Amazon. Com, Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 3

Acquisition price: €3.258 each share

Profit/(loss) to date: €227

Major Holders breakdown:

13.67% % of Shares Held by All Insider

59.42% % of Shares Held by Institutions

68.83% % of Float Held by Institutions

4,856 Number of Institutions Holding Shares

6 months performance:

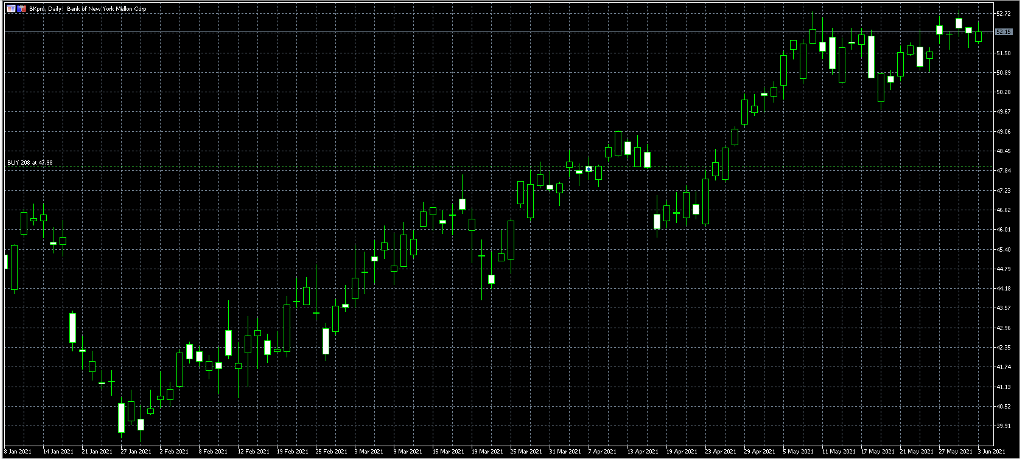

Bank of New York Mellon Corp

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 208

Acquisition price: €47,98 each share

Profit/(loss) to date: €300

Major Holders breakdown:

0.25% % of Shares Held by All Insider

84.78% % of Shares Held by Institutions

85.00% % of Float Held by Institutions

1,392 Number of Institutions Holding Shares

6 months performance:

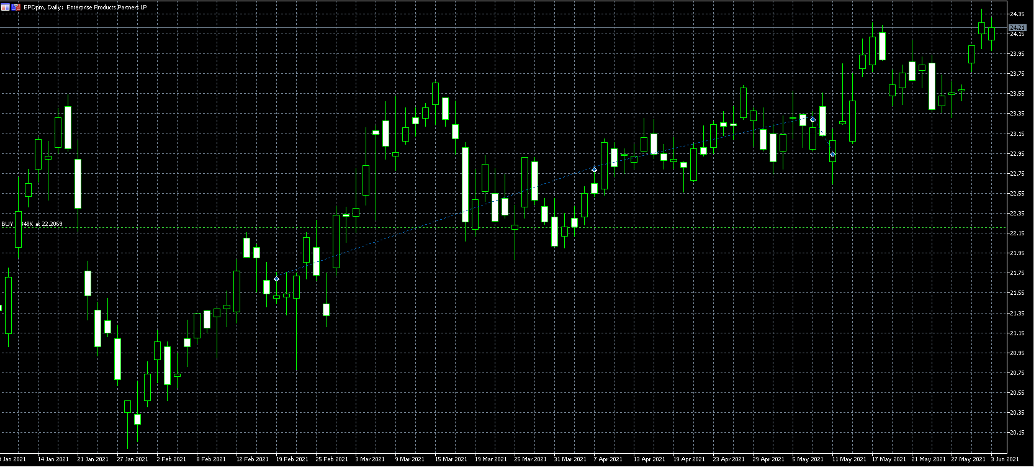

Enterprise Products Partners L.P. (EPD)

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 1.238

Acquisition price: €22,11 each share

Profit/(loss) to date: €3.003

Major Holders breakdown:

