Although we can argue that the coronavirus contraction could end up being the shortest U.S. recession ever, there are several industries that are still heavily impacted by the consequences of the pandemic and their recovery will probably be slower than expected.

While the beginning of 2021 looks to continue to be rough, with Q1 being another lost quarter for many industries, the rest of the year looks promising for a huge resurgence. Nearly all industries are likely to see a bounceback in 2021 from a massive 2020 falloff. However, we will focus on four industries that seem poised for massive rebounds.

Airlines and transportation

• Businesses Affected: airlines, car rental companies, coach services, tour services.

• Jobs Affected: airport workers, drivers, pilots, flight attendants, tour guides, travel agents.

Airlines and transportation industry is undoubtedly one of the most negatively affected industry by the pandemic, since for a significant period of time people were not allowed to travel from one country to another in order to restrict the virus spread. Even during the first months of 2021, there are still travel restrictions and requirements in place that have made travelling experience less convenient.

The revenues of airlines and transportation companies collapsed as passengers cancelled trips and countries imposed travel bans and as a result the stocks plunged in early March based on bankruptcy fears. Thanks to the government bailouts and private financing, airlines made it through the initial liquidity crunch.

On the other hand, what we know for sure is that, when the pandemic ends, people would be looking to travel again but it may take years to return to pre-crisis levels, especially if companies conduct more business virtually for cost-savings and to protect employee’s health.

Why it may be time to buy airline stocks

According to some wall street analysts it may be the time to add airline companies to your portfolio since now it appears they have weathered the worst of the coronavirus pandemic.

