Square, Inc

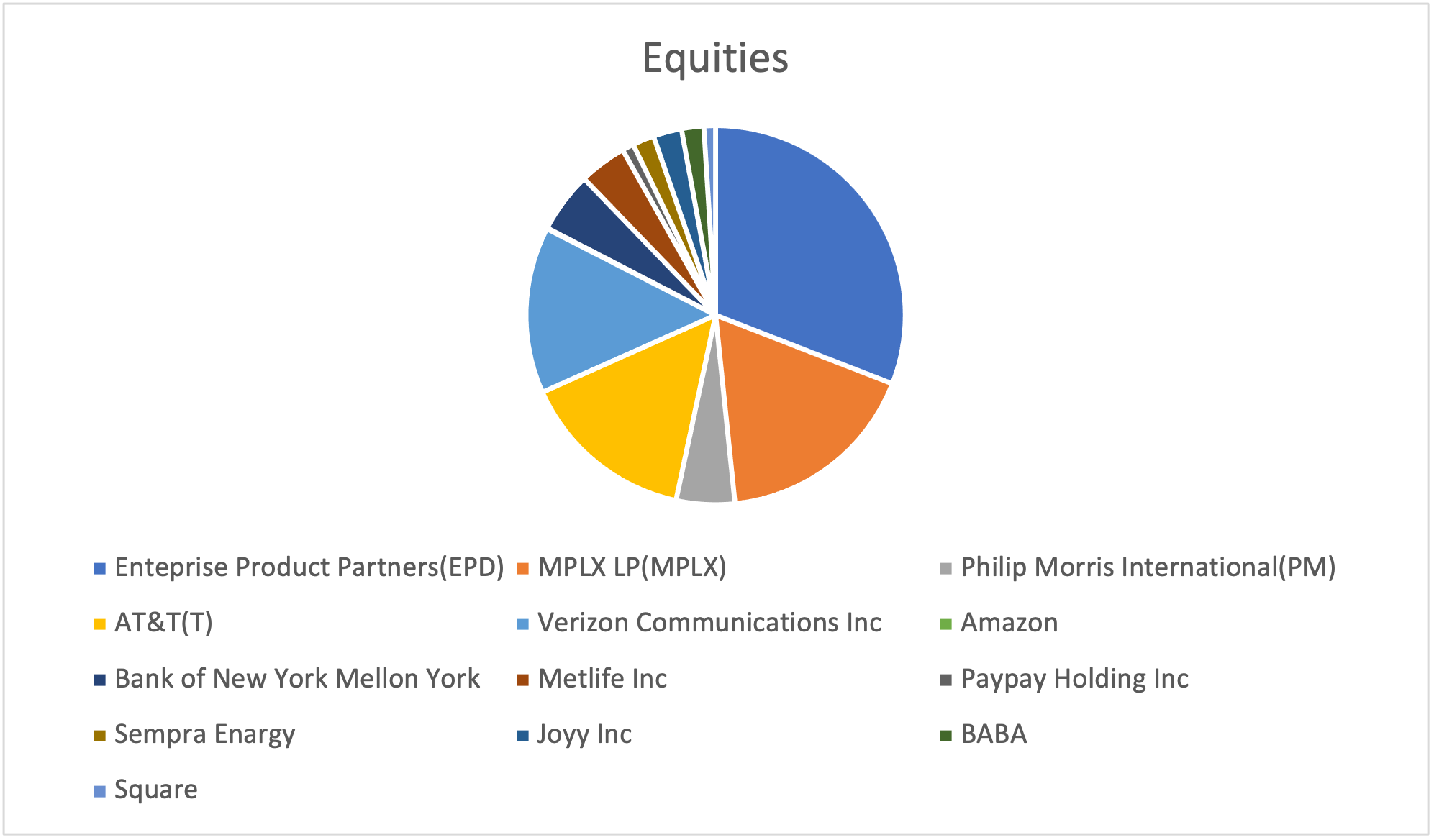

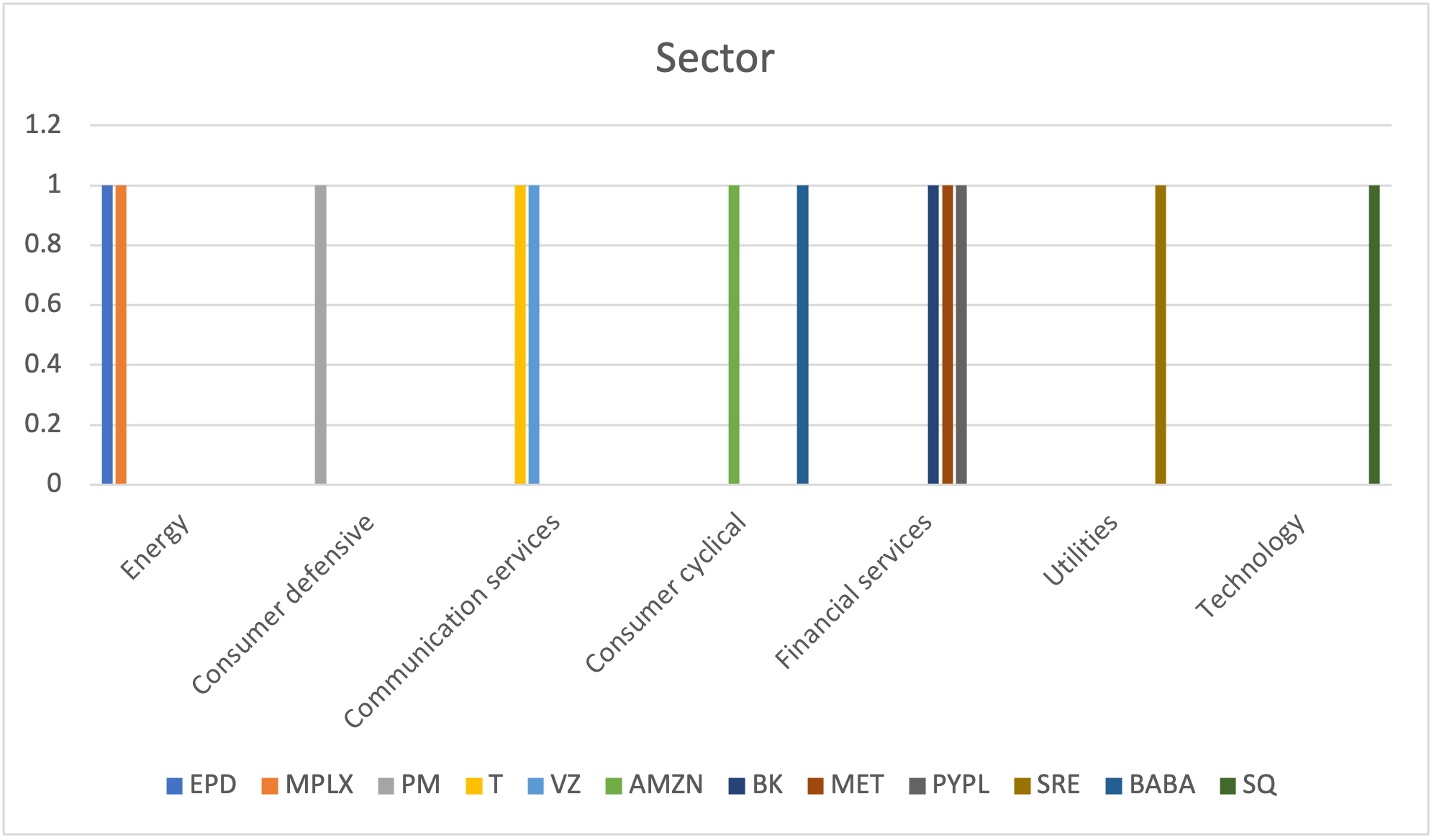

Our first additions this week is Square Inc, we have added 40 shares at the price of €250,21. The Company operates in the technology sector and the Software-Infrastructure industry.

Square, Inc. is a San Francisco, California-based financial services and digital payments company that currently has a $113.2 billion market capitalization. Since the beginning of the year, SQ delivered a 14.41% return, extending its 12-month gains to 333.79%. As of April 19, 2021, the stock closed at $245.33 per share. The combined business has grown gross profit at a 37% CAGR over the past five years to $2.7 billion (due to pass through costs, gross profit is more reflective of top-line growth) and we believe that the company has an enormous long-term runway, as it has less than a 2% share of a more than $160 billion market. It is our view that the company’s Cash App (which has grown from nothing in 2015 to $1.2 billion gross profit last year) has a particularly large opportunity with its powerful ecosystem of digital financial services including digital wallets, direct deposits, stock trading, bitcoin trading, and business and tax services, which are all relatively new.

If Square can build a big enough ecosystem of businesses and consumers, it can essentially cut out the banks and credit card companies that have always been middlemen in the payment infrastructure. The fact that Square is already doing that within invoices could be foreshadowing what’s to come for payments within the Square app.

Having an ecosystem of finance products for both businesses and consumers, including a bank, is proving to be a great growth business for Square. And that’s why this is a stock we are bullish on over the next decade.

