What is a margin call?

In the world of investments, it is vital to clearly understand the basic and fundamental terms in order to be able to observe the market, learn from history and avoid certain mistakes. In simple terms, a margin call occurs when the value of an investor’s margin account falls below the broker’s required amount.

Moreover, a margin call is usually and indicator that one or more of the securities held in the margin account has decreased in value. Brokers may force traders to sell assets, regardless of the market price, to meet the margin call if the trader doesn’t deposit funds.

In the case of Archegos, one reason for the widening fallout is the borrowed funds that investors use to magnify their bets: a margin call occurs when the market goes against a large, leveraged position, forcing the hedge fund to deposit more cash or securities with its broker to cover any losses. Archegos was probably required to deposit only a small percentage of the total value of trades.

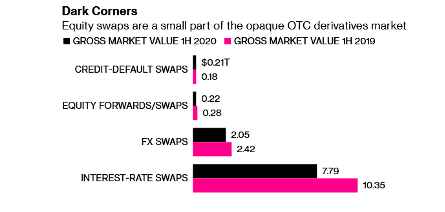

Billions in secret derivatives at center of Archegos blowup

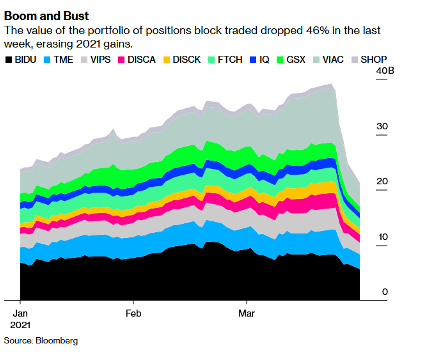

The forced liquidation of more than $20 billion in holdings linked to Bill Hwang’s investment firm is drawing attention to the covert financial instruments he used to build large stakes in companies.

The two banks that provided most of the leverage used by wang’s Archegos Capital Management was Credit Suisse Group and Nomura Holdings Inc through complex financial instruments such as swaps and contracts-for-difference, according to people with direct knowledge of the deals. Without this much leverage provide by the banks Archegos may never actually have owned most of the underlying securities.

Normally, investors who own a stake of more than 5% in a U.S listed company are obliged to disclose their holdings and subsequent transactions. In the case of Archegos, due to the positions built through the type of derivatives which are transacted off exchanges, allow managers like Hwang to amass exposure to publicly-traded companies without having to declare it.

While the margin calls on Friday triggered losses of as much as 40% in some shares, there was no sign of contagion in markets broadly on Monday. Contrast that with 2008, when Ireland’s then-richest man used derivatives to build a position so large in Anglo Irish Bank Corp. it eventually contributed to the country’s international bailout. In 2015, New York-based FXCM Inc. needed rescuing because of losses at its U.K. affiliate resulting from the unexpected de-pegging of the Swiss franc.

Karen Kessler, a spokesperson for Archegos, said late Monday in an emailed statement that this is a challenging time for the family office, their partners and employees. He also added that, all plans are being discussed as Mr. Hwang and the team determine the best path forward.

Impact on the banks involved and dark concerns on CFDs

They added that Nomura’s indication of potentially losing $2 billion and press speculation of a $3 billion to $4 billion loss at Credit Suisse is “not an unlikely outcome.” Analysts and investors are trying to figure out the final losses to banks exposed to the Archegos implosion, with the task made harder by the opaque nature of the leveraged trading involved.

Regulators have begun clamping down on CFDs in recent years because they’re concerned the derivatives are too complex and too risky for retail investors, with the European Securities and Markets Authority in 2018 restricting the distribution to individuals and capping leverage. In the U.S., CFDs are largely banned for amateur traders.

Banks still favor them because they can make a large profit without needing to set aside as much capital versus trading actual securities, another consequence of regulation imposed in the aftermath of the global financial crisis. Among hedge funds, equity swaps and CFDs grew in popularity because they are exempt from stamp duty in high-tax jurisdictions such as the U.K.

Stocks fell as traders braced for another supersized US rate hike tomorrow: Everything you need to know

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Twitter Sues Elon Musk for Trying to Terminate $44 Billion Deal

Goldman Sachs Offers Its First Bitcoin-Backed Loan

Goldman Sachs Offers Its First Bitcoin-Backed Loan