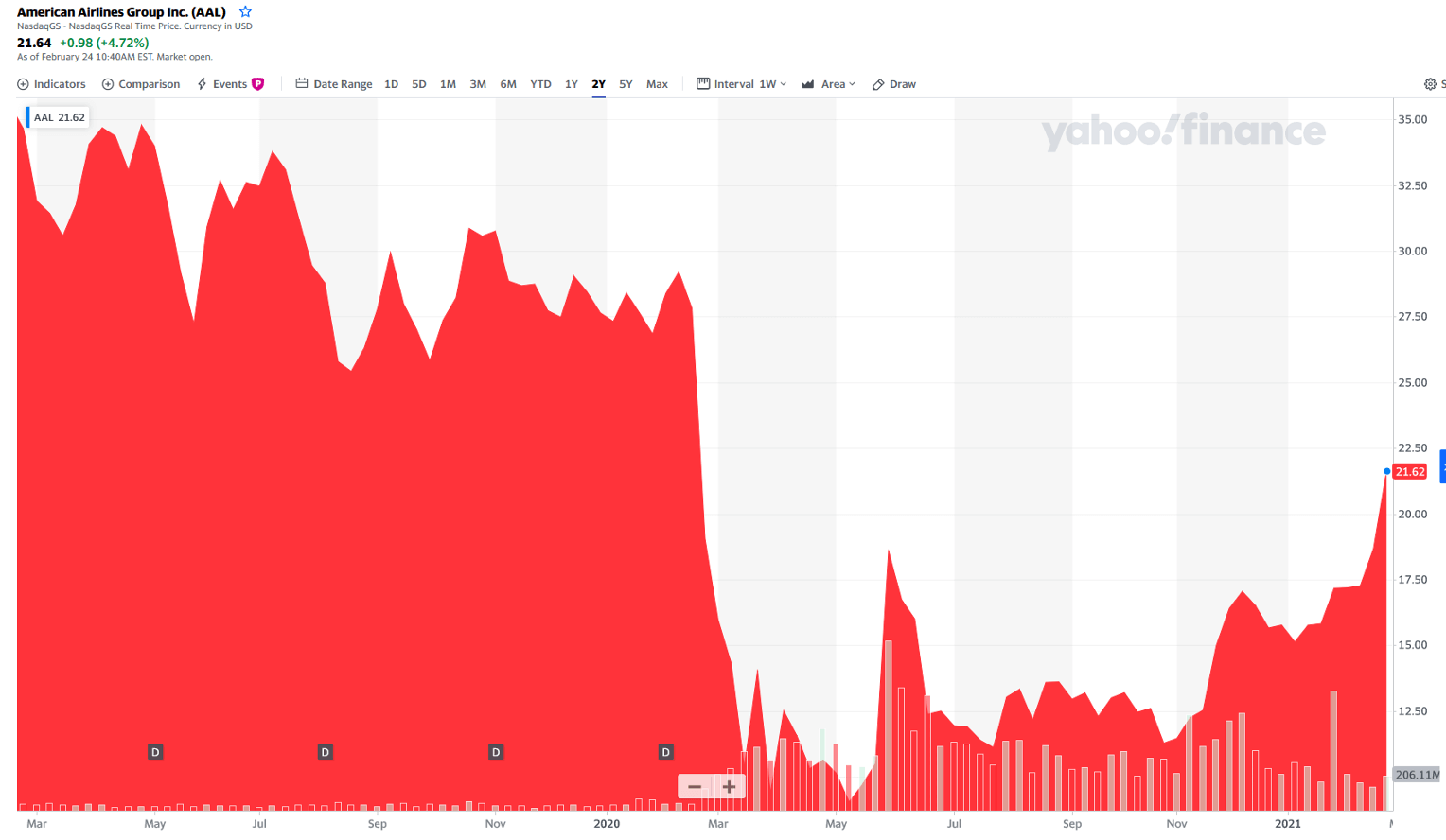

American Airlines Chief Revenue Officer Vasu Raja commented in Yahoo finance that “It’s a matter of letting the vaccine distribution play out, demand is currently at between 40% to 45% of its 2019 levels, our revenues trail that may be about 30%. But every day is a little bit better.” Raja also said that American Airlines sees the recovery building in real time with increased bookings to leisure destinations but he cautions that there is still a long way to go.

American (AAL) stock is up 30% year-to-date and up 67% over the past six months. At Delta (DAL) shares are up 20% year-to-date and 75% over the past six months. United (UAL) is up 15% and 51% for the same time periods while Southwest (LUV) is up 22% and 61%.

In the following diagram you can see an example of the market reaction on American Airlines Group Inc. stock. The stock price has dramatically fallen on early March, when the stock market crush occurred. Shares have surged recently and are headed towards profit-taking range. But AAL stock is still below pre-pandemic levels. The relative strength line for American has spiked, and the 50-day line is trending upward.

Hotels and accommodation

• Businesses Affected: hotels, resorts, bed and breakfasts, hostels,

• Jobs Affected: hotel workers, resort staff, AirBnB renters, cruise staff.

The hotel industry has been severely affected by the COVID-19 pandemic and its resulting travel and dining restrictions, and other social-distancing rules.

Shutdowns prompted by the COVID-19 pandemic continue to devastate workers in the hospitality industry, as slower-than-expected vaccine distribution and new variants raise concerns about when American life will return to normal.

According to a jobs report released by the Bureau of Labor Statistics last month, the sector has already suffered staggering damage. It cut nearly half a million jobs in December and saw a total loss of 3.9 million positions since February 2020.

People are going to want to travel again. The world is suffering from a near-universal case of cabin fever and the best solution for that is to get out of town. People will likely be traveling in record numbers once it is safe to do so.

While many hotels and other accommodations were forced to shut their doors for good during the pandemic, those that make it through should find an abundance of riches on the other side.

Irina Novoselsky, CEO of the online recruitment website CareerBuilder mentioned that companies in the sector plan to bring back jobs ‘really quickly’, she has also commented that hospitality companies are preparing for a “V-shaped” recovery triggered by widespread vaccination that unleashes pent-up demand for travel. As soon as people get vaccinated, there’s an expectation that people are going to hit the hospitality sector pretty quickly, wanting to travel; wanting to get out there because they’ve been cooped up for several months.”

