In reality, getting a loan on your crypto assets can often be a less complicated way than getting traditional bank loans. Therefore, in this article we will simplify crypto lending and explore its various benefits and some best practices you can use to start your lucrative journey in this new era of Decentralized Finance.

Crypto lending explained

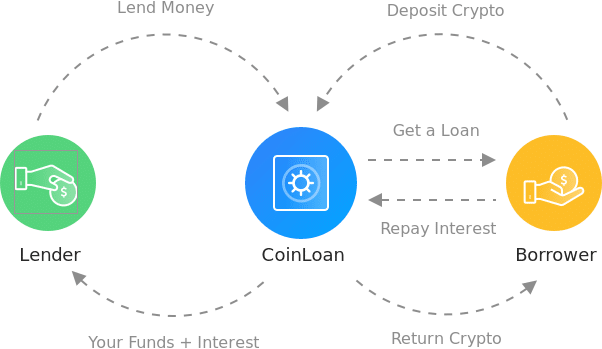

You’ve probably all heard of people getting loans from banks or companies to cover their needs when they are short of cash. Then this loan is being repaid with an interest amount and this is how the bank or company would make money. There are solutions out there that could give you a loan with your crypto, and this is called Crypto Lending.

Crypto lending is a very popular form of Decentralized Finance(DeFi) and has been steadily increasing it’s popularity over the past few months. Decentralized Finance is one of the major use-cases of blockchain technology and with this new trend around DeFi, many new ways to grow your crypto assets are emerging.

Not only can it enable savers to receive interest on their stash of Bitcoin, but it enables borrowers to unlock the value of their digital assets by using it as collateral for a loan.

In other words, crypto-lending is the process of lending your digital assets(BTC, ETH, LTC etc..) through crypto exchanges or different lending sites with an interest. In the recent years crypto lending has massed some significant amount of attention and is now increasingly becoming a mainstream conversation in banking as well as institutional investors.

Meanwhile, unlike personal loans or credit cards, collateralized loans are much more secured for the lender, which enables the borrower to take advantage of cheap interest rates.

People investing in cryptocurrencies already know that it’s a highly volatile market and that is one of the reasons why these loans are almost always maintain their loan-to-value (LTV) ratio. Also, unlike traditional banking, lending is more accessible to people who don’t have a financial history, underbanked consumers who don’t have a bank account and self-employed workers who struggle to access credit because their fluctuating earnings don’t meet a bank’s strict lending criteria. Repayments can also include more flexible terms.

Why would I want to lend my crypto to someone else?

Attractive interest rate

When investing, one of the biggest challenges can be cashflow — and there’s nothing worse than having to raid the capital you’ve got tied up in assets for short-term costs and lack liquidity.

Crypto lending is another form of passive income. One of the major benefits of crypto lending is the attractive interest rates that your can earn. You will potentially get back more crypto than the amount that you’ve lent out, meaning you’ll be making a profit without needing to do anything for it. And who doesn’t like making a nice passive income? On top of that, the interest rate is way more high than the one of your savings account.

Avoid crypto volatility

Another benefit of crypto investing is avoiding crypto volatility. In theory, you are able to lend the crypto you want. However, lending stablecoins may appear as a new solution for you all crypto owners. Stablecoins are cryptocurrencies designed to keep the same value as certain real-world assets (most of them are pegged to the US dollar for example).

By lending stablecoins, you are able to grow your assets without the variation risk that you usually have with crypto. In other words, you’ll likely know how much you’ll be getting back for lending your crypto assets. Of course, you have to keep in mind that zero risk does not exist, especially in the crypto universe. The higher the risk, the higher the return could be.

Crypto lending best practices

As an investor, I always receive many questions like, which stock or cryptocurrency should I invest in? Which investing platform should I use? Or any other question from people asking for advice or recommendation. I never advice them to buy a specific stock or cryptocurrency. I always try to direct them on using the available tools and lead them into researching stocks and cryptos in order to take their decisions based on their own research.

It is always wise to do our own research and understand our risk appetite and the risks involved in every decision. It is highly important to understand the financial product in which we are investing our hard earned money in order to be able to identify if this specific assets fits your portfolio.

This cannot be said often enough – for many things in crypto, doing your own research can help you tremendously. Lending is no different in this. You don’t want to accidentally entrust a poorly secured platform, or even worse a scam. It’s best to go with lending platforms or smart contracts that have had its security audited well and that have a good track record.

Know your parameters

The terms of the loan are vital to understand properly. You’ll want to make sure that you know beforehand when you’d be getting your crypto back and how much interest you’ll be getting out of it.

Last but not least, it’s vital that there’s a good backup plan for you, in case the borrower isn’t able to pay you back. You’ll want to make sure that the platform or smart contract you’re using will still return your crypto, either through an insurance or collateral the borrower had to lock away.

Nike just bought a virtual shoe company that makes NFTs and sneakers ‘for the metaverse’

Nike just bought a virtual shoe company that makes NFTs and sneakers ‘for the metaverse’

5 major players building up the Metaverse

5 major players building up the Metaverse

El Salvador plans to create a ‘Bitcoin City’

El Salvador plans to create a ‘Bitcoin City’