) to date: €689

Major Holders breakdown:

0.14% % of Shares Held by All Insider

84.81% % of Shares Held by Institutions

84.93% % of Float Held by Institutions

3,225 Number of Institutions Holding Shares

6 months performance:

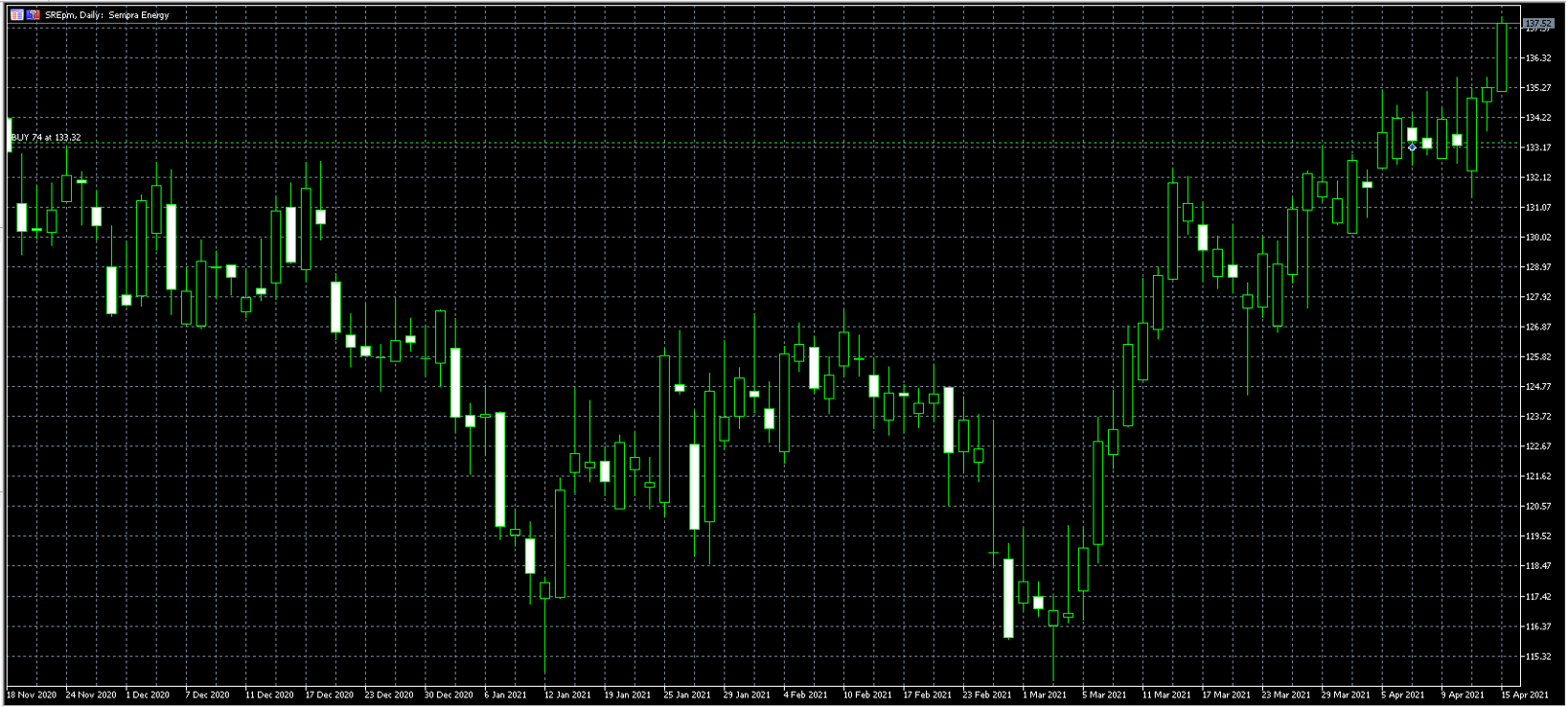

Sempra Energy

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 74

Acquisition price: €133,32 each share

Profit/(loss) to date: €253

Major Holders breakdown:

0.06% % of Shares Held by All Insider

83.50% % of Shares Held by Institutions

83.55% % of Float Held by Institutions

1,160 Number of Institutions Holding Shares

6 months performance:

AT &T Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 600

Acquisition price: €29,40 each share

Profit/(loss) to date: €236

Major Holders breakdown:

0.10% % of Shares Held by All Insider

53.01% % of Shares Held by Institutions

53.06% % of Float Held by Institutions

3,168 Number of Institutions Holding Shares

6 months performance:

Verizon Communications Inc.

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 569

Acquisition price: €57,54 each share

Profit/(loss) to date: €166

Major Holders breakdown:

0.02% % of Shares Held by All Insider

68.15% % of Shares Held by Institutions

68.17% % of Float Held by Institutions

3,452 Number of Institutions Holding Shares

6 months performance:

Verizon Communications Inc.

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 97

Acquisition price: €103,31 each share

Profit/(loss) to date: (€656)

Major Holders breakdown:

1.41% % of Shares Held by All Insider

76.17% % of Shares Held by Institutions

77.26% % of Float Held by Institutions

371 Number of Institutions Holding Shares

6 months performance:

3 REIT stocks to buy now with at least 7% dividend yield

Real Estate Investment Trusts are publicly traded companies that allow individual investors to buy shares in real estate portfolios that receive income from a variety of properties.

Stock Portfolio performance 4/6/2021

Stock Portfolio performance 4/6/2021

Index fund vs. ETF: What’s the difference?

In this article, we will analyze the main differences between an index fund and an exchange traded fund, in order for investors to be able to recognize which one is more suitable for them based on their strategy.