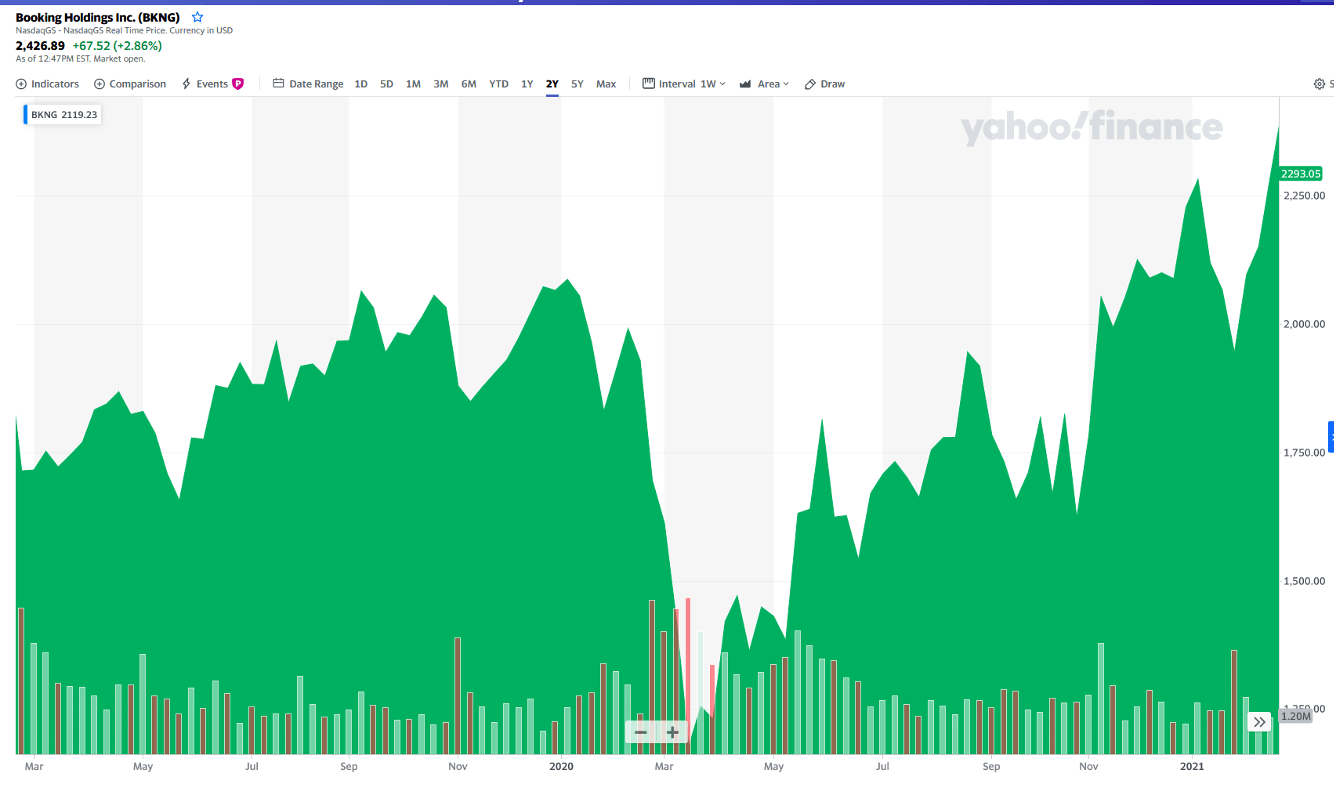

In the case of the hotel industry, there seems to be a positive sentiment in the market since Booking Holdings Inc not only recovered it’s March losses, but the price is currently at all- time high levels.

