The frenzy surrounding Coinbase Global Inc.’s listing on the Nasdaq this week may subside, but fund managers will have to reckon with heightened investor interest in bitcoin in the wake of the crypto exchange’s direct listing, one asset manager says.

“If you’re not talking about it, you’re really stuck in the past,” Rick Lear, founder and managing partner of Lear Investment Management, said in an April 14 phone interview. “Having another currency creates a whole lot more problems out there, but it’s happening, and you got to be ready to deal with it.”

Over the last year, we have seen a continuous surge on the price of various cryptocurrencies, especially in the most popular cryptocurrency of the world, Bitcoin. Cryptocurrencies are going from one ATH to another and apparently the world of finance has changed creating a new Era for investors and traders. On previous Wednesday we have seen the Coinbase IPO on NASDAQ.

With 63.6B Market Cap, the price of Coinbase ranges to day from €321 to €345 per share. If you haven’t heard of Coinbase, a brief introduction is in order. The Company has been described as the most popular consumer-facing cryptocurrency exchange in the U.S.,” enabling ordinary investors (and traders) to buy and sell Bitcoin and similar cryptocurrencies on its platform.

It’s also one of the three biggest such exchanges in the world. Contributing to the company’s popularity is the fact that Coinbase has never been hacked, giving it a reputation as a “safe harbor among crypto exchanges” — not all of which can make the same claim.

Here are some facts you need to know about Coinbase:

Popularity

The Company had 56 million “verified users” at the end of Q1 2021, up 30% from the end of Q4 2020. What’s more, the number of “monthly transacting users” (i.e. verified users who actually placed trades on the platform)at Coinbase more than doubled to 6.1 million over the past three months. So in addition to storing value on the platform, traders are also using Coinbase more actively. In a Q1 2021 estimated earnings report released April 6, Coinbase revealed that its revenues were $1.8 billion for the quarter, which was more than the company’s revenue for all of fiscal 2020. Trading volume also appears to be accelerating, up nearly four-fold sequentially to $335 billion in just the three months from Q4 2020 to Q1 2021. And Coinbase is already a profitable operation.

Profitability

The company earned $322.3 million in 2020, and earned an operating profit margin of 32% — even more than traditional stock exchanges such as Nasdaq (16% operating margin) or the NYSE’s parent company ICE (25%) get. And Coinbase is growing dramatically more profitable as time goes by. In Q1 2021, for example, revenues are estimated to come in at $1.8 billion, and net income at anywhere from $730 million to $800 million. If that’s how things play out, Coinbase could earn a net profit margin as high as 44%. When you consider that revenues are expected to more than quadruple this year to $6.1 billion, merely maintaining that level of profitability could result in net income of more than $2.7 billion this year. On a $60 billion market capitalization, that implies a P/E ratio of only 22.2 — which actually seems pretty cheap for a company growing as fast as this one appears to be doing.

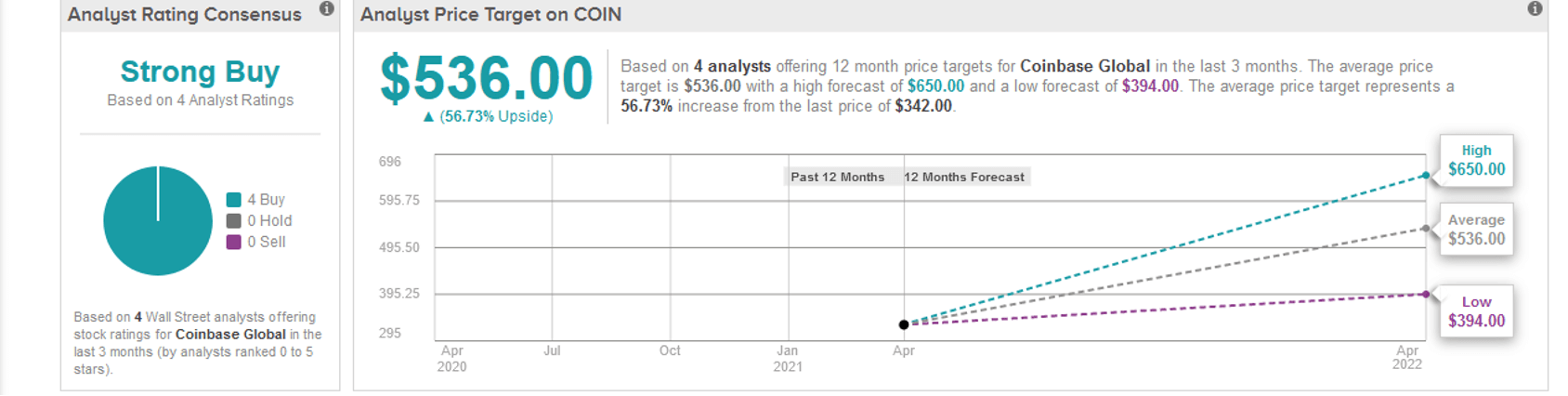

Based on 4 analysts offering 12 month price targets for Coinbase Global in the last 3 months. The average price target is $536.00 with a high forecast of $650.00 and a low forecast of $394.00. The average price target represents a 56.73% increase from the last price of $342.00.

Risks involved

Regardless of the success of Coinbase, there are still notable risk factors. Cryptocurrencies are still in the early stages of development and volatility is likely to continue. In 2019, Coinbase posted a loss of $31 million because of the plunge in Bitcoin.

Another nagging issue is the potential for regulation. Treasury Secretary Janet Yellen seems to be no fan of cryptocurrencies. There has also been skepticism from Federal Reserve Chairman Jerome Powell. This week, he noted, “[Cryptocurrencies are] really vehicles for speculation. They’re not really being actively used as payments.”

On top of this, there is a relatively high fee structure, which could be tough to sustain. Just look at what has happened with equities trading. In response to Robinhood’s zero commission strategy, other brokerages had little choice but to follow suit.

In other words, even if cryptos experience continued growth, this may not be enough to keep up the momentum for Coinbase.

Why build a position in Coinbase? Does this mean that I have changed my thinking in regards to cryptocurrencies? One, this is a real business with real earnings. Two, I don’t know.

I still think that at some point the central banks and treasury departments of the world fight back against the power and anonymity provided by “cryptos,” but I would have thought that they would have done so by now. So, either I am wrong, or they are late. Maybe they are too late.

I think it’s quite obvious that the vast majority of cryptocurrencies available to investors today will end up worthless. If the central banks act too slowly, or do not act at all, then the real chance exists that one or more of these cryptocurrencies, though in no way actually fitting my definition for money, could perhaps (think bitcoin) become at some point a reserve asset, or at a minimum, find utility in replacing the cash, or underground economy.

Top 10 Altcoins for January 2022

Top 10 Altcoins for January 2022

Weekly Market News 10-14 January

Weekly Market News 10-14 January

Weekly Market News 3-7 January

Weekly Market News 3-7 January