32.54% % of Shares Held by All Insider

29.91% % of Shares Held by Institutions

44.33% % of Float Held by Institutions

1,145 Number of Institutions Holding Shares

6 months performance:

Metlife Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 162

Acquisition price: €61,56 each share

Profit/(loss) to date: €293

Major Holders breakdown:

15.37% % of Shares Held by All Insider

78.69% % of Shares Held by Institutions

92.98% % of Float Held by Institutions

1,458 Number of Institutions Holding Shares

6 months performance:

MPLX LP

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 700

Acquisition price: €24,88 each share

Profit/(loss) to date: €3.087

Major Holders breakdown:

63.10% % of Shares Held by All Insider

28.06% % of Shares Held by Institutions

76.05% % of Float Held by Institutions

345 Number of Institutions Holding Shares

6 months performance:

Philip Morris International

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 200

Acquisition price: €86,44 each share

Profit/(loss) to date: €1.806

Major Holders breakdown:

0.21% % of Shares Held by All Insider

75.92% % of Shares Held by Institutions

76.07% % of Float Held by Institutions

2,290 Number of Institutions Holding Shares

6 months performance:

PayPal Holdings Inc

Date of acquisition of shares: 11/2/2021

Number of shares acquired: 40

Acquisition price: €253,18 each share

Profit/(loss) to date: €597

Major Holders breakdown:

0.12% % of Shares Held by All Insider

82.67% % of Shares Held by Institutions

82.77% % of Float Held by Institutions

3,336 Number of Institutions Holding Shares

6 months performance:

Sempra Energy

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 74

Acquisition price: €133,32 each share

Profit/(loss) to date: €373

Major Holders breakdown:

0.05% % of Shares Held by All Insider

88.64% % of Shares Held by Institutions

88.68% % of Float Held by Institutions

1,140 Number of Institutions Holding Shares

6 months performance:

AT &T Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 600

Acquisition price: €29,40 each share

Profit/(loss) to date: -€444

Major Holders breakdown:

0.10% % of Shares Held by All Insider

52.68% % of Shares Held by Institutions

52.73% % of Float Held by Institutions

3,200 Number of Institutions Holding Shares

6 months performance:

Verizon Communications Inc.

Date of acquisition of shares: 19/2/2021

Number of shares acquired: 569

Acquisition price: €57,54 each share

Profit/(loss) to date: -€144

Major Holders breakdown:

0.02% % of Shares Held by All Insider

66.81% % of Shares Held by Institutions

66.82% % of Float Held by Institutions

3,501 Number of Institutions Holding Shares

6 months performance:

Joyy Inc

Date of acquisition of shares: 7/4/2021

Number of shares acquired: 97

Acquisition price: €103,31 each share

Profit/(loss) to date: -€2.393

Major Holders breakdown:

1.44% % of Shares Held by All Insider

89.31% % of Shares Held by Institutions

90.61% % of Float Held by Institutions

386 Number of Institutions Holding Shares

6 months performance:

Square Inc.

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 40

Acquisition price: €250 each share

Profit/(loss) to date: -€1.108

Major Holders breakdown:

1.23% % of Shares Held by All Insider

74.08% % of Shares Held by Institutions

75.00% % of Float Held by Institutions

1,700 Number of Institutions Holding Shares

6 months performance:

Alibaba Group Holding Limited (BABA)

Date of acquisition of shares: 19/4/2021

Number of shares acquired: 74

Acquisition price: €236,52 each share

Profit/(loss) to date: -€1.403

Major Holders breakdown:

10.18% % of Shares Held by All Insider

35.87% % of Shares Held by Institutions

39.94% % of Float Held by Institutions

2,784 Number of Institutions Holding Shares

6 months performance:

Technical analysis: What Is the Risk/Reward Ratio and How to Use It

What is Forex and how does it work?

Forex market has became increasingly popular in the recent years as we see more and more individuals to get involved and trade in the foreign exchange market.

What is stock split and stock split reverse?

Apple, Amazon and Tesla have all split their stocks in the past in order to make their shares more accessible to retail investors. In the following article you will learn what a stock split is, why do companies go through the hassle and expense of a stock split, what are reverse stock splits and why would a company do a reverse split.