Oil and Gas

WTI&BRENT

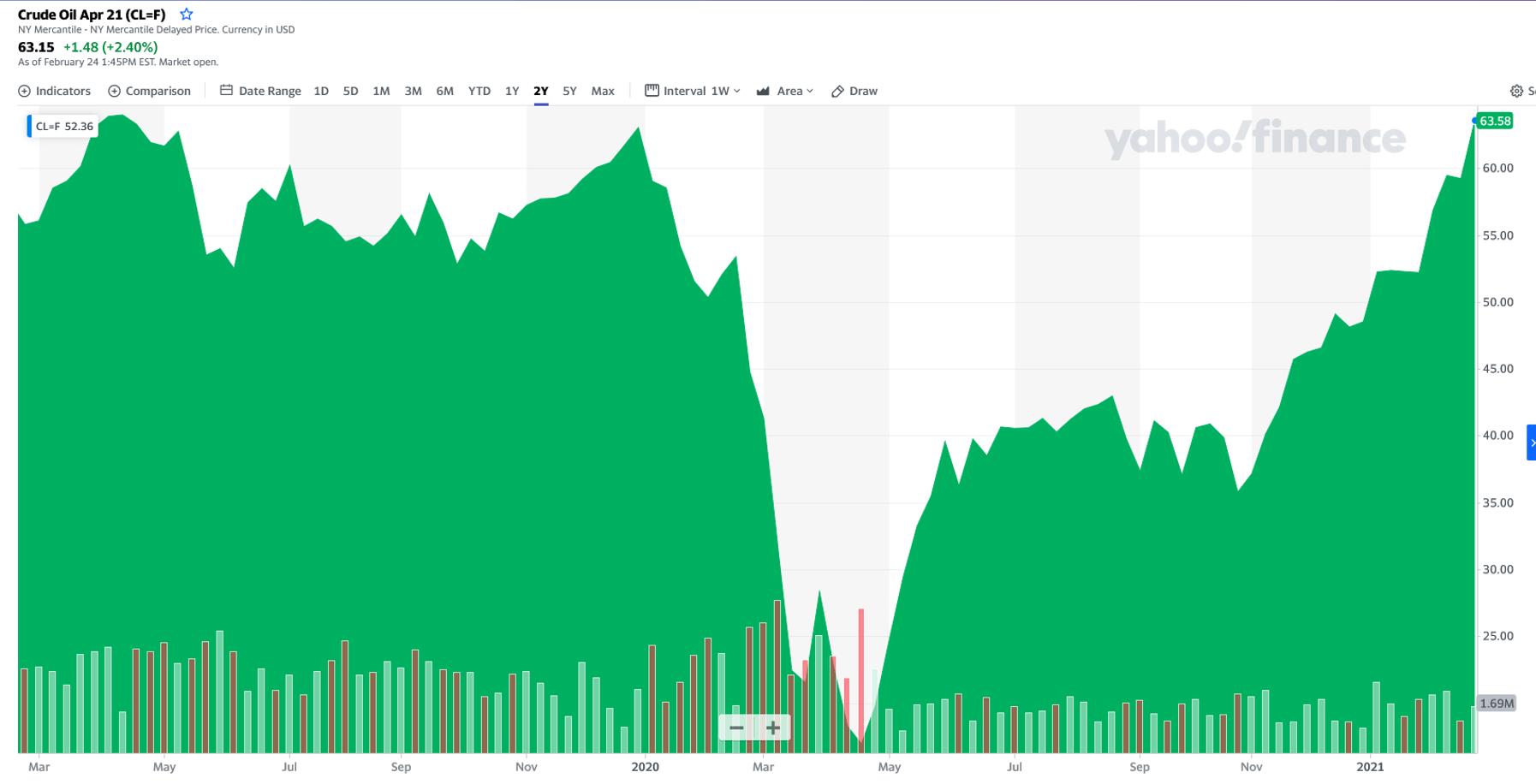

This pandemic will be remembered as the first time in history when oil prices actually fell below $0. Covid-19 forced lockdowns around the world that destroyed demand for oil products like gasoline and jet fuel.

Moreover, as tracked by West Texas Intermediate, the negative oil prices only lasted for 24 hours.

According to Reuters, Oil prices have extended gains for a fourth session on Thursday to reach the highest levels in more than 13 months, underpinned by an assurance that U.S. interest rates will stay low, and a sharp drop in U.S. crude output last week due to the storm in Texas.

Barclays said it is seeing staying power in the recent oil price rally on a weaker-than-expected supply response by U.S. tight oil operators to higher prices.

U.S. West Texas Intermediate crude for April was at $63.54 a barrel, up 32 cents, 0.5% while Brent crude futures for April gained 37 cents, 0.6%, to $67.41 a barrel by 0718 GMT. Jeffrey Halley, senior market analyst for Asia Pacific at OANDA commented that combined with a dovish Jerome Powell and an already tight physical market, oil prices exploded higher.

Head of Market Research

Stocks fell as traders braced for another supersized US rate hike tomorrow: Everything you need to know

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Goldman Sachs Offers Its First Bitcoin-Backed Loan

Goldman Sachs Offers Its First Bitcoin-Backed Loan