CFDs: What is a Contract for Difference

Learn how to trade in a few simple and easy steps. Pure Market Broker gives you the opportunity to trade the world’s biggest and most popular markets through CFDs (contracts for difference). CFDs are a type of securities and derivatives, which means that you don’t buy the underlying asset itself. You buy or sell units of a financial instrument depending on whether you believe the underlying price will either rise either fall.

Leverage: What it is and how it can be used

CFDs can also be leveraged, meaning you are able to take on a larger position with a fraction of initial capital. Said differently, you only invest a deposit of the value of your trade and borrow the remainder from your forex broker. For this reason leveraged trading is also referred to as trading on margin.

Going long or short

CFD trading gives you the opportunity to profit from a rising or falling market. You can profit on an appreciating or depreciating asset by going long, buying if you think the market is going to rise. You can profit as well by going short, selling if you think the market is going fall.

What instruments can you trade

When trading CFDs, you can open positions on several different asset classes, including, currencies, commodities, shares, indices, and cryptocurrencies.

Is trading risky?

Trading is risky in general, this is a fact. While trading with leverage gives you the opportunity to profit hugely, your chances of losing are at the same time magnified.

We implement negative balance protection for all clients, so you can not lose more than you put in. In addition to that, stop-loss and take-profit orders allow you to ensure that you make risk-aware trades – protecting you from any unforeseen downturns in the market.

What exactly is stop-loss in trading?

Stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price. Stop-loss is a vital risk management tool when it comes to trading. Stop-loss is widely applied for two main reasons – to prevent losing money or to lock in profits.

When the markets are volatile, stop-loss can become a trader’s best friend, helping to manage the risk involved in trading.

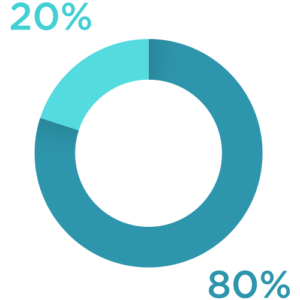

Margin Requirement

A Margin Requirement is the percentage of margin-able securities that an investor should pay for with his/her own funds. For example, if you have an initial margin requirement of 20% for your margin account, and you want to purchase $100,000 worth of securities, then your margin would be $20,000. The rest of the funds you can borrow it from the broker.

4 NFT projects you should know

4 NFT projects you should know

By our Head of investments & Market research Styliana Charalambous

What is Arbitrage Trading?

Understanding risk management

Understanding risk management

By our Head of investments & Market research Styliana Charalambous