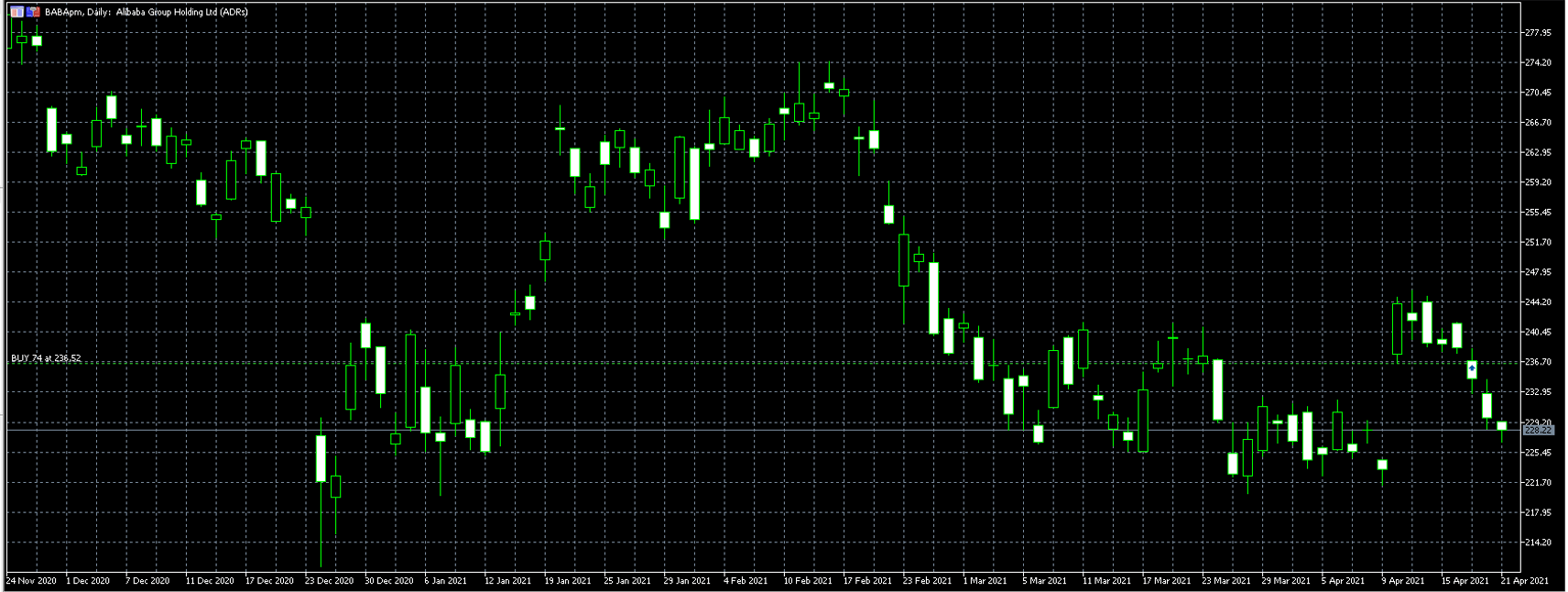

Alibaba Group Holdings Limited

Our second addition for the week is Alibaba Group Holdings Limited. We have added 76 shares at the price of €236,52. The Company operates in the consumer cyclical sector and the internet retail industry.

In terms of valuation, BABA is currently trading at a Forward P/E ratio of 21.94. This valuation marks a discount compared to its industry’s average Forward P/E of 64.39. We can also see that BABA currently has a PEG ratio of 1.21. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company’s expected earnings growth rate into account. BABA’s industry had an average PEG ratio of 2.52 as of yesterday’s close.

BABA will be looking to display strength as it nears its next earnings release. In that report, analysts expect BABA to post earnings of $1.91 per share. This would mark year-over-year growth of 46.92%.

Let’s not forget that e-commerce is still a high-growth industry in China, where it’s also benefiting from a fast-developing middle class. Alibaba is still ahead of the pack there and is a leader in cloud computing and AI services in its domestic market as well. China’s regulators may be tapping the brakes of their largest tech firm right now, but Alibaba’s trajectory is still pointing upward — and it should remain that way for the foreseeable future.

Plus, this is an incredibly deep-pocketed tech titan. Total cash and equivalents were $69.9 billion, plus another $65.2 billion in equity investments and other company ownership stakes at the end of 2020, offset by total debt of only $18.0 billion. The $2.8 billion fine it was hit with was a record levy in China, but it’s quite manageable for Alibaba. Regulatory risks aside, this company is riding an unstoppable wave of e-commerce and tech development in China and the greater Asia Pacific region and looks like a solid long-term buy right now.

Stocks fell as traders braced for another supersized US rate hike tomorrow: Everything you need to know

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Goldman Sachs Offers Its First Bitcoin-Backed Loan

Goldman Sachs Offers Its First Bitcoin-Backed Loan